Daily Comment (July 15, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a quick note on the aftermath of the attempted assassination of former President Trump, although we caution that it is still too early to really understand how the incident could affect US politics and policy. We next review several other international and US developments with the potential to affect the financial markets today, including more news about China’s worsening trade relations with the West and a note on the US apartment market.

US Politics: Law enforcement officials continue to investigate Saturday evening’s attempted assassination of former President Trump. At the same time, investors and commentators are trying to gauge the impact on November’s elections. At this early moment, a key consideration is whether the event will increase the probability of a Trump win in the presidential contest and the probability of Republican gains in the Senate and House of Representatives. Early signs suggest that the incident has, indeed, boosted support for Trump and the Republicans so far.

- For a time earlier this month, increased expectations for a Trump win prompted a clear “Trump trade” based on the idea that his policy proposals (such as less independence for the Federal Reserve, a dramatic hike in import tariffs, and tax cuts) would be inflationary. For example, those concerns temporarily pushed Treasury yields higher.

- Such concerns had diminished in the face of economic data pointing to moderating economic growth and lower inflation. Going forward, more such data could well continue to offset concerns about inflationary policies under a new Trump administration. All the same, we caution that these are early days in this crisis, and the full implications for investors are still to be seen.

China: New data today shows gross domestic product rose by a seasonally adjusted 0.7% in the second quarter, short of expectations and much weaker than the 1.5% gain in the first quarter. As a result, second-quarter GDP was up just 4.7% from the same period one year earlier, also short of expectations and weaker than the 5.3% increase in the year ended in the first quarter. Details in the data showed most of the growth in the second quarter came from new factory investment and exports, while weak consumer demand and residential investment pulled down growth.

- The expansion in factory investment and exports is consistent with the government’s plan to rekindle growth by supporting the production and foreign sales of advanced technology goods, such as electric vehicles and solar panels. However, a key problem with that strategy is that it is generating pushback and protectionist measures by countries fearful of having their domestic industries devastated by cheap Chinese goods.

- The continued weak economic data will keep alive hopes for added stimulus measures from the government.

- The weak figures will also likely inform the discussions at this week’s Third Plenum, in which top Communist Party officials will work on new long-range economic reforms.

China-Global Rare Earths Market: In one example of how excess Chinese production can drive down prices and undermine other countries’ producers, new data reveals that surging Chinese output has pushed the price of certain rare earth minerals down almost 20% this year. China already dominates the reserves, production, and refining of these minerals, which are important to the electrified economy of the future. A likely reason for China’s overproduction of them is to short-circuit the effort by Western countries to develop their own independent sources.

Canada-China: Canadian Deputy Prime Minister Freeland, who is also the country’s finance minister, warned for the first time that Ottawa may impose protectionist tariffs against a broad range of Chinese imports. Previewing the government’s upcoming consultation with businesses about potential tariffs on Chinese electric vehicles, Freeland forcefully argued that world leaders for too long have accepted the unfair trading advantages arising from China’s communist economy.

- Given Canada’s enormous trade relationship with the US, policymakers in Ottawa have a strong incentive to be aligned with US trading policies against China. The US is also likely pressuring Ottawa to ensure Chinese EVs don’t reach the US via Canada to skirt the new US tariffs against them.

- In any case, Freeland’s warning is another sign of how the US geopolitical and economic bloc is closing ranks and erecting broad new protectionist measures against Chinese exports. Of course, that will further worsen tensions between the West and China.

France: As politicians keep trying to form a government after no party gained a majority in the country’s recent parliamentary elections, the state financial watchdog Cour des Comptes has issued a report suggesting that continued big budget deficits and high debt have left the government “dangerously exposed” to a fresh economic crisis. The audit report warns that in the event of a new crisis, the government may not have the financial capacity to respond appropriately.

Italy: Prime Minister Meloni’s right-wing government said it will propose new legislation to bring small, modular nuclear reactors into the country’s energy mix, almost 35 years after Italy closed its last nuclear power plant. The new policy would complement Meloni’s moves to restrict the further development of solar power and other renewables. More broadly, the policy is another example of the increased interest in nuclear power around the world, which has driven up spot uranium prices.

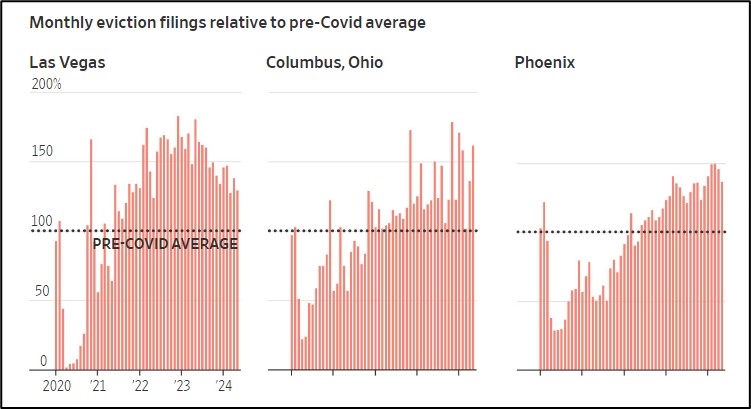

US Apartment Industry: Although average renter eviction rates nationwide are now back down to their pre-pandemic levels, new data shows that the rates remain high in several cities in the Sunbelt and elsewhere that experienced a surge in population and rent rates. The high eviction rates suggest landlords may be coming to the end of their ability to keep hiking rents. If so, stabilizing rent rates could help hold down consumer price inflation in the coming months and quarters, helping convince the Federal Reserve to cut interest rates.