Daily Comment (July 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are off to a slow start as investors look for more confidence in the data. In sports news, the players of the American League were able to beat the National League in the MLB All-Star game. Today’s Comment starts with a summary of how former President Donald Trump and incumbent President Joe Biden are strategizing to win over supporters. We follow with discussions on the bitcoin and gold rivalry and the potential shift in US foreign policy. As always, the report concludes with a roundup of domestic and international news.

Political Re-Brand: Republican presidential candidate Donald Trump seems to be moving toward the center, while President Joe Biden has shifted further toward the left.

- During an interview with Bloomberg Businessweek, Trump outlined his vision for a second term. He made concessions such as allowing Fed Chair Jerome Powell to complete his term, despite previous reports suggesting he might challenge the Federal Reserve’s legal independence. Additionally, he is reportedly considering Jamie Dimon for Treasury Secretary, a position Dimon declined in 2016 but may be open to taking now that he is mulling retirement. Another newsworthy announcement was Trump’s expectations that his unreleased economic agenda would be implemented quickly after his victory.

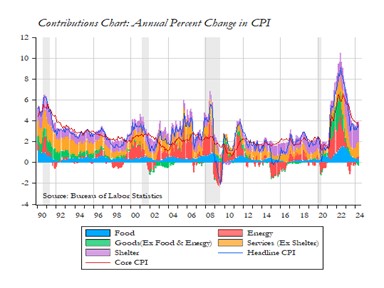

- Meanwhile, President Biden has sought support from progressives as he looks to beat back calls to drop out of the election. In an effort to address concerns about inflation impacting everyday households, he unveiled a list of re-election promises on Tuesday. These include capping rent hikes for large landlords at no more than 5%, forgiving medical debt, and raising the minimum wage. Shelter prices and costs associated with healthcare have been significant drivers of inflation throughout his term, and these proposals aim to directly target those areas.

- Less than four months away from the election, betting markets show that former President Donald Trump has about a 67% chance of winning. These odds are likely to fluctuate in the coming months. While Trump’s current lead is significant, he may encounter resistance from his opponents, especially if Biden unexpectedly withdraws from the race. A major point of concern is Trump’s lack of a detailed economic plan, which is likely to make investors nervous given some of his positions. The uncertainty could introduce volatility into financial markets leading up to the November election.

New vs. Old School Hedges: Investor confidence in a potential Trump victory has driven a surge in gold and bitcoin prices over the past few days.

- Gold prices have skyrocketed 4% over the past week, while bitcoin has surged an even more impressive 12%. The surge in demand for these assets reflects investor concerns about the US Treasury’s safe-haven status. They fear the potential deregulation of cryptocurrencies and rising government spending, leading to ballooning deficits, could weaken the attractiveness of US dollar-denominated assets. Trump recently added to those concerns after he complained that the US dollar remains too strong compared to the Japanese yen (JPY) and Chinese yuan (CNY).

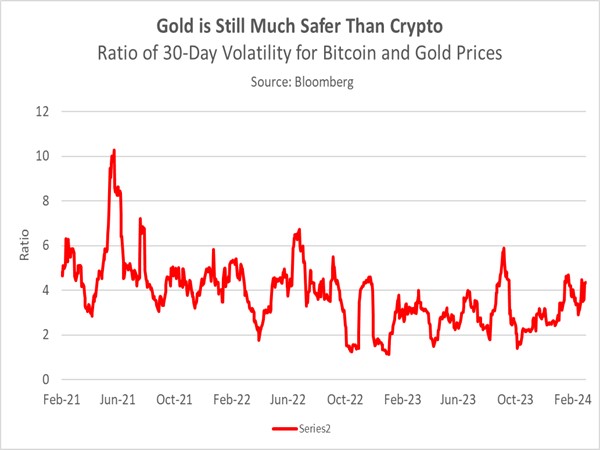

- A second Trump term is likely to ramp up the competition between precious metals and cryptocurrencies. Gold’s established reputation makes it a go-to for traditional investors, but younger generations are drawn to bitcoin’s potential. This digital asset’s allure stems partly from its innovative technology, which streamlines trading and purchases. However, its significant price swings raise concerns about its viability as a long-term store of value. As the chart illustrates, bitcoin’s volatility is roughly four times higher than gold’s, potentially making it a riskier option for long-term investment strategies.

- The coming years could see high-risk investors experiment with bitcoin, but for most, gold remains a more reliable choice. Central banks’ preference for gold diversification will likely bolster its value, especially as the world breaks into blocs. While bitcoin offers the potential for higher returns, its lower trading volume makes it a more volatile investment. We recommend gold for most investors due to its stability. However, bitcoin’s popularity may rise as the cryptocurrency market matures. Thorough research is essential before investors enter this market.

No More Mr. Nice Guy: The Republican populist wing appears to advocate a more transactional approach to foreign policy as it looks to pivot inward.

- There are growing signals that President Trump could dramatically shake up US foreign policy in his second term. In a letter to the European Council president, Hungarian Prime Minister Viktor Orbán claimed that if reelected, Trump would force Ukraine to accept a peace deal with Russia. The comment comes after Viktor Orbán held separate in-person meetings with Russian President Vladimir Putin and Trump earlier this month to discuss the matter. In that same vein, Trump also mentioned that Taiwan should pay the US for protection in a sign that he may not be willing to deter a Chinese invasion.

- The abrupt shift in stance regarding security assistance likely represents a significant reversal in American foreign policy. Traditionally, the US has advocated shielding allies from threats posed by Russia and China; however, now it appears that these countries will have to protect themselves. This newfound hesitation to provide security guarantees, specifically to smaller allies, comes amid growing anxieties that the US needs to do more to provide security domestically. This was shown as both Trump and his running mate J.D. Vance criticized US efforts to prioritize aid to foreign conflicts over securing the southern border.

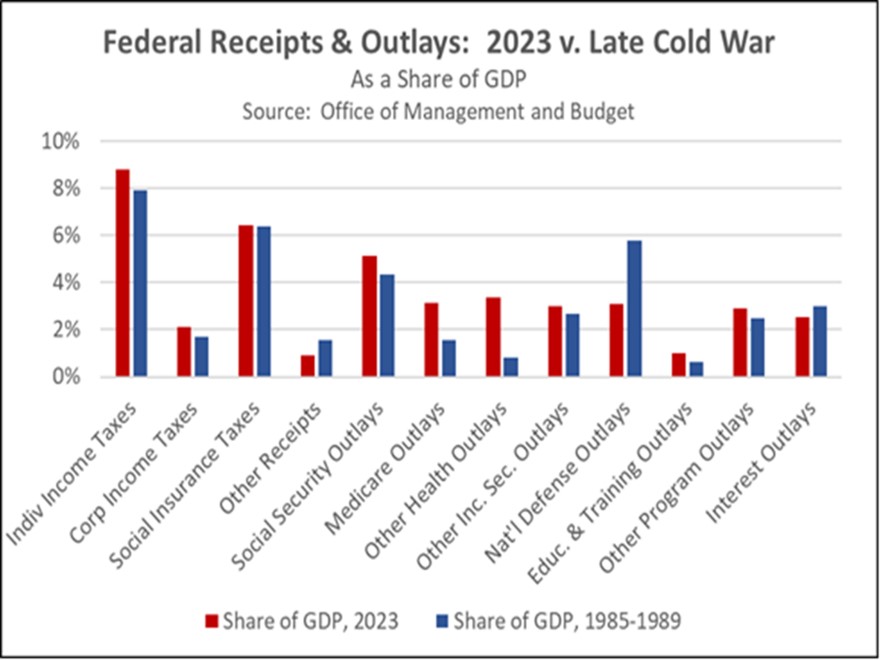

- If Trump wins the office, one of the most intriguing developments will be how he handles defense spending. Although US defense spending is at an all-time high, its share of GDP has dramatically decreased from the levels seen during the late Cold War. That said, while we expect that he will likely favor less spending abroad, we remain confident that overall spending for national security will stay at current levels or could even increase. This is due to the US’s need to develop deterrents to foreign threats and enforce strict immigration policies. As a result, we believe that defense companies could perform well under his leadership.

In Other News: China’s suspension of nuclear arms talks with the US further strains their already tense relationship. Meanwhile, a ceasefire agreement remains elusive in the Israel-Hamas conflict, despite hints of willingness from both sides. Additionally, there are concerns in Japan that its intervention in currency markets is becoming less effective, in a sign that the central bank may be forced hike rates soon.