Daily Comment (July 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are improved from yesterday following TSMC’s outlook. In sports news, Team USA crushed Serbia in an exhibition game, just 11 days before their Olympic opener. Today’s Comment dives into three key topics: the growing rivalry between the West and China over semiconductors, the market’s growing belief in a Federal Reserve policy shift, and the enduring power of centrist parties in the EU. We’ll also cover the usual roundup of international and domestic data releases.

Chip War to Trade War: Semiconductors are a flashpoint in the technological rivalry between the West and China, as both powers vie for supremacy in this critical industry.

- The US is looking for ways to undermine China’s semiconductor industry. Earlier this week, the Biden administration announced that it might implement the Foreign Direct Product Rule to prevent companies from selling chip-related technology to China. This rule allows the US to control foreign-made goods containing even minimal American technology. The clampdown is not only limited to sales, as the US has also pushed a top Dutch technical university into not accepting Chinese students.

- The European Union has also taken steps to counter China’s semiconductor industry. On Tuesday, it launched an anti-dumping investigation into imports of low-tech chips (also called legacy chips) from China. EU regulators suspect Beijing of unfairly undercutting prices to gain an advantage in the European automotive market. The investigation comes amidst concerns that China could use its overcapacity to flood foreign markets to the detriment of its competitors. The probe will likely open the door for tariffs, which is likely to further strain the EU trade relationship with Beijing.

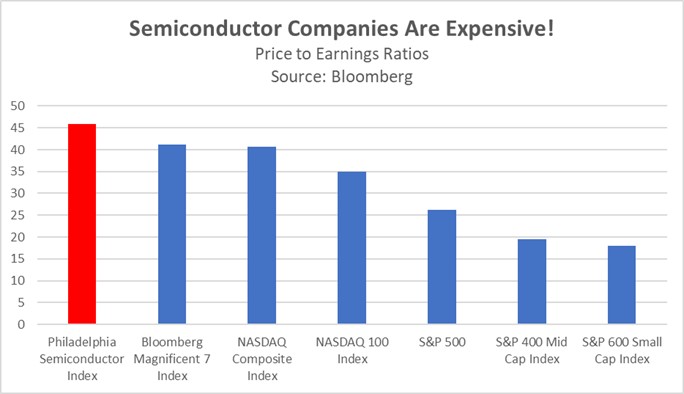

- The US and Europe’s recent moves, though in early stages, signal a growing trend of coordinated action to counter rivals in the chip industry. This will likely intensify regulatory scrutiny for chip companies as Western regulators look to close ranks. While TSMC’s latest revenue outlook suggests that firms are confident that they can navigate these headwinds, investors may turn their focus to whether Nvidia can maintain its streak of exceeding earnings expectations. In general, the current lofty valuations of chip companies, especially when compared to peers, suggests that the market rally for chip companies may lose momentum over the coming months.

Fed Soft Landing Near? A potential rate cut appears more likely, with the latest Beige Book and Fed comments offering some dovish hints.

- The July 17 Beige Book, a summary of economic conditions across the Fed’s 12 districts, indicates a slowdown in the economy. According to the report, five districts are experiencing muted or declining economic activity, an increase of three compared to the previous report. This is likely to strengthen the Fed’s case that inflation is cooling, and that it should shift its focus toward protecting economic growth. On Wednesday, Richmond Fed President Thomas Barkin hinted that Fed officials may drop their assessment that inflation is elevated and suggested that a 25 bp cut may be inconsequential.

- Investors are betting heavily on a September rate cut, with the CME FedWatch Tool indicating a near-certain likelihood at 99%. However, the prospect of additional cuts remains unclear. While the latest economic projections suggest that the Fed will only cut its policy rate once this year, it appears that the estimate was heavily influenced by the acceleration in inflation in the first quarter. In contrast, traders project that the recent rise in the unemployment rate and persistent disinflationary pressures may persuade Fed officials to cut rates 2-3 times this year.

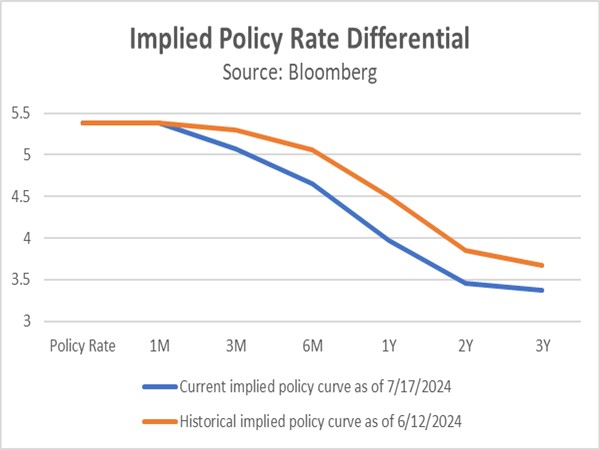

- There has been a significant shift in the expectations for rate cuts following the Fed’s hawkish turn at its June 11-12 meeting. The implied policy rate curve, which tracks expectations for up to three years ahead, now suggests that the Fed could lower rates to as low as 3.5% by 2026. This level implies policymakers are expected to bring interest rates down to a neutral zone, neither tightening nor loosening the economic grip. If this holds true, it suggests the market, despite recessionary fears, remains confident in a soft landing. This bodes well for value stocks, which should outperform in such a scenario.

European Centrists Fight On: As right-wing populists gain ground, European centrists still have the edge in gaining power.

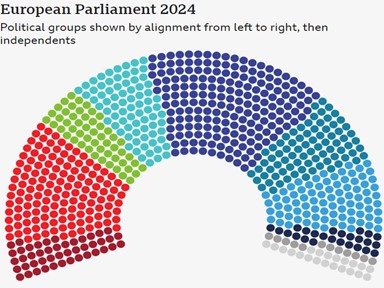

- Today, the European Commission is set to hold a vote on who will lead as president. The front-runner appears to be current head Ursula von der Leyen, and there does not seem to be anyone standing in her way. However, because the vote is done in secret, it gives party members the ability to vote against party lines. She has attempted to mediate tensions by appealing across party lines and vowing to push prosperity and security throughout the bloc. She will need 361 of 720 votes to win another five-year term.

- Her potential victory would likely be viewed as a triumph for centrist parties after the recent parliamentary elections. Earlier this month, far-right parties saw a major increase in seats, with their share growing from 14.8% to 26.0%. However, they were unable to secure enough seats to take power. Recent elections in France also suggest that these groups are not necessarily making significant inroads domestically. Despite their growing influence, their lack of success suggests they will struggle to enact meaningful changes to European policies.

- That said, even though the far right doesn’t sit in the driver’s seat, they still have a hand on the wheel. This victory will likely give these groups a larger platform to voice their concerns, which could potentially lessen some of the anti-establishment resentment. Roberta Metsola’s landslide victory for president of the European People’s Party illustrates the continued dominance of centrist forces in the European Parliament. As a result, this could lead to a somewhat more favorable environment for investment in Europe, particularly since centrists seem likely to retain control.

In Other News: The Democratic National Convention’s decision to delay the procedural roll call for the party nominee is yet another indication that the party apparatus is losing confidence in President Biden’s ability to win in November. The European Central Bank opted to hold interest rates steady at its recent meeting, a cautious move reflecting its concern about lingering inflationary pressures. Meanwhile, UK Chancellor Rachel Reeves hinted at tough choices ahead, suggesting the country is gearing up for debt control measures.