Daily Comment (July 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some initial comments on President Biden’s decision over the weekend to withdraw from the November election. We next review several other international and US developments with the potential to affect the financial markets today, including an apparent agreement between China and the Philippines to diffuse their dangerous tensions in the South China Sea and a statement by a former Federal Reserve official predicting that monetary policymakers could still cut interest rates as many as three times this year.

US Politics: Obviously, the key development to watch in the coming days will be the fallout from President Biden’s decision to pull out of the 2024 presidential election in favor of Vice President Harris. Polls suggest Harris might have a modestly better chance at beating former President Trump than Biden did. Keeping the White House in Democratic hands would have big implications for geopolitics, national security policy, international trade, fiscal policy, and other aspects of economic policy. It still seems too early to call a winner.

- Until the dust settles, it wouldn’t be a surprise to see the “Trump trade” temporarily cool or go into reverse. Indeed, both the dollar and US Treasury yields are trading lower so far this morning.

- All the same, the betting markets, which have been reliable predictors of electoral outcomes in the past, are currently showing Harris trailing Trump substantially. Of course, this could change as Harris gets her campaign up and running. Again, it is too early to say who will win in November.

- Much will probably depend on whom Harris chooses as her running mate. A strong choice that helps the Democrats win a key battleground state would help keep the race wide open.

- Another key consideration is whether Harris and her eventual vice-presidential nominee can help the Democrats keep control of at least one chamber of Congress. Investors often look favorably on a divided government, in which no party controls both the White House and all of Congress.

China-Philippines: Manila yesterday reiterated it would not rely on US help to resupply its marines on an outpost coveted by Beijing in the South China Sea. The statement comes despite Chinese coast guard harassment of the resupply missions and an offer by US National Security Advisor Sullivan for the US to do “what is necessary” to make sure they succeed. Keeping the US at arm’s length suggests Manila understands how dangerous the China-Philippine standoff had become and is now trying to keep the dispute under control.

- Indeed, the Philippine Department of Foreign Affairs yesterday said Manila and Beijing have struck a “preliminary” deal allowing resupply missions to the outpost. However, Beijing has not yet confirmed such an agreement.

- If the agreement is confirmed and holds, it could help diffuse a crisis that we believe had become even more dangerous than China’s aggressiveness against Taiwan. After all, the Philippines has a mutual defense treaty with the US, so any armed attack by the Chinese against the Philippines could potentially draw in the US.

Brazil-China: Brazilian President Lula da Silva revealed late Friday that his government is drawing up plans to join China’s controversial “Belt and Road Initiative,” under which Beijing has provided more than $1 trillion in grants and loans to mostly less-developed countries for ports, highways, railroads, and other trade-related infrastructure. The revelation suggests Brasilia is again drawing closer to Beijing, despite the risk that doing so could worsen ties with the US and potentially invite trade or capital retribution.

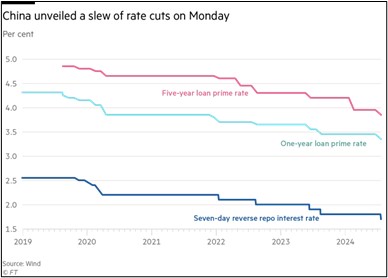

China: The People’s Bank of China today cut several of its key interest rates in a new effort to spur the flagging economy. For example, the central bank cut its one-year prime interest rate by 0.1%, marking its first such rate cut since last August. The new prime rate is 3.35%. The central bank also cut its five-year prime rate, which is a benchmark for mortgage lending, by 0.1% to 3.85%. The years-long downtrend in interest rates reflects how the wind has come out of the Chinese economy because of challenges such as weak consumption and high debt.

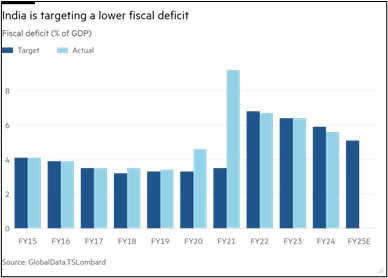

India: As Prime Minister Modi works to develop his proposed budget for the upcoming fiscal year, the two regional parties brought into his coalition in June are reportedly demanding the equivalent of billions of dollars in new funding for their states. The demands threaten to derail Modi’s plan to bring India’s budget deficit back under control after it blew out during the coronavirus pandemic. Failure to rein in the deficit could undermine foreign investors’ faith in the Modi government and reduce foreign investment in the country.

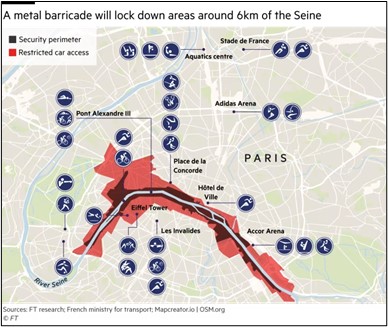

France: We want to extend our condolences to anyone taking a summer jaunt to Paris this week. With the Summer Olympic Games starting on Friday, authorities have begun locking down large sections of central Paris, including installing metal barriers to block car traffic along about 6 km of the Seine. Opening ceremonies begin Friday evening with a procession of athletes in boats along the river — the first such opening ceremony outside of a stadium.

US Monetary Policy: In an interview, former Federal Reserve Vice Chair Richard Clarida said there is “a real possibility” that the monetary policymakers could cut interest rates three times this year, due to rapidly cooling price inflation. We think that many cuts would be on the aggressive side, given that the Fed officials have expressed extreme caution about cutting too early and allowing inflation to rebound. The consensus among investors is still around two cuts, beginning in September.

US Airline Industry: Large numbers of US flights were canceled again yesterday and today as airlines continue trying to recover from last week’s global cybersecurity software glitch. Delta and United are reportedly the two most affected airlines. The cancellations have compounded the challenge of faltering consumer demand as the post-pandemic travel surge now seems to be petering out worldwide.