Daily Comment (July 25, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The S&P 500 is off to a sluggish start as investors digest recent earnings reports. In sports news, Morocco’s men’s soccer team was almost robbed of its Olympic victory over Argentina. Today’s Comment will explore the possibility of a Fed rate cut in July, analyze the disproportionate impact of the recent market downturn on large companies, and delve into the reasons behind the yen’s recent surge. As always, our report concludes with a roundup of international and domestic economic data.

A July Cut? A sudden turn by a former Fed official and weak economic data fueled further speculation that the Fed may cut imminently.

- Former New York Fed President William Dudley called for an immediate interest rate cut on Wednesday, warning that the Federal Reserve may be running out of time to prevent a recession. While acknowledging the benefits of low mortgage rates and a buoyant financial market for the wealthy, Dudley emphasized the broader economy’s struggles. He argued that maintaining current interest rates unnecessarily increases recession risks. Dudley is not alone in this opinion as former PIMCO Chief Mohamed El-Erian also expressed concerns about Fed cautiousness and suggested that the Fed may be two meetings away from a mistake.

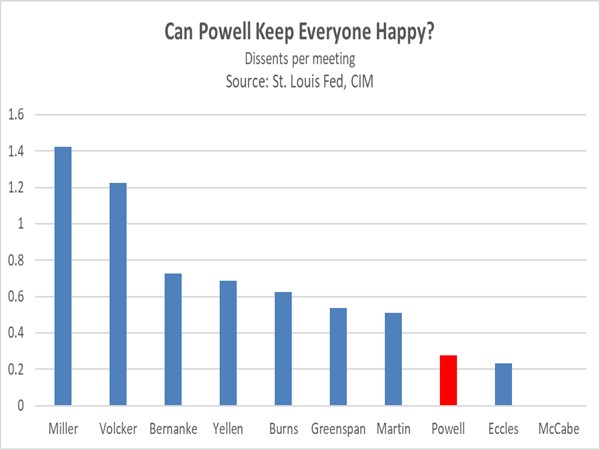

- His comments come at a time when the Federal Reserve is presenting a united front, yet also showing signs of growing divisions. During his tenure as Fed Chair, Jerome Powell has experienced the fewest dissents since Marriner Eccles held the position from 1948 to 1951. However, Fed speeches reveal significant divergence among policymakers regarding the appropriate policy path with officials making the case both for and against rate cuts. The March summary of economic projections underscored this disparity, with some members of the FOMC advocating for no rate cuts while one proposed as many as four.

- The Fed will make its next policy rate decision next week. While not a voting member, Dudley’s comments are likely to influence discussions as policymakers navigate the path forward. If inflation continues to moderate and labor market conditions worsen, the Fed may signal the potential for multiple rate cuts before year-end. However, a surprise rate cut, which can’t completely be ruled out, could prompt the central bank to indicate a pause on further reductions until after the election in order to avoid perceived political bias.

Market Friend or Foe: The unwinding of the AI tech rally is a reminder of why it is risky to make investments based on momentum.

- The AI-related stock sell-off has gone global. The Stoxx Europe 600 Technology Index plunged 2.8% on Wednesday, fueled by steep declines in chipmakers like Netherlands-based ASML and Germany’s Infineon. The rout extended to Asia, with SK Hynix, a key Nvidia supplier, plummeting 8.9% on Thursday despite reporting robust chip sales. This market downturn was triggered by Alphabet’s earnings call, during which the company signaled increased expenses due to hiring and infrastructure costs, raising concerns about the ability of tech companies to improve profit margins.

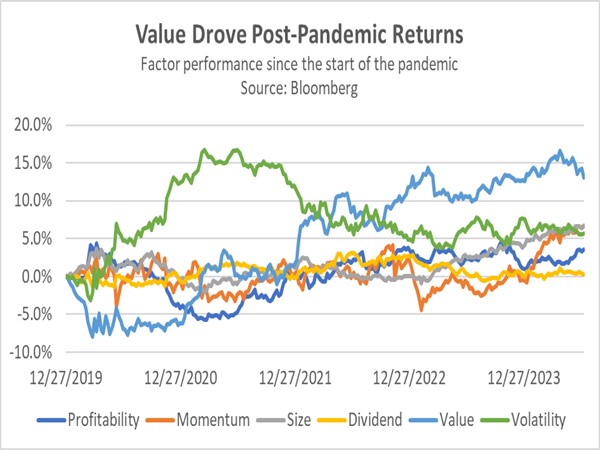

- This sell-off serves as a stark reminder of the risks associated with momentum investing. While riding market trends can be profitable, it’s essential to recognize that such strategies are inherently cyclical. The underperformance of momentum stocks coincided with a confluence of negative factors, including declining inflation and interest rate expectations, as well as growing pessimism about consumer spending. The reversal of these trends has led to a sharp increase in market volatility as investors plan for the next move, with value stocks emerging as an attractive option.

- Market fundamentals suggest a potential rotation from large-cap to small-cap stocks. However, unforeseen challenges like a more hawkish Fed stance or an economic downturn could derail this trend. Nevertheless, a bounce back for AI-related stocks cannot be ruled out entirely. A strong earnings report from Nvidia next month could potentially bolster the broader tech sector, including mega-cap companies. That said, we remain optimistic about companies that have yet to fully participate in the market rally, particularly mid- and small-cap stocks.

The Yen’s Comeback: The Japanese yen (JPY) has strengthened as the Bank of Japan’s monetary policy appears relatively more hawkish compared to its G7 counterparts.

- The JPY has strengthened 3.1% against the dollar over the past five days, surpassing the psychologically significant 152 level. This appreciation follows a series of dovish policy actions and statements from other central banks aiming to stimulate economic growth. On Wednesday, the People’s Bank of China reduced its one-year medium-term lending rate by 20 basis points. Simultaneously, the Bank of Canada lowered its benchmark interest rate by 25 basis points for the second consecutive month, while the European Central Bank is mulling another cut in September.

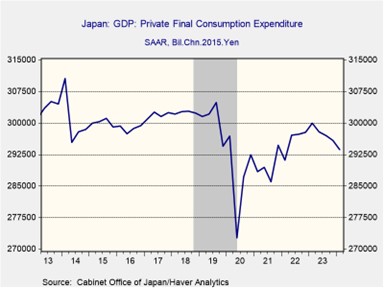

- While global central banks lean towards easing monetary policy, the Bank of Japan (BOJ) is charting a divergent course. At their upcoming policy meeting, policymakers are expected to discuss potential steps to unwind their expansive stimulus program. BOJ officials are considering a potential rate hike and halving their bond purchase program. Their decisions will likely hinge on expectations for future consumption and inflation. While inflation has shown signs of stickiness, with the core CPI above its 2% target, domestic consumption has weakened.

- The strengthening of the JPY is likely to be a sustained trend. For years, Japan has been signaling its intention to normalize monetary policy after a prolonged period of negative interest rates. This policy shift is expected to impact carry trades as investors may hedge their JPY exposure, which proliferated during the BOJ’s ultra-loose monetary policy era. Clear communication from the BOJ regarding its policy exit should mitigate the risk of a significant market disruption. Additionally, it should provide some resistance to the USD.

In Other News: Former President Trump is set to be the keynote speaker at a crypto conference in Nashville later today. Speculation is rife that he may be considering building a strategic bitcoin reserve, a move that could potentially usher in a bitcoin standard. Russia and China participated in a joint mission near Alaska in a sign that their rivalry with the West is intensifying.