Daily Comment (July 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a quick note on the renewed risk of a wider war between Israel and Iran-backed militants in Gaza and southern Lebanon. We next review several other international and US developments with the potential to affect the financial markets today, including a potential trade deal that the European Union might offer to former President Trump if he is re-elected in November and a preview of the Federal Reserve’s upcoming policy meeting this week.

Israel-Hezbollah: A rocket apparently fired from Lebanon by Iran-backed Hezbollah militants struck a soccer field in the Golan Heights on Saturday, killing a dozen Israeli children and teenagers. In response, the Israeli military launched airstrikes against militant positions across Lebanon yesterday. The retaliatory strikes by the Israelis have the potential to widen the continuing Israel-Hamas conflict into a regional war with bigger economic and security consequences for the world, as has long been feared.

European Union-United States: According to the Financial Times, European Union officials are planning a two-step, carrot-and-stick response if former President Trump is re-elected in November and imposes minimum 10% tariffs against all imports. Under the plan, the EU would approach Trump even before inauguration day to explore which US products the EU could import more of in order to forestall Trump’s tariffs. If no deal is reached, the EU would retaliate with tariffs of 50% or more against some US goods.

- EU officials reportedly estimate the minimum 10% tariffs floated by Trump would reduce EU exports by around 150 billion EUR annually.

- The EU plan clearly draws lessons from the so-called “Phase I” trade deal that the US and China sealed under Trump in 2020. Under that deal, China was supposed to dramatically boost its imports of certain US products, but ultimately fell far short, with few US complaints from either Republicans or Democrats.

France: Interior Minister Gérald Darmanin today said far-left radicals could have been behind the big sabotage attacks that disrupted high-speed rail service last week on the opening day of the Olympic Games in Paris. However, he also noted that the perpetrators could have been acting on behalf of other entities, keeping alive the possibility that the sabotage was ultimately inspired by Russia or its allies.

United Kingdom: In an effort to finally stop the periodic strikes by junior physicians in the National Health Service, the new Labour government of Prime Minister Starmer has offered them a pay hike of 22% over two years. That would still fall short of the 35% raise sought by the doctors, but it is much richer than what the previous Conservative government was willing to offer. Clearly, price inflation and labor shortages still have the potential to spark labor unrest and pay demands, even though the global surge of strikes has cooled over the last year or so.

Venezuela: With four-fifths of voting stations counted in yesterday’s election, the national electoral authority said President Maduro won with 51.2% of the vote. The authority said Edmundo González, the main opposition candidate, garnered only 44.2% of the vote, despite media reports saying he enjoyed strong, widespread support. There were also reports of voter intimidation and irregularities. The disputed results are likely to further isolate the Venezuelan government and possibly lead to new US sanctions, including on the national energy industry.

United States-Japan: In a new sign that the US and its allies are prepping for a possible conflict with China sometime in the future, the Pentagon yesterday said it will upgrade US Forces Japan to a joint force headquarters with expanded missions and operational responsibilities. With the change, the US’s roughly 55,000 personnel in Japan will be led locally, potentially by a four-star commander, rather than from the Indo-Pacific Command in Hawaii.

- Separately, US Secretary of State Blinken and Secretary of Defense Austin met with the Japanese cabinet to discuss measures clarifying the circumstances in which US nuclear forces could be used to deter a threat to Japan, from China or North Korea, for example.

- The officials also discussed further defense industrial cooperation, including having Japanese factories produce advanced US missiles to help get around the US’s current capacity shortfalls at home. The two sides also already have an agreement for Japanese firms to provide maintenance and repair services for US navy ships and aircraft.

US Monetary Policy: The Fed’s policy committee holds its latest meeting this week, with its decision due on Wednesday at 2:00 PM ET. Despite growing calls from some observers to start cutting interest rates at this meeting, we think the more likely course is for the officials to signal an initial cut in September. Recent data has certainly revealed that the economy is cooling and price pressures have fallen, but the officials still say they want to see more evidence that those changes will be sustained, despite a risk that continued high rates could spark an economic downturn.

- As investors anticipate rate cuts starting this fall, new reports show they have been pouring cash into exchange-traded funds focused on bonds.

- The data indicates that flows into bond ETFs and mutual funds accounted for almost 90% of all net fund inflows in the US in the first half of the year.

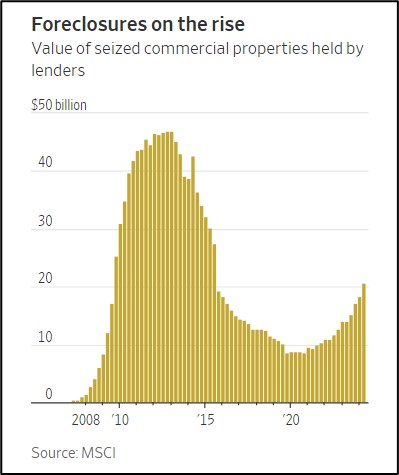

US Commercial Real Estate Industry: Data from MSCI shows lender portfolios of foreclosed and seized office buildings, apartments and other commercial property jumped 13% in just the second quarter, to a value of $20.5 billion. That marked the highest level of seized properties since 2015 and suggests many lenders have finally given up on those property owners struggling with high interest rates, weak demand, and low occupancy rates.

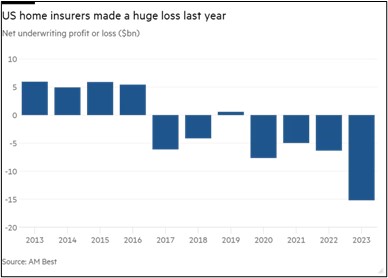

US Property Insurance Industry: New reports from rating firm AM Best indicate that property insurers in the US suffered a total net underwriting loss (premiums minus claims) of $15.2 billion on their homeowner polices last year. That marked their worst underwriting loss since at least 2000. The analysis shows the big losses stemmed from the increasing frequency and severity of weather events, rapid price increases for building materials, more people moving to disaster-prone areas, and regulators’ slow approvals for premium increases.

US Cryptocurrency Industry: In a speech at a bitcoin conference on Saturday, former President Trump made a strong pitch for cryptocurrency supporters. If re-elected, Trump vowed to sack Securities and Exchange Commission leader Gary Gensler over his efforts to restrict cryptocurrency investments. He also promised to end the Biden administration’s “persecution” of the industry. Meanwhile, reports say Vice President Harris’s advisors have reached out to key cryptocurrency leaders in an effort to reset relations.

- The Trump and Harris overtures show each side recognizes that younger voters have a more favorable view of cryptocurrencies and want to see the industry succeed.

- This suggests that the SEC’s current resistance to the industry will likely be dismantled following the election, no matter who wins the White House.