Daily Comment (July 30, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new data on economic growth in the eurozone and the prospects for more interest-rate cuts by the European Central Bank. We next review several other international and US developments with the potential to affect the financial markets today, including emergency spending cuts to bring down the UK’s budget deficit and a preview of the Federal Reserve’s latest policy meeting, which starts today.

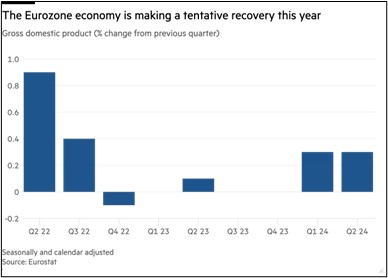

Eurozone: In an initial estimate, second-quarter gross domestic product rose by a seasonally adjusted 0.3%, beating the expected increase of 0.2% and matching the first-quarter growth rate. That translates to an annualized growth rate of only about 1.2% in each quarter, and the region’s GDP in the second quarter was up just 0.6% from the same period one year earlier. The figures do reflect a modest improvement in the eurozone’s economy in 2024, but they remain weak enough to suggest the European Central Bank will continue to cut interest rates.

United Kingdom: The new Labour Party chancellor, Rachel Reeves, yesterday revealed a series of emergency spending cuts to help plug what she called an undisclosed 22-billion GBP budget hole left by the previous Conservative Party government. The spending cuts include measures to end winter fuel subsidies for higher-income pensioners and eliminate outlays on roads and hospitals. The measures are being seen as a prelude to tax hikes in the next fiscal year budget, due to be released on October 30.

Japan: Global investors continue to brace for the Bank of Japan’s latest policy decision tomorrow. After the central bank ended its previous policy of negative interest rates in March, market indicators now suggest investors see about a 40% chance that the BOJ will lift its benchmark short-term interest rate further to 0.25%. It is also expected to release a plan for starting to unload its $3.8 trillion in Japanese government bond holdings (JGB). (See our preview of the Fed’s Wednesday policy decision below.)

- Amid investor anticipation of the BOJ’s rate hike and bond sales, the yen (JPY) has appreciated and JGBs have depreciated sharply so far this month.

- Since the JPY is used globally as a funding currency, the recent currency moves and investor repositioning has also fed an increase in volatility in global markets over recent weeks.

China: At the Communist Party’s latest Politburo meeting yesterday, top officials reportedly decided to implement aggressive new economic measures to boost China’s consumer spending and corporate investment. However, the announcement in state media offered few specifics.

- Any new measures would supplement the central bank’s interest-rate cuts last week and a range of other modest measures implemented earlier, such as easier rules for home purchases and subsidized appliance trade-in programs.

- All the same, General Secretary Xi and his top officials have shown little inclination to adopt the wide-ranging, consumer-oriented reforms that many economists believe are necessary to reignite Chinese growth. Going forward, we suspect Chinese economic growth will continue to be held back by factors such as weak consumer demand, excess capacity and high debt, poor demographics, disincentives from the Communist Party’s interventions in the markets, and decoupling by the West.

China-Philippines: Following a recent deal by Beijing and Manila, the Philippine military has reportedly carried out a resupply mission for the marines it has stationed on an old, grounded naval vessel in an area of the South China Sea claimed by both countries. According to Beijing, the Philippines allowed China to inspect the shipment beforehand, but Manila denies it gave up its sovereignty in such a manner.

- Given that Philippine President Ferdinand Marcos Jr., is so politically skilled and probably intent on avoiding a conflict, it would not be surprising if he has secretly shown some flexibility with the Chinese demands for control over the situation. (For an in-depth discussion of Marcos’s background and character, see our Bi-Weekly Geopolitical Report from July 22, 2024.) Indeed, Manila has admitted to an “exchange of information” with the Chinese prior to carrying out the mission.

- All the same, to the extent that Manila is willing to overtly or secretly bow to China’s demands, it could potentially be a sign that the Philippines has lost some faith in the strength of its alliance with the US and the US’s commitment to its defense. If that is true, and if the sentiment spreads among other US allies, it would reflect a worrisome weakening of the US alliance system in the Indo-Pacific region.

Russia: President Putin has reportedly signed a decree allowing military equipment designers to utilize foreign intellectual property without the owner’s consent, bypassing traditional patent protections. At one level, the move highlights Russia’s desperate attempt to catch up to Western technological advances as it faces greater sanctions over its invasion of Ukraine. The move also shows how Russia has become a rogue state that no longer operates under accepted economic rules, which will likely further cut it off from Western trade and capital.

North Korea: In a report to lawmakers yesterday, South Korea’s intelligence service reportedly said North Korean Supreme Leader Kim Jong-un has chosen his pre-teen daughter, Ju-ae, to be his eventual successor. According to the intelligence service, the younger Kim is being educated specifically to take over the reins of power, although there is still some chance that a sibling could displace her.

Venezuela: A day after President Maduro claimed he won a third term in office in the weekend election, mass protests have broken out in Caracas and other cities across the country. The US, the European Union, and several Latin American nations also criticized the apparently fraudulent outcome, prompting the Maduro government to sever diplomatic ties with Argentina, Chile, Costa Rica, Peru, Panama, Uruguay, and the Dominican Republic.

- As we noted in our Comment yesterday, the apparently fraudulent outcome is likely to further isolate Venezuela. It could also lead to a snap back of economic sanctions on the country, including on its energy sector.

- On top of that, the size of the popular protests suggests Maduro could also face rising internal dissent and increased political instability. That could further harm the Venezuelan economy and push even more of its citizens to emigrate, including to the US.

US Monetary Policy: The Fed today begins its latest two-day policy meeting, with its decision due tomorrow at 2:00 PM ET. Despite growing calls from some observers to start cutting interest rates now, the more likely course is for the officials to signal an initial cut in September. Recent data has certainly shown the economy is cooling and price pressures have fallen, but the officials still say they want to see more evidence that those changes will be sustained, despite a risk that continued high rates could spark an economic downturn.

US Energy Industry: British energy giant BP today said it will start drilling a new oilfield in the Gulf of Mexico. The move is a reminder that the Gulf remains an important energy resource, despite the prolific expansion of onshore shale fields in places like the Permian Basin over the last two decades. The move also shows that traditional energy resources can remain attractive in an era of policy preferences for renewable energy, tough regulation, and shareholder demands for cash returns.