Daily Comment (July 31, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are trading higher this morning as investors await the Fed’s rate decision. In sports news, Simone Biles led the US women’s gymnastics team to gold at the Olympics. Today’s Comment will delve into the Federal Reserve’s interest rate decision, examine the cooling AI hype, and analyze the Bank of Japan’s latest policy move. We will conclude with a review of key domestic and international economic data.

Is it Pivot Time? The FOMC is set to conclude its two-day meeting today, with investors eagerly awaiting clues about potential rate cuts.

- Federal Reserve policymakers are expected to announce a shift in their focus away from inflation and toward employment to achieve greater economic balance. Concerns are growing amid four consecutive months of rising unemployment, which could trigger the Sahm Rule if the trend persists in July. This rapid labor market deterioration has prompted prominent economists, including former New York Fed President William Dudley and former PIMCO CEO Mohamed El-Erian, to push for an immediate rate reduction within the next two Fed meetings in order to avert a policy mistake.

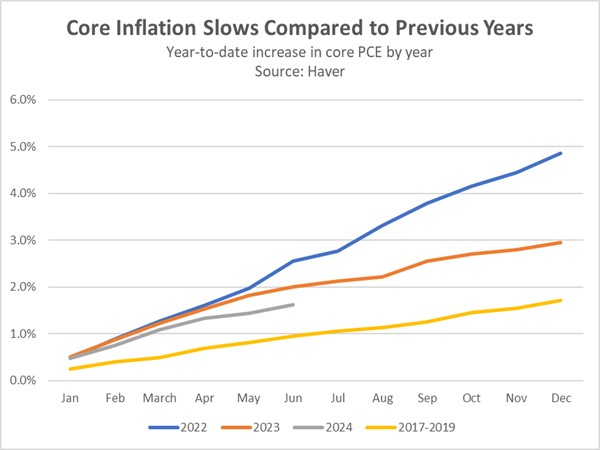

- While Fed officials have signaled increased confidence in inflation’s downward trajectory, concerns persist about the potential resurgence of price pressures. Richmond Fed President Thomas Barkin recently expressed skepticism about the current restrictive nature of interest rates, noting that inflation, though improved, remains above pre-pandemic levels. The core PCE price index rose 1.6% in the first half of 2024, a deceleration from the 2.0% pace in the same period of 2023 but still significantly higher than the 0.9% average seen in the three years preceding the pandemic.

- Despite mounting pressures for an immediate rate cut, the Fed is expected to maintain its current policy stance at today’s meeting. The central bank is likely wary of potential inflationary pressures during the typically quiet summer months, which would delay any rate reduction until September or beyond. Although unemployment has risen sharply, it remains within a range typically associated with economic growth. As a result, the Fed is expected to adopt a cautious approach, potentially keeping rates unchanged for an extended period. If this occurs, it could impact the rotation trade.

Magnificent 7 in Focus: Microsoft is the latest tech company to disappoint investors following its earnings reports, as investors start to question AI profit expectations.

- While Microsoft surpassed overall earnings expectations, its Intelligent Cloud division fell short. Revenue for the highly touted segment climbed 19% to $28.5 billion but missed estimates by $200 million. The company attributed the shortfall to a weak European market and capacity constraints, as it struggles to keep pace with surging AI demand. These challenges coincide with recent service outages, including CrowdStrike’s software failure and a cyberattack yesterday, which will now lead to concerns about the company’s overall technical infrastructure.

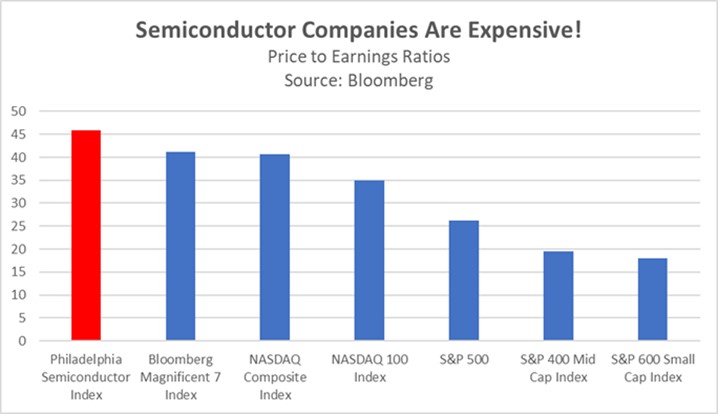

- Microsoft is the third of the Magnificent 7 to disappoint investors this month, following in the footsteps of Alphabet and Tesla. Their bleak outlooks have contributed to a broader tech sell-off, as investors seek more attractive valuations in other equity sectors. The S&P 500 is down 0.7% so far this month, while the NASDAQ 100 has plummeted over 5%. Hardware companies have taken the brunt of the downturn as investor are not sure whether these stocks have any more room to grow from their current valuations.

- Four Magnificent 7 companies remain, and Nvidia’s August 28 report will serve as a crucial test for the AI rally. The chipmaker’s triple-digit revenue growth and earnings beat have made it the index’s sole standout. A disappointing result could dampen investor enthusiasm for AI and accelerate a market shift towards smaller companies, especially if the Fed maintains a dovish stance today. AMD’s recent earnings report, boasting strong sales and a bullish outlook, suggests sustained spending on AI chips. This could bode well for Nvidia given the similar landscape.

Hawkish BOJ: The Bank of Japan unexpectedly raised interest rates in a sign that the central bank is looking to normalize policy after decades of policy accommodation.

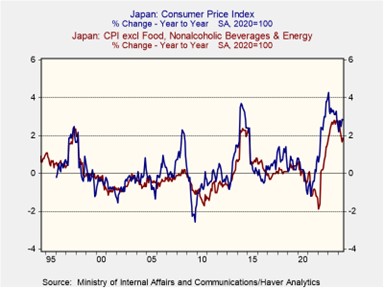

- The Bank of Japan (BOJ) has raised its benchmark interest rate to 0.25%, its highest level in over 25 years, from a previous target range of 0-0.1%. This move is intended to bolster the weakening yen (JPY) and stimulate economic growth by mitigating inflationary pressures from rising import costs. Additionally, the central bank revealed that it would gradually reduce its bond purchase program by half to 3 trillion JPY a month by early 2026, or the equivalent of about $20 billion.

- The Bank of Japan’s recent policy adjustments signal a determined effort to normalize monetary policy and strengthen the yen. Prior to its latest meeting, concerns mounted over Japan’s economic slowdown, with GDP failing to surpass its Q2 2023 peak. Governor Ueda defended the policy shift, arguing that a stronger yen could invigorate growth by fostering consumer confidence through stable import prices. Although Japan’s inflation rate has peaked, it remains a persistent issue. Headline CPI, which includes volatile energy and food costs, continues to exceed the 2% target, amplified by the impact of dollar-denominated commodities.

- Assuming interest rate expectations remain stable, the recent policy shift is likely to contribute to dollar weakness. The Bloomberg Dollar Spot Index has already fallen by 0.4% in response to the decision by the BOJ. We anticipate a convergence of US interest rates with those of other G7 nations over the coming months. This shifting interest rate environment is expected to exert downward pressure on the dollar initially, although other factors will increasingly influence the currency’s strength going forward, which include GDP growth expectations and capital flows.

In Other News: An Israeli strike on Beirut reportedly killed a top Hezbollah commander, signaling a potential escalation of tensions in the Middle East. Meanwhile, China’s manufacturing sector contracted for the third consecutive month as the country grapples with declining industrial output.