Daily Comment (August 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with an overview of the Federal Reserve’s latest monetary policy decision yesterday, in which it set the stage to potentially cut interest rates in September. We next review several other international and US developments with the potential to affect the financial markets today, including a rate cut by the Bank of England and signs that global and US climate-change spending is starting to shift from prevention to adaptation.

US Monetary Policy: Wrapping up their latest policy meeting yesterday, Fed officials held their benchmark fed funds interest rate unchanged at 5.25% to 5.50%, as widely expected. Just as important, their policy statement downgraded their assessment of consumer price inflation from “elevated” to “somewhat elevated” and said the risks of high inflation versus a weak labor market have “continued to move into better balance.” In his press conference, Chair Powell also stressed that he doesn’t want to see any “material further cooling in the labor market.”

- Even though Powell stressed that the policymakers aren’t ready to cut interest rates just yet, the statements point to a possible cut in September. All the same, the statement and press conference were probably a bit less dovish than initial press reports suggested. Both held far back from any commitment to cut rates at the next meeting in about six weeks, giving the policymakers some wiggle room if the inflation data turns against them.

- Powell’s statement about avoiding further deterioration in the labor market seems warranted. Multiple indicators suggest labor demand has softened considerably. To avoid the risk of further deterioration, it does seem likely that the Fed will finally cut interest rates in September, marking its first election-year rate cut since 2008.

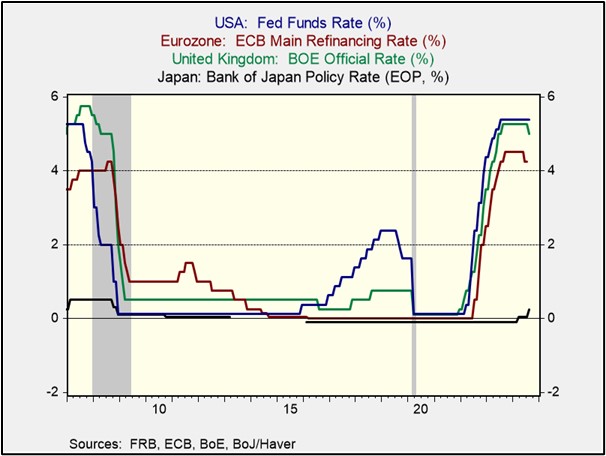

- The chart below shows how the world’s major central banks have shifted their benchmark interest rates in recent years.

UK Monetary Policy: The BOE today cut its benchmark interest rate from 5.25% to 5.00%, but the vote to do so was extremely close. While five members of the policy committee voted to cut rates, four voted to hold them steady. Following the announcement, BOE Governor Bailey also cautioned that the officials must be careful “not to cut interest rates too quickly or by too much.” In sum, the tenor of the action was cautious, suggesting the BOE may continue to cut rates only slowly or sporadically.

- In response to the Fed’s decision yesterday and today’s initial rate cut by the BOE, the pound (GBP) is trading down about 0.6% to $1.2782.

- The rate cut has also given a boost to the UK’s two-year government bonds, pushing their yield down to 3.76%.

UK Public Security: During a vigil on Tuesday night for three children killed in a knife attack earlier this week, right-wing protestors attacked a mosque, rioted, and scuffled with police in the northern England city of Southport. The violence has now spread to other cities as well, including London. The rioting, which has injured dozens of police, arose despite investigators’ insistence that the 17-year-old attacker was a native-born Briton, and that they have found no sign of an Islamist motive so far.

- It appears the protestors were largely inspired by misinformation and conspiracy theories on social media, including by Russian state-controlled media.

- The violence illustrates the risk that rapidly spreading misinformation and scapegoating could spark disruptive, destabilizing violence even in stable developed countries.

European Union-United Kingdom: Responding to British Prime Minister Starmer’s overtures for improved EU-UK cooperation in international security and trade, the European Commission has issued a list of eight demands it wants London to meet as a sign of good faith. The demands center on measures to fully implement the Brexit deal under which the UK left the EU, including UK commitments related to Northern Ireland and the rights of EU citizens living in the UK. The demands suggest it may be harder to repair EU-UK relations than Starmer expected.

European Union-Hungary-Venezuela: As world leaders continue criticizing Venezuelan President Maduro’s apparently false declaration that he won re-election in last weekend’s balloting, Hungary’s right-wing populist government has vetoed any official condemnation by the EU. The European Commission’s foreign affairs chief, Josep Borrell, has issued a personal condemnation, but Budapest’s veto signals that Hungarian Prime Minister Orbán intends to keep undermining democratic values in favor of authoritarianism around the globe.

Russia-Ukraine: New public opinion polls show a majority of Ukrainians still opposes ceding any territory to Russia to end its invasion of their country, but the share willing to consider such a concession has grown to as much as 45%. The shift in public opinion comes as top government officials begin to show more openness to negotiation in their statements and diplomatic activity.

- If the Ukrainians really are becoming more open to territorial concessions in return for peace, it likely stems from general war weariness, the armed forces’ inability to stop Russia’s slow advances, and skepticism about continued support from the West.

- We have long expected that the most likely outcome of the war is a negotiated settlement, once both sides are sufficiently exhausted. That point hasn’t yet been reached, but it does appear to be coming closer.

- In any case, we continue to believe that any negotiated settlement could merely provide a temporary peace. With the support of his like-minded authoritarian revisionists in places like Beijing and Pyongyang, Russian President Putin would likely use any truce to rebuild his military and prepare for new assaults against Ukraine and potentially other countries in the future.

- Because of that possibility, we suspect Western European nations will continue working to rebuild their defense capabilities even after a Russia-Ukraine peace deal. That would likely lead to continued growth in Western European defense budgets and good prospects for the region’s defense contractors.

China: According to data provider Preqin, private capital fundraising in the second quarter fell to a record low of $3.4 billion, less than one-tenth the average quarterly fundraising of roughly $45 billion from 2019 through 2021. The weak second-quarter fundraising figure — which includes all funds raised for private equity, venture capital, private debt, real estate, and infrastructure — reflects both China’s worsening economic growth and weaker prospects for profitable exits in the future.

US Climate Policy: The Wall Street Journal today carries an interesting article claiming the $1.3 trillion or so spent globally and in the US to address global warming is gradually shifting away from prevention (reducing emissions, etc.) toward mitigation (shoring up infrastructure, etc.). According to the article, only about 5% of total climate spending is now on mitigation, but that share is rising. If the trend continues, an entirely new set of companies could be the beneficiaries, beyond today’s solar cell makers, electric vehicle manufacturers, and the like.