Daily Comment (August 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a recap of the wild market swoon around the world on Monday. So far today, the markets have calmed down considerably, and the Japanese equity market regained most of the 12% decline it suffered yesterday. We next review several other international and US developments with the potential to affect the financial markets today, including a potential new point of conflict between China and the Philippines and an antitrust ruling against technology giant Google.

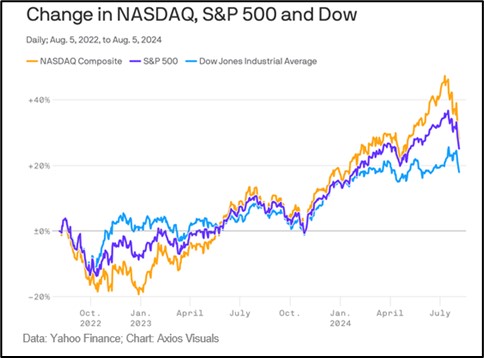

Global Financial Markets: The global rout in risk markets yesterday ultimately drove large-cap US stock prices down about 3.0%, with previously high-flying technology stocks and small-cap stocks faring even worse. All the same, our close read of the markets and our second look at recent economic data still suggest that the culprits were largely what we tagged in yesterday’s Comment: an overreaction to the weak July employment report on Friday, rising Japanese interest rates, and an unwinding of yen carry trades.

- Multiple US data series suggest lower-income consumers continue to struggle with the high price inflation of recent years. Those consumers have been especially whipsawed by the way tax brackets are indexed to inflation only with a lag. Many responded by borrowing more, only to be hit with higher interest charges. On top of that, higher interest rates have cooled parts of the production sector, such as apartment developers. Weaker consumer demand and cooler business investment is now hurting the labor market.

- As we noted in our Economic and Financial Market Outlook for 2024, which we titled “The Slow-Bicycle Economy,” slower economic growth will make the US economy more susceptible to recession, especially if there is an exogenous shock to the system. At this point, however, such an exogenous shock is not readily apparent. It is entirely possible that the US will merely experience a period of slower growth or perhaps a mild, short recession. The silver lining is that such a situation would imply lower interest rates.

- Looking ahead to the coming days, the unwinding of yen carry trades and continued concerns about the US economy could keep the markets volatile. This volatility will likely prompt investors to reassess their expectations and valuations for certain sectors, potentially leading to a longer-lasting rotation away from recent high-flyers to down-trodden assets that may benefit from lower interest rates, such as real estate and bonds.

- In the Japanese stock market, which dropped 12.4% yesterday to get the rout going, indexes closed up about 10.4% today.

Global Oil Market: Saudi Aramco, Saudi Arabia’s largely state-owned oil company and the world’s biggest producer, confirmed it will pay out $124 billion in dividends this year, dwarfing the $32 billion in dividends and share buybacks expected from US oil giant ExxonMobil. More broadly, the firm warned that global oil demand is much stronger than investors realize.

- According to CEO Amin Nasser, global oil demand is “robust,” especially in China, despite its economic slowdown and the broader global transition to green energy.

- If Nasser is correct, it would suggest the US and global economies are still in decent shape. In turn, that could point to ongoing upward pressure on oil prices.

China-Philippines: Yesterday’s South China Morning Post said Manila has deployed a coast guard vessel to a new area of the South China Sea claimed by both China and the Philippines. The Philippine vessel, the Teresa Magbanua, has reportedly been blocking Chinese coast guard ships from interfering with boats from the Philippine Bureau of Fisheries and Aquatic Resources, which have been refueling fishing boats in the area. According to the article, Beijing has accused Manila of intentionally grounding the Teresa Magbanua on the disputed Sabina Shoal.

- The report comes just days after Beijing and Manila reached a deal to defuse tensions around a Philippine naval vessel, the Sierra Madre, which was intentionally grounded in 1999 on the disputed Second Thomas Shoal, also in the South China Sea. The Sierra Madre is now an outpost for Philippine marines, helping assert Philippine sovereignty over the area.

- Since the old, rusting Sierra Madre is now in danger of breaking up, Beijing has been pressuring Manila to stop shoring it up. Once the Sierra Madre breaks up and the Philippine marines have to abandon her, Chinese forces would be free to seize the Second Thomas Shoal and assert Beijing’s sovereignty over the area.

- If Manila really has grounded the Teresa Magbanua on Sabina Shoal, right after promising not to shore up the Sierra Madre any further, it would mark a stunning and aggressive sleight of hand by Philippine President Ferdinand Marcos, Jr. The result would be to keep alive the increasing territorial tensions between Beijing and Manila, which could potentially draw in the US and lead to conflict in the South China Sea.

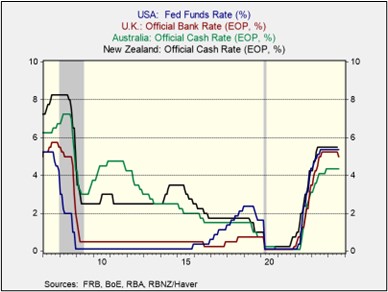

Australia: The Reserve Bank of Australia (RBA) today held its benchmark short-term interest rate unchanged at 4.35%, right where it has been since November. In its statement, the central bank said underlying inflation pressures remain too high and probably won’t come down enough to support a rate cut anytime soon. That puts the RBA at odds with most other developed-country central banks, many of which have started cutting rates or are preparing to do so.

European Union-Mercosur: According to the Financial Times, European and South American officials have said they recently resolved some sticking points in the 20-year negotiations over an EU-Mercosur free-trade deal and could have the pact signed by the end of 2024. If signed and approved by a majority of the EU’s 27 member states, the deal is expected to save EU businesses more than 4 billion EUR per year in tariffs, while opening new markets in Europe for the five Mercosur nations of Brazil, Argentina, Uruguay, Paraguay, and Bolivia.

Mexico: For the first time, Defense Secretary Gen. Luis Cresencio Sandoval has admitted that the country’s drug cartels have killed some Mexican soldiers with bomb-dropping drones like those being used in the Russia-Ukraine war. In our view, the cartels’ successful use of the drones illustrates why they are revolutionizing modern warfare: The drones are highly effective at killing and destroying equipment, while they are also cheap and relatively easy to use.

US Monetary Policy: After yesterday’s global market selloff, as discussed above, Chicago FRB President Goolsbee vowed the Fed would “fix” any deterioration in the US economy. Separately, San Francisco FRB President Daly said the policymakers “will do what it takes” to meet their price stability and employment goals.

- The statements are far from any commitment to implement an interim interest-rate cut, a 50-basis point cut in September, or even a 25-basis point cut that month.

- However, the statements do confirm that yesterday’s market action and recent soft economic data have gotten the Fed’s attention, raising the probability that they will ease monetary policy this autumn more aggressively than previously planned.

US Antitrust Policy: In a ruling yesterday, a federal judge said Google violated US antitrust law by spending billions of dollars on exclusive deals to maintain a monopoly on internet searches. The judge is still deciding what remedies to impose, and the company said it plans to appeal the ruling in any case. Still, the ruling illustrates the federal government’s increased focus on uncompetitive behavior by big technology firms. The question is how much that focus will hurt those firms’ revenues and profitability going forward.

US Artificial Intelligence Industry: New reports say AI chip darling Nvidia and manufacturing partner Taiwan Semiconductor have suffered production snags on Nvidia’s new Blackwell data center chip. The snags reportedly could delay shipments of Nvidia’s key new product scheduled for later this year. The news could take further wind out of Nvidia’s high-flying stock price.