Daily Comment (August 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with several items on China’s international relations and domestic economy. We next review several other international and US developments with the potential to affect the financial markets today, including a statement by a British monetary policymaker calling for continued high interest rates and new data showing a recovery in US trucking demand.

China-Philippines: Manila has accused the Chinese air force of harassing a Philippine military transport plane on routine patrol in Philippine airspace near the disputed Scarborough Shoal last Thursday. The Chinese harassment comes despite the recent deal between Beijing and Manila to diffuse tensions over a Philippine military outpost on Second Thomas Shoal, another disputed outcrop in the South China Sea. The new incident suggests dangerous Chinese-Philippine tensions in the disputed waters are likely to continue, despite one-off deals or lulls.

China-Estonia-Finland: On a more positive note, the Chinese government has admitted that a Chinese-owned ship severed an important natural gas pipeline and damaged communication cables in the Baltic Sea last October. As long suspected, the damage was caused by the Chinese ship dragging its anchor along the seabed. However, Beijing insists the incident was an accident caused by bad weather.

- The incident, which affected a pipeline and communications cables running between Finland and Estonia, had raised fears that it was a sabotage operation to punish Helsinki and Tallin for their opposition to Russia’s invasion of Ukraine. Once investigators tied the incident to the Chinese ship, it also raised concern that Beijing might be cooperating in Russian sabotage.

- Of course, the new admission by Beijing won’t necessarily end the concern about China helping Russia politically and militarily; however, it may help ease that concern in the near term.

China: The country’s fourth-largest mutual fund company, Harvest Fund Management, on Friday said its chairman has resigned due to a corruption investigation. The resignation is probably related to Beijing’s new effort to make China a “financial superpower,” in part by cleaning the sector up and purging corrupt officials. Cutting corruption is a laudable goal, but the sector will likely be challenged by other aspects of Beijing’s program, such as capping pay for financial professionals.

- Separately, multiple Western companies have said in their latest quarterly earnings reports that they are seeing steep declines in their sales in China, reflecting both weak consumer demand and a growing preference for Chinese brands.

- The statements are consistent with our view that the US and Chinese geopolitical blocs will continue to decouple. In addition to growing government-imposed trade barriers between the blocs, we think China’s cooling economic growth and reduced appetite for foreign goods and services will increasingly weigh on foreign investment in the country, especially from the US bloc.

United Kingdom: Catherine Mann, an external member of the Bank of England’s monetary policy committee, has warned that consumer price inflation in the UK will likely reaccelerate. According to Mann, who dissented from the central bank’s decision to cut interest rates earlier this month, business surveys show companies plan to continue hiking wages and prices, which will boost inflation again and require continued tight monetary policy.

Russia-Ukraine: The Ukrainian military’s surprise incursion into Russia’s Kursk region last week is apparently continuing. The Ukrainians have now advanced as much as 20 miles into Russia, and reports today say they have tried to open up a new incursion into the Belgorod region, farther south. The Russian military has had to respond by stitching together several inexperienced, poorly prepared, under-strength units, and those units still have not been able to push the Ukrainians back over the border.

- The aim of the incursions may be to force the Kremlin to redeploy troops and other military assets away from the frontlines in Ukraine, easing pressure on Kyiv’s troops.

- Even though Kyiv’s goal may be rather limited, the incursion is embarrassing for Russian President Putin and his military officials. If it continues, it could become a more serious political problem.

- Because of that, it’s important to remember that if the fighting on Russian soil continues, Putin could unleash a bigger-than-expected assault to crush the Ukrainian forces, even if it means temporarily pulling resources off the frontlines in Ukraine.

US Politics: At a campaign rally in Las Vegas over the weekend, Vice President Harris said that along with hiking the federal minimum wage, she would seek to eliminate income taxes on tips for service and hospitality workers. The proposal on tips echoes a recent promise by former President Trump and signals that Harris may try to meet or exceed any populist economic ideas espoused by her rival between now and the November election.

- Exempting tips from taxes would probably have only a small impact on federal revenues. After all, many service and hospitality workers have such low income that they aren’t liable for taxes. Those that are liable for taxes are often in the lowest tax bracket.

- Nevertheless, if the two candidates get into a bidding war for the populist vote, they could begin to promise more costly proposals, such as big spending increases or broader tax cuts for favored groups.

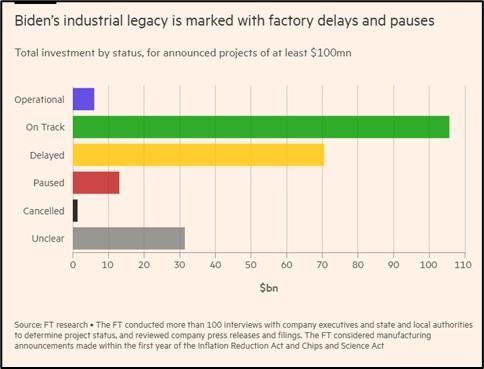

US Industrial Policy: New research by the Financial Times shows that about 40% of the factory investments announced in the first year of the CHIPS Act and Inflation Reduction Act have been delayed or paused. While it isn’t clear whether that rate is unusually small or large for similar unsubsidized project, the data is likely to be a black eye for the Biden administration. On a more positive note, the slow progress on some projects may also reduce or slow their draw on the federal budget, lowering their negative impact on the budget deficit in the near term.

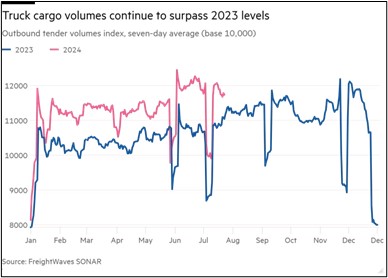

US Trucking Industry: New data from logistics data firm FreightWaves shows that trucking shipment orders in the second quarter were up 9% year-over-year, while tender rejections (a measure of capacity tightness) rose 1.3%. The figures suggest trucking demand is now rebounding again, even if pricing remains in the doldrums due to issues such as excess fleet size. In turn, stronger trucking demand could point to a rebound in the US industrial sector and help calm fears about a recession in the US economy.