Daily Comment (August 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are trading sideways as investors process the latest CPI figures. In sports news, the St. Louis Blues made a significant move by submitting offer sheets to Edmonton Oilers’ prospects Broberg and Holloway. Today’s Comment will discuss why the Fed may be hesitant to cut rates despite market expectations, why we remain skeptical of chip companies, and why the latest developments in the war in Ukraine could lead to a broader conflict. As always, we’ll conclude with a roundup of key economic indicators.

Market is Moving Too Fast: Fed officials continue to push back against market expectations of imminent rate cuts, even as price pressures show signs of easing.

- While market anxieties center on a potential recession, Federal Reserve officials remain steadfast in their focus on taming inflation. Atlanta Fed President Raphael Bostic offered a tempered view of the recent surge in the unemployment rate on Tuesday, suggesting that an influx of new workers, rather than a weakening labor market, accounted for much of the increase. Despite acknowledging progress in the fight against inflation, Bostic indicated a desire for more concrete evidence of its sustained decline before considering a policy shift. Nevertheless, he maintained his stance on favoring a rate cut later this year.

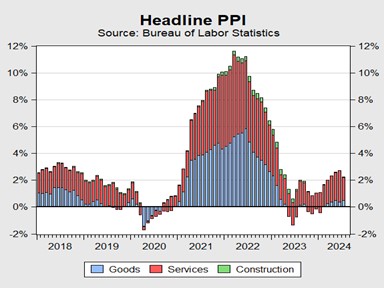

- The ease in supplier inflation has likely boosted sentiment. The July PPI report released on Tuesday indicated a deceleration in price pressures. Trade services, which measure the margin charged by wholesalers, were the biggest drag on the index, suggesting firms are losing pricing power. Notably, the components that feed into the Fed’s preferred inflation gauge (the PCE price index), such as financial services, airline fares, and healthcare, were all relatively tame. This positive data encouraged bond investors, leading to a rally in 10-year Treasury bonds and a pick-up in equities prices.

- The CME FedWatch Tool projects a 70% probability of at least a 100 basis-point decline in the fed funds rate, but that seems overly optimistic. The robust economy, as indicated by the Atlanta Fed’s GDPNow forecast of 2.9% growth this quarter, suggests that the economy is still resilient. Moreover, the Fed will likely seek confirmation of sustained inflation stability over the next two months before committing to more than one rate cut. Consequently, we anticipate a 25-bps rate reduction in September, with the potential for additional cuts contingent upon supportive economic data.

Chipmakers Bounce: A benchmark for semiconductor companies rallied on Tuesday, but skepticism remains about the sustainability of this momentum.

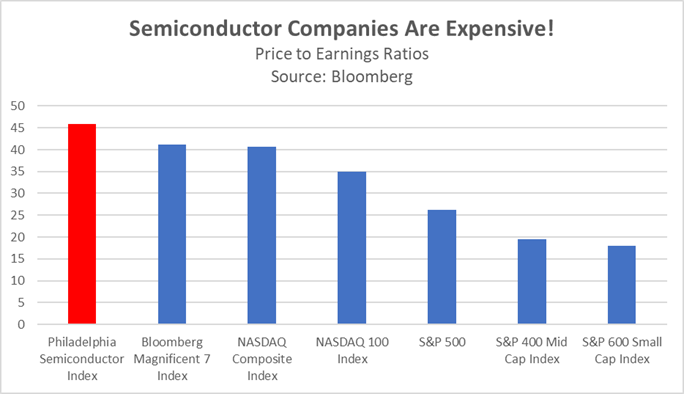

- The PHLX Semiconductor Sector Index surged 4.15% on Tuesday, significantly outperforming both the S&P 500 and the Bloomberg Magnificent 7 Index. Nvidia led the rally after announcing a less severe delay for its Blackwell B200 AI processor. Additionally, Intel contributed to the gains following its announcement of a restructuring plan to bolster its competitiveness. While other chipmakers benefited from improved investor sentiment fueled by positive inflation data, concerns about the industry’s long-term outlook remain prevalent.

- The semiconductor sector is likely to encounter significant headwinds in the coming months. The index, comprising roughly 30 companies, has heavily relied on Nvidia’s performance, which has surged nearly 141% year-to-date and disproportionately contributes to the sector’s earnings. Nvidia’s upcoming report is expected to face intense scrutiny after many peers failed to meet investor expectations for future sales. While Nvidia’s biggest clients have plowed ahead with investments in AI capabilities, they also face investor pressure to deliver profits, which could impact the demand for chips.

- Despite the recent rally in tech stocks, we maintain a cautious outlook due to overvaluation concerns. Many of the sector’s leading companies have already priced in substantial growth over the next several years, limiting potential upside. Furthermore, the sector’s heavy reliance on Nvidia’s performance poses risks, as the company’s ability to consistently deliver earnings surprises is unlikely to persist. We believe smaller companies with solid fundamentals offer more attractive growth prospects, particularly if the Fed successfully engineers a soft landing.

Ukraine Gambit: Kyiv’s decision to move into Russian territory may have won it early gains, but it is also likely to ramp up the risks of a broader war in Europe.

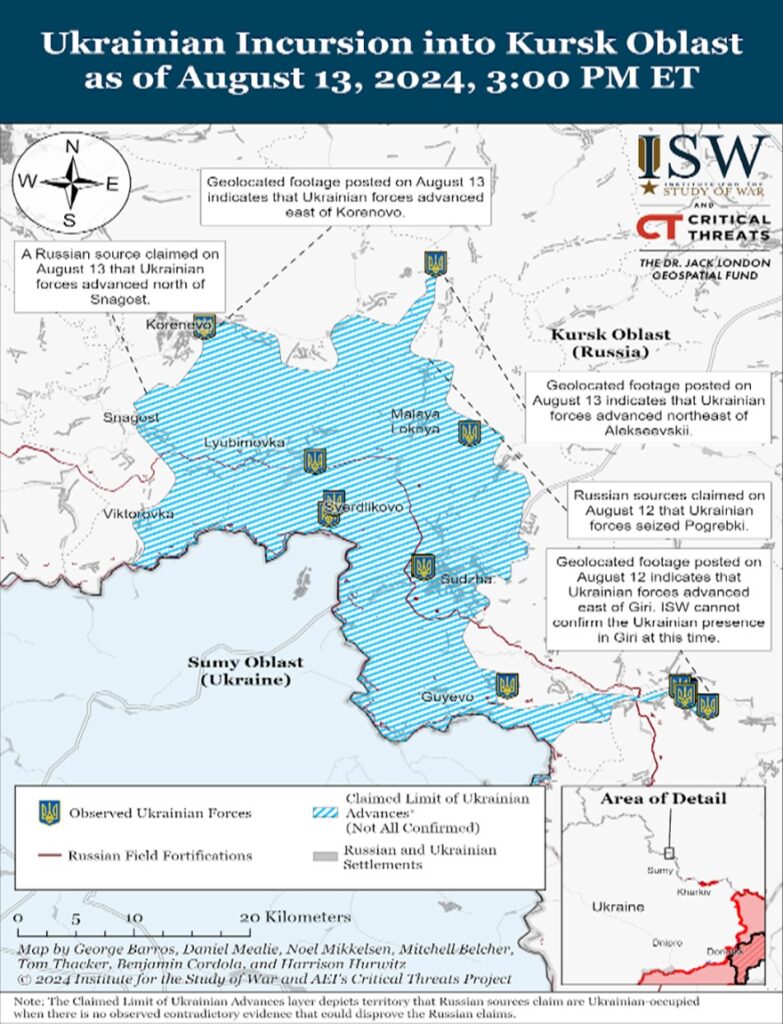

- A week-long Ukrainian offensive into Kursk province has compelled Russia to redirect some troops from Ukraine to bolster its own defenses. While the scale of the troop withdrawal remains unclear, this strategic adjustment signals a significant re-evaluation of Moscow’s military campaign. Ukrainian forces have, thus far, seized approximately 390 miles, an area comparable to San Antonio, Texas. Moscow has struggled to give an adequate response to the incursion and is now considering broadening out its campaign.

- Ukraine’s invasion of Russia was a high-stakes gamble with an uncertain outcome. Despite initial territorial gains, holding these positions will prove difficult as Russia mobilizes a larger force through renewed conscription. Ukraine may have calculated that seizing Russian territory would strengthen its bargaining position in potential peace negotiations. However, Russia has rescinded its original peace proposal, which demanded a ceasefire in exchange for retaining occupied Ukrainian territory and permanently blocking Ukraine’s NATO membership.

- The incursion could heighten the risk of miscalculation, particularly from Russia. Since the conflict began, Moscow has repeatedly alluded to the potential use of strategic nuclear weapons. Moreover, there has been speculation about a possible Russian attack on Poland. While the consequences of employing tactical nuclear weapons remain uncertain, an attack on a NATO member state could directly involve the United States. Although a broader European conflict remains unlikely, the risk has escalated significantly in recent weeks.

In Other News: Japan’s Prime Minister Fumio Kishida is expected to step down next month in a move that would usher in new leadership and potentially delay parts of his pro-growth agenda. Meanwhile, US President Joe Biden has expressed confidence that Iran will refrain from aggression if a ceasefire is reached in Gaza, a development that could help prevent the conflict in the Middle East from escalating further. Additionally, the US Department of Justice may pursue action to break up Google following a court ruling that deemed the company to have monopolistic power.