Daily Comment (August 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is awaiting more guidance from Fed officials as it looks for a better understanding of the path of policy rates. In sports news, Jets QB Aaron Rodgers is being pushed to his limits in training camp as he prepares for a grueling comeback attempt after an injury ended his previous season. Today’s Comment will explore the reasons behind the market’s recent broadening, analyze the implications of payroll revisions for the Fed’s upcoming rate decision, and examine why investors are growing nervous about central bank independence in Brazil. As always, our report will include a comprehensive roundup of key international and domestic data releases.

The Great Rebalancing: While mega-cap companies struggle to recover from the July sell-off, smaller firms are leading the market rally.

- The S&P 500 is poised for a new high this week as market uncertainty stemming from Fed rate cuts and recession worry diminishes. This surge seems to reflect strong second-quarter 2024 earnings. Over 80% of companies surpassed earnings expectations, with the overall index outperforming estimates by 13.6% compared to the anticipated 8.3%. A strong guidance also played a role as companies were relatively upbeat about future growth despite growing concerns of a looming economic slowdown.

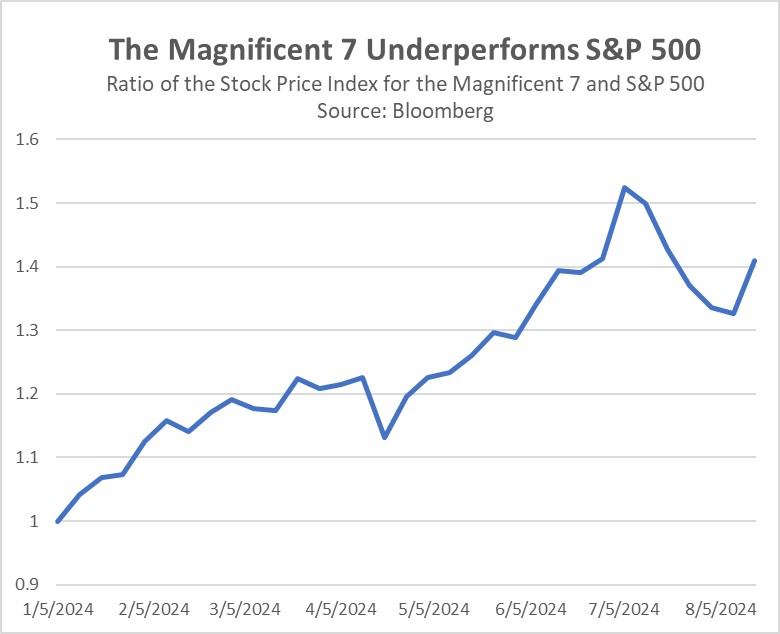

- Surprisingly, this market rally has not been driven by the tech giants that typically dominate the S&P 500. While the Magnificent 7 Index, which once led the S&P 500’s gains, is now 8% below its early July peak, the overall S&P 500 has remained relatively unchanged during the same period. In contrast, the S&P 500 Equal Weight Index, which eliminates market cap bias, has reached an all-time high. Although the mega-tech companies have regained some ground, there are signs of a potential shift in market leadership.

- This shift in market leadership is likely to be gradual and uncertain over the next few months. The upcoming election, unclear monetary policy, and economic strength will likely weigh heavily on investor sentiment. As a result, investors may be reluctant to abandon their previous winning trades in the Magnificent 7, especially given their strong performance over the past two years. This will be particularly true if Nvidia reports another strong earnings result next week. However, we are increasingly confident that the dominance of tech stocks may be nearing its end.

Gloomy Payrolls: Bureau of Labor Statistics (BLS) revisions are expected to show that the economy added less jobs than originally estimated, which is likely to place additional pressure on the Fed.

- Market expectations suggest that benchmark revisions will unveil a significant overestimation of job growth in the prior report, ranging from 400,000 to 600,000 positions. These revisions arrive amid growing criticism that the Federal Reserve may have neglected its maximum employment mandate in its singular focus on taming inflation. While the anticipated downward adjustment to job numbers is unlikely to reshape the overall economic outlook, it could exacerbate worries about a more rapid labor market cooldown than policymakers realized in its previous rate decision meetings.

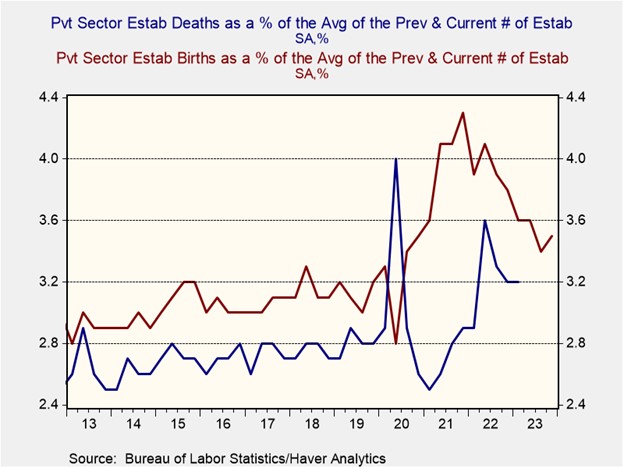

- The pandemic likely contributed to the BLS’s difficulty in accurately determining the number of job openings in recent years. Government stimulus and increased free time encouraged many people to start their own businesses, complicating the Fed’s efforts to track hiring trends. Additionally, many of these new companies struggled to stay open in the years following the pandemic, making it challenging to assess their impact on the job market. This likely caused delays in the BLS’s data collection, forcing surveyors to rely on educated guesses while awaiting more accurate information.

- The revisions could influence how the Fed adjusts policy rates. A larger-than-expected drop might push the central bank to take a more aggressive stance to safeguard the labor market. On the other hand, a milder revision could encourage caution, with officials gradually easing policy restrictions to prevent inflation from reaccelerating. Additionally, the upcoming jobs data will be pivotal in shaping the Fed’s September decisions. While we expect the Fed to limit rate cuts to 25 bps, a surprise rise in unemployment above 4.5% could prompt stronger measures to prevent further labor market deterioration.

Brazil: While the central bank has mentioned that it will not hesitate to raise interest rates to control inflation, it appears that Brazilian President Lula da Silva has other plans.

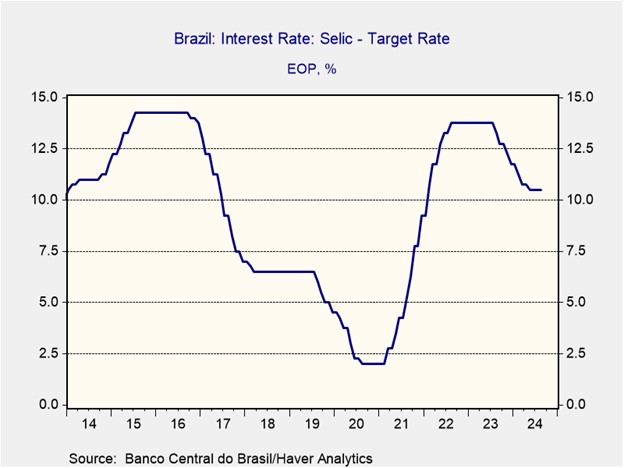

- On Tuesday, Brazil’s central bank chief, Roberto Campos Neto, appeared to downplay the possibility of raising interest rates in a newspaper interview. Specifically, he stated that he was not committed to raising interest rates and remained optimistic about inflation falling below the country’s 3% target. His comments led to a sharp decline in the Brazilian real (BRL), as investors interpreted them as signaling a lack of urgency from policymakers to address rising inflation, which had increased from 3.7% in April to 4.5% in July.

- The Central Bank of Brazil, while officially independent since 2021, has struggled to maintain its autonomy amidst political pressure to adopt more expansionary monetary policies. This pressure has been particularly evident in calls for lower interest rates to stimulate economic growth from the Brazilian president. Last week, Lula attempted to deflect criticism of his involvement in monetary policy decisions by asserting that the next central bank head he appoints will need to demonstrate courage when deciding to lower or hike interest rates.

- In the coming weeks, Lula is widely expected to choose Gabriel Galipolo as his pick to take over the central bank. The central bank faces internal tension as Galipolo, set to take full control in 2025, has views more closely aligned with Lula’s economic team. While Galipolo has also pushed for rate hikes, there are concerns about his loyalty. That said, the leadership announcement could spark division within the central bank and could complicate efforts to shift policy in any one direction. As a result, the September meeting will be a crucial indicator of the bank’s future direction.

In Other News: A federal judge has halted the Biden administration’s attempt to ban noncompete clauses, underscoring the challenges that presidents face in advancing their agendas within a highly partisan government. Meanwhile, China has countered the EU’s crackdown on EV imports by launching an investigation into European dairy products, further highlighting the escalating trade tensions between China and the West. Ford is scrapping plans for a fully electric SUV due to cost concerns, in another sign that the EV market is starting to cool.