Daily Comment (August 27, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is eagerly awaiting earnings reports from several chip companies. In sports news, Dallas Cowboys’ wide receiver CeeDee Lamb has signed a new multi-year contract. Today’s Comment analyzes the influence of the Fed on equities, the impact of China’s trade restrictions on the West, and why Germany’s economy appears to be in the gutter. As always, the report concludes with international and domestic data releases.

Smaller is Better? A highly anticipated Fed pivot has helped boost smaller companies, but there are still many unknowns.

- Investors will closely watch the Fed for the next few weeks as it prepares to cut rates in September. While Fed officials have signaled a 25-basis-point cut at the next meeting, they have been less committed to future policy moves. On Monday, San Francisco Fed President Mary Daly advocated for rate cuts, while Richmond Fed President Thomas Barkin acknowledged inflation risks but saw no harm in a modest rate reduction. Their comments build on Fed Chair Powell’s remarks at Jackson Hole on Friday, indicating a shift in the central bank’s focus from inflation to safeguarding the labor market.

- Since the Jackson Hole speech, investors have adopted a more risk-tolerant stance. On Monday, the S&P small-cap and mid-cap indexes rose as high as 2.2% and 2.6%, respectively. This robust performance reflects a shift in investor preference toward factors like profitability and dividends, which have outperformed traditional metrics like size and momentum. Historically, smaller firms have offered higher dividend yields than those of their larger counterparts. Additionally, declining borrowing costs will enhance profitability for small-cap firms, which are more likely to hold floating-rate debt.

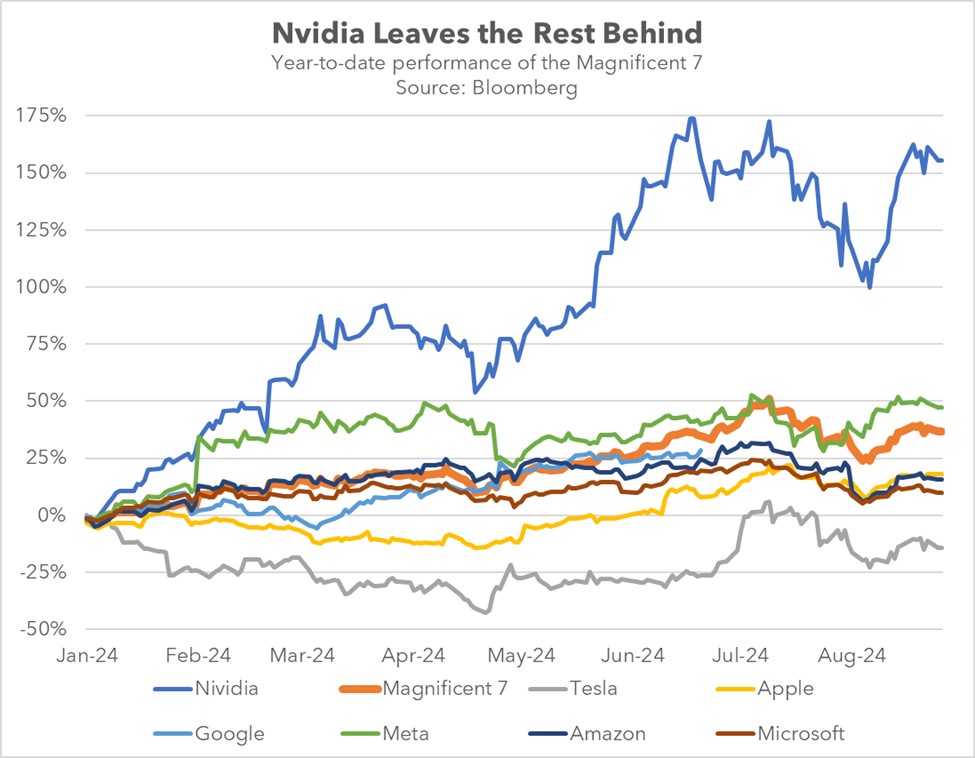

- Smaller companies have outperformed larger tech stocks, which have experienced a slight pullback despite year-to-date gains. Investors searching for undervalued opportunities have led to a shift away from mega-caps, whose stock prices have outpaced earnings growth. AI-related companies have been particularly vulnerable to this sell-off as skepticism mounts about their growth potential, given their strong performance over the last two years. Earnings from chip companies will release this week, and those, especially Nvidia’s, will be a crucial test of tech’s resilience in the current market.

Chip Wars: Beijing has imposed trade restrictions on critical minerals needed for chip production as trade tensions continue to escalate with the West.

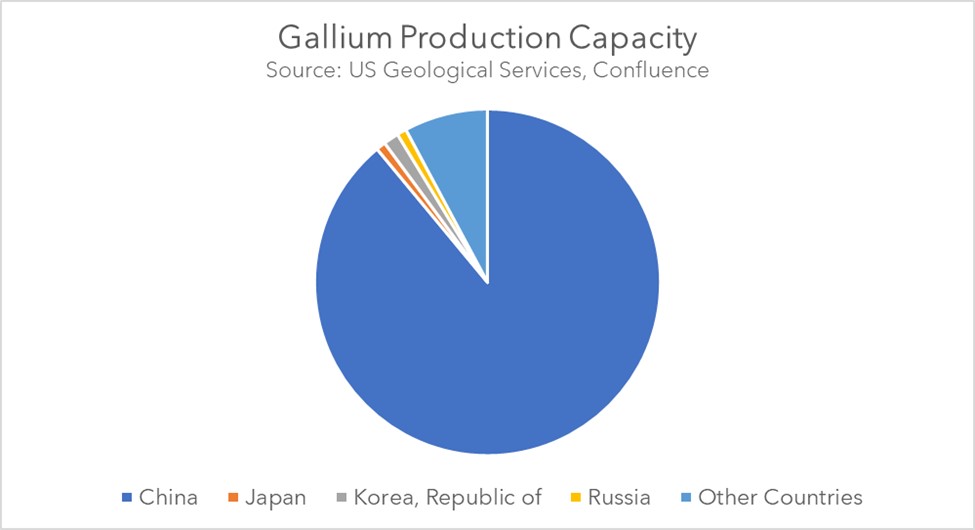

- China’s recent aggressive trade policies have started to worry firms with limited alternatives. Last year’s export controls on gallium and germanium, both crucial for semiconductor manufacturing, have led to a surge in prices for the commodities as other countries have been forced to make up the gap. The move comes as Beijing signals that it is willing to retaliate if its companies are targeted. In two weeks, China is poised to further restrict antimony, a vital component in defense technology, such as infrared missiles, night-vision equipment, and even nuclear weapons.

- The West has struggled to counter China’s strategic advantage in critical minerals. China dominates global production of gallium (over 80%), germanium (60%), and antimony (48%), while Western countries, hampered by stringent regulations, have found it difficult to develop competitive domestic industries. So far, companies have relied on existing stockpiles to maintain production. However, there are concerns about how long this can continue. Companies like Intel have continued to rely on gallium to make breakthroughs in semiconductor efficiency, even as prices have more than doubled.

- China’s market dominance is primarily due to its ability to undercut competitors’ prices. By restricting the supply of resources to the rest of the world, China is likely to spur greater competition from other countries that were previously unable to compete. Since the restrictions were implemented, there have been increased discoveries of these resources in Utah and Montana. Moreover, governments are likely to leverage these restrictions as a justification for increased support of key industries as they seek to reduce their reliance on China in the future.

Germany’s Industrial Crisis: There are growing concerns that industrial capacity in Europe’s second largest economy will not be able to recover in the coming months.

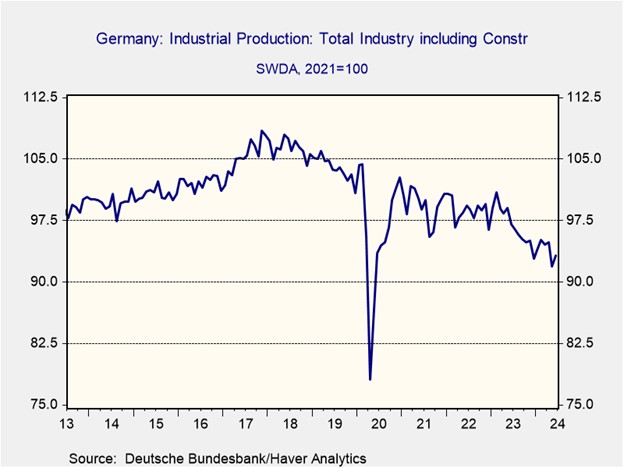

- The German economy contracted by 0.1% in the second quarter of the year, which was primarily driven by a 2.2% decline in capital spending and a modest 0.2% drop in consumer spending. Waning consumer confidence, which was fueled by concerns about job security and a struggling manufacturing sector, contributed to these declines. The GfK Consumer Climate indicator registered a five-month low, reflecting these concerns. Meanwhile, factory output has declined for three consecutive months, raising fears of a prolonged manufacturing downturn.

- The negative report marks a setback as Germany struggles to regain its economic footing after a disappointing 2023. Despite an initial 0.2% growth in the first quarter, the overall economic activity remains relatively unchanged from the previous year. The country’s flagging industrial sector has been the primary drag on growth, with German output declining steadily since its 2017 peak. Rising competition from China and the United States, coupled with difficulties in securing cheap Russian gas, has contributed significantly to this industrial downturn.

- A significant risk to the German economy is the ongoing green energy transition. Although the government has committed to clean technology, public resistance to the associated costs has been substantial. The current economic downturn could exacerbate populist sentiment, especially as the country also confronts rising concerns about illegal immigration. Consequently, we anticipate a potential shift toward easing some of the more stringent regulations on fossil fuels in the coming years. This could help mitigate further declines in Germany’s factory output.

In Other News: Canada announced that it will impose a 100% tariff on Chinese cars and a 25% tariff on Chinese steel in a sign that the West is working together to isolate China. A pivotal Mexican congressional committee sanctioned Mexican President Andrés Manuel López Obrador’s restructuring of the judiciary in a move likely to incite a potential impasse with the United States and Canada regarding the existing trade arrangement. French President Emmanuel Macron ruled out the possibility of a left wing coalition as he looks to form a government with moderate politicians.