Daily Comment (August 28, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Anticipation is high for Nvidia’s upcoming earnings report as markets hope for another strong performance. In sports news, NCAA football is considering eliminating the spring transfer window. Today’s Comment will explore the reasons behind rising confidence but declining job expectations. We will then delve into the ongoing clash between governments and social media companies and analyze Argentina President Javier Milei’s policy adjustments. Additionally, this report offers a comprehensive roundup of international and domestic news releases.

Sentiment Improves Despite Job Concerns: Consumer optimism increased in August, even as concerns about employment grew.

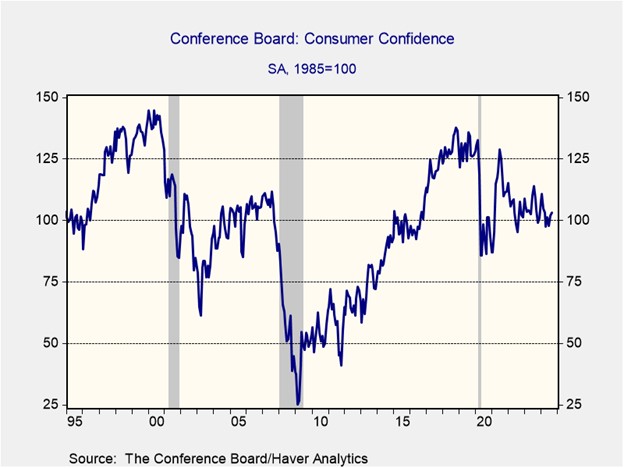

- Consumer sentiment reached a six-month high in August as households reported increased confidence in both business conditions and the overall economy. The Conference Board Consumer Confidence Index climbed from a revised 101.9 to 103.3, driven by gains in both the Expectations and Present Situation indexes. The Expectations Index, which remained above 80 for the second consecutive month, rose from 81.1 to 82.5, its highest level since August 2023. Meanwhile, the Present Situation Index improved from 133.1 to 134.4.

- Despite the broader market’s positive tone, concerns persisted about the labor market. The report indicated a decline in respondents expressing optimism about job availability and an increase in those finding jobs more challenging to secure. This weaker outlook reflects a broader concern that firms are beginning to slow hiring as the economy shows signs of losing momentum. This sentiment aligns with the Federal Reserve’s increased focus on its employment mandate. In July, the employment rate surged to its highest level since October 2021, while job openings showed signs of deceleration.

- The rise in consumer confidence is another indication that earlier-month recession fears may have been exaggerated. This bodes well for the equity market, bolstering the chances of a soft landing, especially given recent signals from numerous Fed officials favoring a September rate cut. However, it also suggests that a substantial rate cut may be less likely, given the economy’s relative stability. Nevertheless, the upcoming jobs report will likely be pivotal in determining the size of the rate cut, as another surge could reinforce the notion that the Fed is behind the curve.

Social Media Takes the Stage: Social media companies and governments are increasingly at odds over the definition of free speech.

- In a letter to the House Judiciary Committee, Meta CEO Mark Zuckerberg accused the Biden administration of pressuring the company to limit content related to the COVID-19 pandemic. Zuckerberg argued that such restrictions were inconsistent with Meta’s content standards and vowed to resist any future attempts to influence the platform’s policies. In response, the White House defended its actions, asserting that its requests for tech companies to curtail misinformation were aimed at protecting public health during the outbreak.

- His comments come amid a growing public outcry over the role of social media in disseminating divisive content. Earlier this month, Elon Musk, CEO of X (formerly Twitter), faced criticism from the UK government for suggesting that the country was on the brink of civil war. This shift coincides with the aging of the US social media audience, hindering the platforms’ abilities to increase advertising revenue. Despite being perceived as a platform for younger users, Meta’s median user age is between 30 and 39, with less than a quarter of its user base under 24.

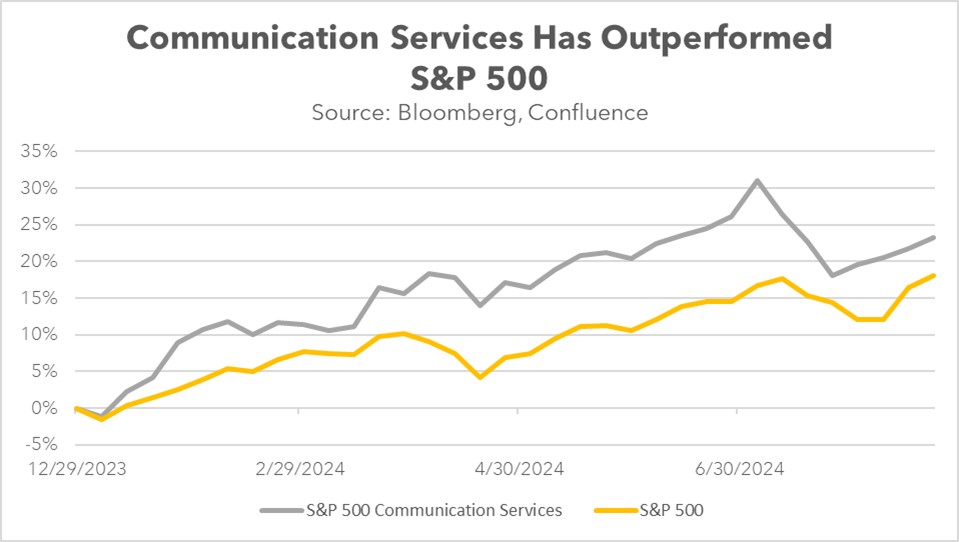

- The ongoing debate about social media content has significant implications for the Communications sector. Many of these companies rely heavily on online advertising as a solid revenue source. Over the past few years, Meta and Alphabet have been major drivers of growth within the Communications sector. While these firms are likely to benefit from the upcoming election season, subsequent regulatory efforts could weigh on the overall sector as lawmakers seek to curtail the power of these tech giants.

Argentina: While he has had some victories, Argentine President Javier Milei is increasingly making more concessions as he looks to revive the economy.

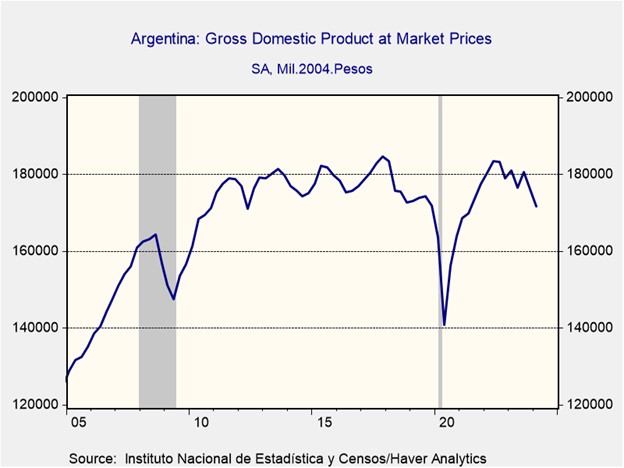

- Since taking office, Milei and his administration have implemented a series of policy adjustments. On Tuesday, the Argentine government announced a reduction in tariffs aimed at combating inflation. Milei’s decision to lower the import tax from 17.5% to 7.5% represents a reversal from his initial post-election increase. Additionally, he has softened his stance on China, shifting from campaign rhetoric that labeled Chinese party leaders as “assassins” to a recognition of the importance of Chinese investment and trade for Argentina’s future.

- Milei’s policy pivot comes amidst Argentina’s struggle to achieve economic growth, despite implementing painful austerity measures. Since taking office, Milei has enacted significant cuts to real pensions and public sector wages, while freezing public infrastructure projects. These measures have strengthened the government’s financial position, resulting in five consecutive budget surpluses and a faster-than-expected deceleration in inflation. However, the economy entered a recession in the first quarter, with economic activity in all but one sector posting annual declines in June.

- Despite being early in his first term, the president has demonstrated the challenges faced by those perceived as extremists in attempting to deviate significantly from their predecessors’ policies. While presidents play a crucial role in setting agendas, they often inherit situations that necessitate compromise. Therefore, it’s essential to consider the broader political landscape when assessing the potential impact of a new leader on the market. That said, Argentina’s long-term outlook is looking better since Milei has implemented some of his reforms.

In Other News: The US has affirmed its commitment to defend Israel if attacked by Iran, underscoring the ongoing threat of conflict in the region. In domestic politics, Democratic presidential candidate Kamala Harris and her running mate, Tim Walz, are scheduled for their first CNN interview, which aims to provide voters with deeper insights into their candidacies. Meanwhile, Mexican President Andrés Manuel López Obrador has suspended relations with the US and Canadian embassies in response to disagreements over his judicial reform plans.