Daily Comment (August 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is closely analyzing Nvidia’s latest earnings report to assess its implications for the future. In sports news, the New York Giants honored rookie wide receiver Malik Nabers by unretiring the iconic No. 1 jersey. Today’s Comment will explore the broader significance of Nvidia’s earnings for the Magnificent 7, delve into why policymakers are having cold feet heading into the monetary easing cycle, and offer a discussion about the ongoing chip war between China and the West. As always, we’ll conclude with a roundup of key international and domestic data releases.

AI Hype Fades: Nvidia’s disappointing results will likely intensify pressure on AI-related companies to demonstrate profitability.

- Despite exceeding analyst expectations with second-quarter revenue of $30 billion compared to the projected $28.7 billion, the US chipmaker’s stock price declined. Investors sought a more substantial earnings beat and were disappointed by the company’s subpar outlook. While the company has expressed confidence in its Blackwell processor, a next-generation AI chip, production delays due to design issues have raised concerns. Despite these challenges, the company expects revenue to increase to $32.5 billion in the current quarter, surpassing analyst estimates of $31.9 billion.

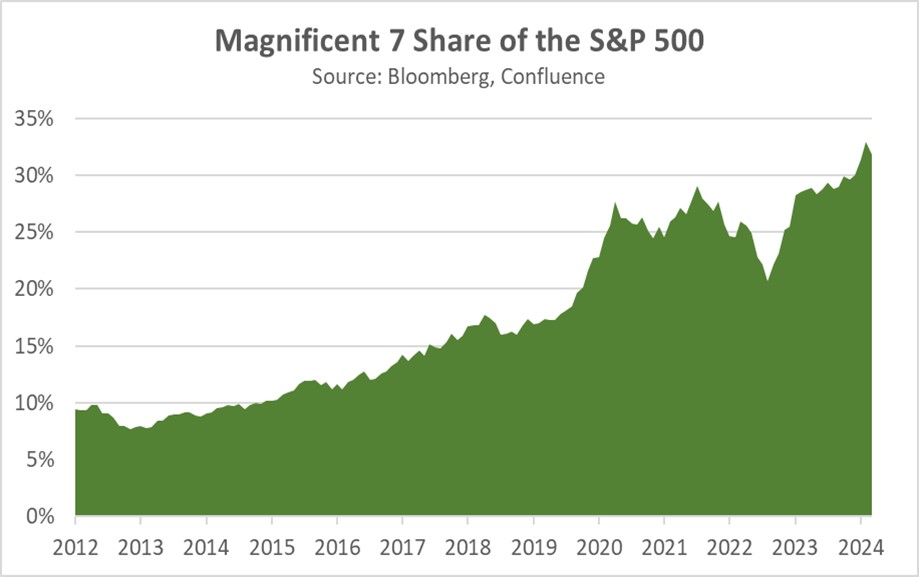

- Nvidia’s underwhelming earnings could foreshadow broader challenges within the Magnificent 7. This cohort of tech giants has been a major catalyst for the S&P 500’s gains this year, but recent signs suggest a potential slowdown. Investors are growing wary of tech companies’ abilities to sustain their current valuations, especially given their significantly higher price-to-earnings ratios as compared to the broader large-cap market. These concerns have become more pronounced as companies like Microsoft, Amazon, and Google have vowed to plow more money into AI, despite a lack of concrete results.

- Today’s results could further fuel a shift in investor sentiment, driving a rotation toward new market leaders. While other sectors may benefit from this change, large cap stocks are unlikely to be completely overlooked. The emergence of a new market leader will hinge on the economic trajectory over the coming months. As signs of a potential slowdown emerge and the Federal Reserve prepares to ease monetary policy, interest rate-sensitive sectors like Financials and Real Estate may experience a resurgence. However, market volatility is expected to be elevated as investors cope with the uncertainty.

Not So Fast: While many Federal Reserve officials have struck a dovish tone, there are still some holdouts who aren’t entirely convinced about the need for a rate cut in September.

- Atlanta Fed President Raphael Bostic on Wednesday expressed skepticism about the need for an immediate interest rate cut at the upcoming Federal Reserve meeting. During an interview, he noted that while inflation has exceeded his expectations and unemployment has risen more rapidly than anticipated, he still wants more conclusive data before fully supporting lowering rates in September. Over the next two weeks, the Federal Reserve will have two inflation reports for Personal Consumption Expenditure (PCE) and another for the Consumer Price Index (CPI) as well as another jobs report to analyze before its upcoming meeting.

- Bostic is not alone in expressing concerns that inflation may resurface if central banks become complacent. Bank of England Governor Andrew Bailey has tempered expectations for another rate cut at the central bank’s next meeting, due to concerns of a reacceleration in inflation. Despite the recent decline in inflation data, the Bank of England anticipates a higher inflation rate at year’s end. In South America, Brazil was one of the first major economies to implement rate cuts but is now considering an interest rate hike to address an unexpected resurgence in inflation.

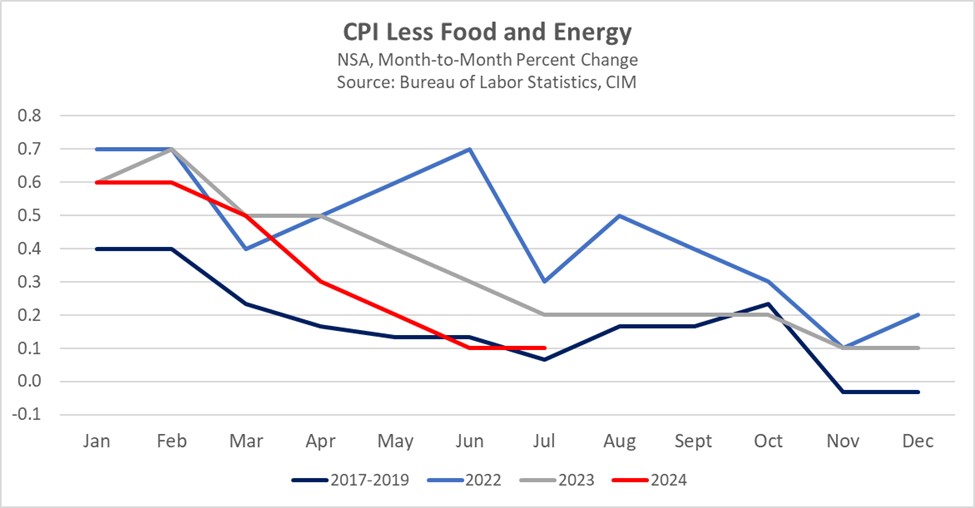

- The PCE is not anticipated to accelerate significantly as some of its components were showing signs of moderation in the Producer Price Index (PPI), but the August CPI report could introduce uncertainty to the Fed’s aims for a rate cut. Historically, prices tend to rise during the fall months. This should not be a problem as long as the month-to-month figures remain relatively in line with last year’s increase of 0.2%. If inflation rises about that amount, it could call into question the path of future interest rate cuts.

The Fight Over Chips: Western nations have shown no signs of backing down in the face of China’s threats over export controls.

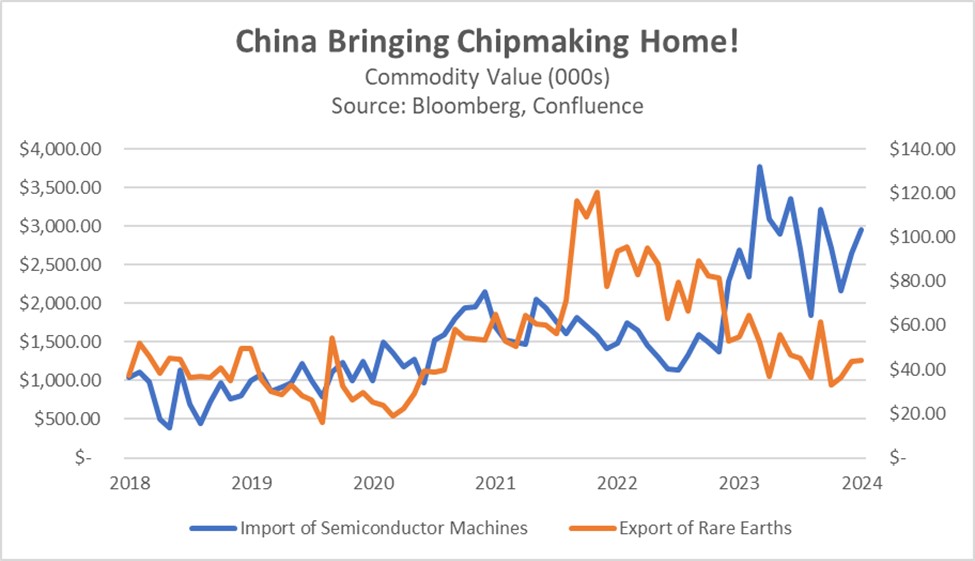

- The Netherlands delivered a major setback to China’s semiconductor aspirations on Thursday by denying ASML license renewals for servicing its advanced ultraviolet lithography equipment within the country. This move effectively curtails China’s access to the cutting-edge technology essential for developing domestic chip manufacturing capabilities. ASML’s lithography machines are indispensable for producing high-performance chips and China has no way of replacing them. The move comes as China prepares to limit export of key materials needed for chip production.

- The Netherlands’ decision aligns with the US-led effort to impose unilateral restrictions on chip exports to China. Japan and South Korea, while expressing reservations, have also complied with US requests to limit exports that could bolster Beijing’s ambitions of developing a domestic chip industry. Behind the scenes, US officials have employed the threat of invoking the Foreign Direct Product Rule against countries that fail to comply. This rule would enable the US to restrict the flow of exports containing even the smallest amount of US technology.

- Denying China access to chipmaking technology is unlikely to prevent the country from eventually developing its own industry. However, it does provide the West with a strategic advantage by incentivizing firms to invest more in the materials needed for chip production. This aligns with the West’s broader goal of reducing reliance on Chinese commodities. The escalating competition between the West and China is likely to persist for the foreseeable future as both sides seek to establish dominance in the clean energy and chipmaking sectors as a means of asserting global influence.

In Other News: As anticipated, Brazilian President Lula da Silva has selected his political ally Gabriel Galipolo to lead the country’s central bank. This choice is likely to temper expectations of a rate hike at the central bank’s upcoming meeting in September. Russia is finding it difficult to retake land captured by Ukraine in a sign of growing uncertainty about the direction of war. The California AI bill has garnered significant attention as lawmakers seek to establish safeguards for the development of new AI technologies.