Daily Comment (August 30, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a note on the eurozone’s consumer price inflation, which has become (shall we say it?) more demure. We next review several other international and US developments with the potential to affect the financial markets today, including a look at the upcoming weekend elections in Germany and new research on the fiscal impact of the policies proposed by both US presidential candidates.

Eurozone: The August consumer price index was up just 2.2% from the same month one year earlier, matching expectations and marking a big slowdown from the 2.6% rise in the year to July. Excluding the volatile food, energy, and tobacco components, the August “core” CPI was up 2.8%, cooling only slightly from the 2.9% rise in the year to July. The data may help convince the European Central Bank (ECB) to institute a second interest-rate cut at its next policy meeting.

- Still, a new ECB rate cut isn’t assured. For example, in a speech in Tallinn today, ECB board member Isabel Schnabel warned the drop in the eurozone’s headline inflation rate is misleading because prices in the region’s service sector continue to rise rapidly.

- The pace of rate cuts by the ECB and Federal Reserve could be especially important for exchange rates. If the Fed cuts rates relatively slowly, as we think it may, faster rate cuts by the ECB could help buoy the dollar and weaken the euro. In contrast, if the Fed cuts rates at the same pace or even faster than the ECB, it could catalyze a drop in the value of the greenback.

Germany: Much of the economic weakness pulling down eurozone price inflation is a reflection of Germany’s faltering economy. A potential further risk for Germany is the balloting to be held in the eastern states of Thuringia and Saxony on Sunday. Polling suggests the far-right Alternative for Germany (AfD) could take control of one or both of those state parliaments. If the AfD manages that, business groups fear the party’s sharp anti-immigrant rhetoric and agenda could further worsen eastern Germany’s demographic decline.

Poland: Prime Minister Tusk’s government has proposed a 2025 defense budget equivalent to $48.7 billion, up about 17.3% from the $41.5 billion in 2024. If approved by parliament, Poland’s defense spending would top 4.7% of gross domestic product, giving it one of the biggest defense burdens in the North Atlantic Treaty Organization and cementing its role as a leader in European defense and politics.

Australia: The Australian government and Norwegian defense firm Kongsberg said they will jointly build a new factory in New South Wales to produce Naval Strike Missiles and Joint Strike Missiles. Initially, the missiles will be for the Australian armed forces, but they will eventually also be for export. The announcement illustrates the reindustrialization of countries in the US geopolitical bloc and the revitalization of the defense industry in many countries.

South Korea: New data shows that the South Korean acreage committed to growing bananas and other subtropical fruits and crops has expanded tenfold just since 2021. According to analysts, the expansion reflects rising average temperatures associated with global warming. In our view, the expansion also illustrates why investors should avoid politicized views of global trends and instead look for the investment opportunities and the risks they might provide.

China: The People’s Bank of China (PBOC) today announced that it made a small net purchase of sovereign foreign notes in the country’s secondary bond market this month, marking its first such intervention in decades and illustrating how the central bank is trying to keep Chinese bond yields from falling further. The PBOC is especially concerned that volatile bond values could destabilize the Chinese banking system.

- Illustrating the continuing economic lethargy that has prompted strong bond buying at the expense of stocks and other risk assets, new data shows office utilization in China’s major cities is now below even the low rates seen during the coronavirus pandemic. Office rents are reportedly at least 10% lower than they were two years ago.

- Unlike in the US, where the work-from-home phenomenon is a major reason for high office vacancy rates, property managers and brokers say China’s vacancy problem is mostly a reflection of slow economic growth.

US Fiscal Policy: New analyses by the Penn Wharton School of Business show the economic proposals of presidential candidates Donald Trump and Kamala Harris would both expand the federal budget deficit over the coming decade. According to the research, former President Trump’s proposals would expand the deficit by $5.8 trillion over current projections, mostly because of his aim to extend his 2017 individual income-tax cuts. Vice President Harris’s proposals would boost the deficit by $1.2 trillion, mostly by expanding the child tax credit.

- According to the research, total federal debt in 2034 would be 9.3% bigger than current projections under Trump, while it would be 4.4% bigger than current projections under Harris.

- The Wharton projections are consistent with our view that the populism embedded in each candidate’s proposals would expand the US budget deficit and boost overall debt.

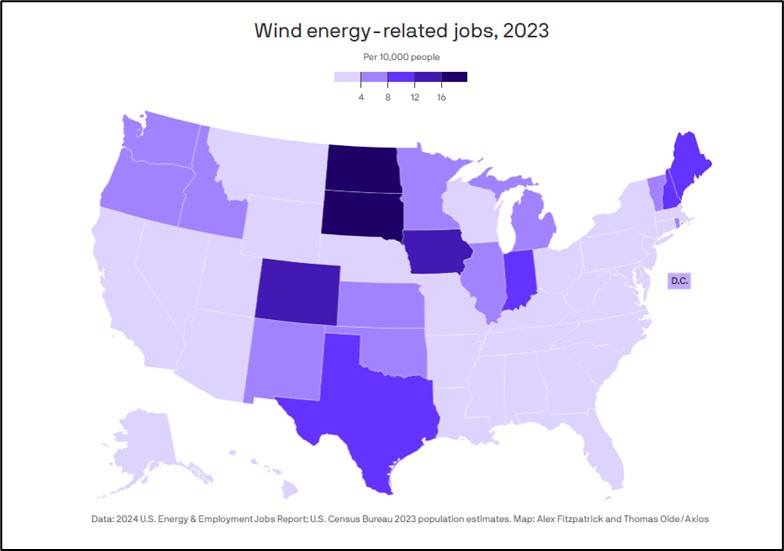

US Labor Market: New projections from the Census Bureau show the fastest-growing job type in the coming decade will be “wind turbine service technician.” By 2023, the Census Bureau projects the country will have 60% more jobs of that type than it currently has. The jobs are currently concentrated in the Dakotas, Iowa, and Colorado.

US Military: According to a US Navy spokesman, the service will meet its goal of 40,600 recruits in the fiscal year ended in September, after two straight years of shortfalls. The other armed services have also seen an improvement in recruiting, especially over the last four to five months. That’s consistent with the recent cooling in the civilian labor market. Historically, the armed services have found it more challenging to find recruits when the civilian labor market is strong.