Daily Comment (September 22, 2016)

by Bill O’Grady and Kaisa Stucke

[Posted: 9:30 AM EDT] As expected, the Fed did not raise rates yesterday. Risk markets rallied following the release and are higher again this morning as investors focus on the more dovish aspects of the release. A key sentence was added to the FOMC statement, which read, “The Committee judges that the case for an increase in the federal funds rate has strengthened but decided, for the time being, to wait for further evidence of continued progress toward its objectives.” Although it is hard to define what the Fed means by “for the time being,” the likelihood of a hike has increased for December, with market expectations for December at 61% last night and 59% this morning. The Fed is signaling that the decision is still data-dependent and the committee is ready to raise rates if conditions improve further.

There were three items of note regarding the FOMC decision to maintain rates at the current level:

- The prepared statement was hawkish, at least for the near term. The language for growth was upgraded, and now states that “economic activity has picked up from the modest pace seen in the first half of this year.” The Fed perceives that the labor market is healing and inflation levels are moving closer to the Fed’s target, and near-term risks to the economy appear “roughly balanced.” In June, the committee indicated that the near-term risks to the economy had “diminished.” Within the statement, business fixed investment was pointed out as an area that could use improvement and, during the Q&A, Yellen also said that the Fed is keeping an eye on international growth. Additionally, the presidential election is adding another measure of uncertainty. The prepared remarks basically said that although the Fed could have raised rates this time, it decided to wait to do so until it sees confirmation of a strengthening trend.

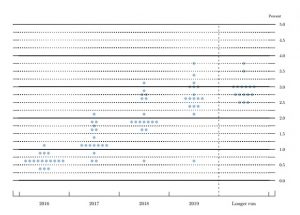

- The dots chart was more dovish as members tapered their expectations for the path of rate increases. Three participants look for no hikes this year compared to zero participants in June. The chart below shows the dots. Participant expectations for increases have moderated from prior data. As a result, we have seen a modest flattening of the yield curve as short-term yields remained roughly unchanged, but the intermediate and longer term durations reacted to the more dovish dots.

- The vote was 7-3, with George, Mester and Rosengren dissenting. All three dissenters called for a September hike. We note that for such a collegial FOMC, three dissenters is actually quite a lot. All three dissenters were regional Fed presidents, rather than FOMC governors, as it is more common for regional presidents to have divergent views. The past two FOMC chairs have generally aimed to maintain as much unity as possible, especially amongst the governors. Divergent opinions are healthy in maintaining a well-rounded debate, but the increasing number of dissenters calling for an increase also means that it is more likely.

Markets have reached a calm following the Fed’s decision. Most risk markets are trading higher as the Fed and other central bank decisions are in the rear-view mirror, thus removing short-term uncertainty.