Daily Comment (September 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is eagerly awaiting the services PMI data, seeking signs that the economy remains resilient. In sports, Cristiano Ronaldo and Lionel Messi have both been left off the Ballon d’Or shortlist for the first time since 2003. Today’s Comment will cover the latest jobs data and its implications for the Fed, why we remain optimistic that the economy is not in recession, and what Michael Barnier’s rise in France reveals about immigration trends in the West. As always, we conclude with a roundup of international and domestic news.

Labor Cooling: The latest employment data reinforced the view that firms are starting to slow down hiring.

- The July Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics reported a sharp decline in job openings, reaching their lowest level since January 2021. Listings dropped from a revised 7.910 million to 7.673 million, suggesting a potential cooling of the labor market. In response to the report, Atlanta Fed President Raphael Bostic stated that the risks of inflation and unemployment are now balanced, likely signaling his full support for a rate cut at the FOMC’s September meeting.

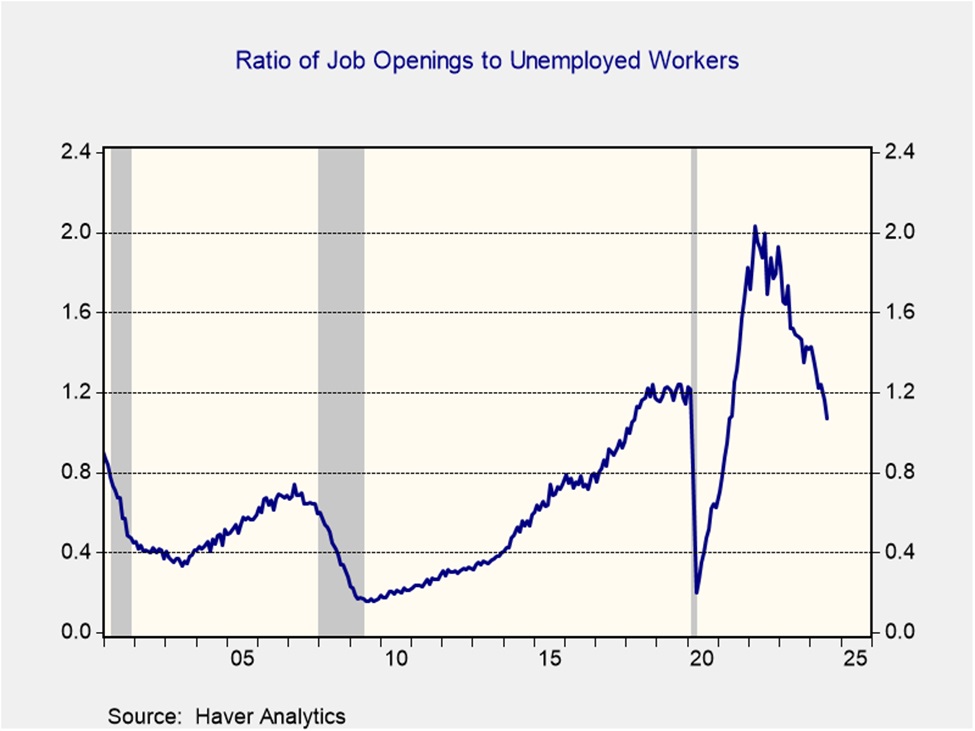

- The weakening JOLTS data has intensified concerns that the central bank may have kept rates too high for too long. The ratio of job openings to unemployed workers has now dipped below pre-pandemic levels, with approximately one job opening for every unemployed individual. Although the ratio itself remains historically high, its significant decline from the peak of nearly two job postings for every available worker further cements the shift in attitudes about the labor market following last month’s triggering of the Sahm Rule.

- While the JOLTS data is disappointing, it is likely to be overshadowed by Friday’s jobs report, which is expected to show a sizeable increase in payrolls from 114,000 to 160,000 and a slight decline in the unemployment rate from 4.3% to 4.2%. A stronger-than-expected jobs report could undermine expectations for an aggressive easing cycle as it may signal that July’s job losses were a one-time occurrence due to Hurricane Beryl. Assuming the economy maintains its resilience, we anticipate the Fed will cut rates one to two times this year.

Disinversion: Growing concerns about the economy caused short-term rates to briefly rise above long-term rates as the market anticipates a strong response from the Fed.

- The Federal Reserve’s Beige Book revealed that the country is starting to feel the weight of tight monetary policy, with the number of districts reporting flat or declining activity increasing from five to nine. In response to the slowdown in business activity, firms indicated a preference for reducing hours, cutting shifts, and slowing hiring rather than implementing layoffs. Despite these measures, firms expressed optimism about a potential economic recovery in the near future. Additionally, the report revealed a moderate increase in both prices and wages.

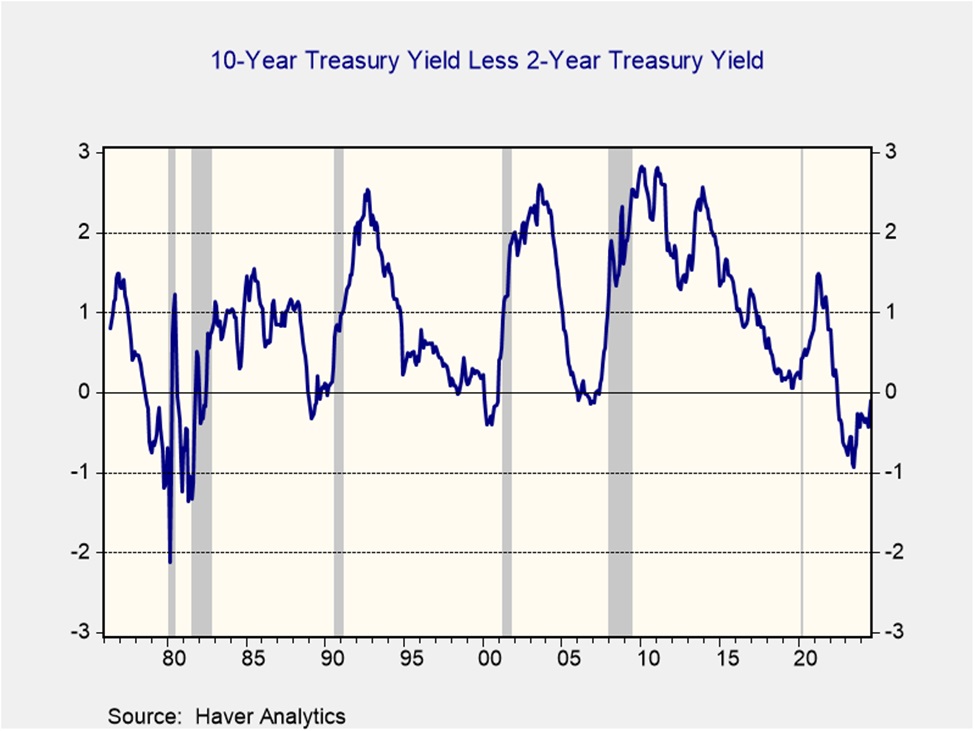

- Weak jobs data and a gloomy Fed outlook caused the market to reassess its policy rate expectations. On Wednesday, the yield curve briefly disinverted, with the two-year Treasury rate ending the day a tad lower than the 10-year. The recent upward slope of the yield curve indicates that investors believe the Federal Reserve will need to significantly lower interest rates to stimulate the economy. The latest CME FedWatch tool reflects this sentiment, indicating a 44% chance of a 50-basis-point rate cut in September, up from 34% last week but still below the peak of 85% seen a month ago.

- While traditional wisdom suggests that yield curve inversions are a reliable precursor to economic downturns, data suggests that the disinversion of the curve might be a better indicator, as the chart above shows. Historically, the normalization of the yield curve has been followed by economic downturns. However, it’s important to note that previous disinversions were often driven by the Federal Reserve’s response to something breaking in the financial system. At this time, we see little evidence of market distress and we remain confident that the economy will demonstrate its resiliency over the next few months.

Immigration Fears Rise: A new French prime minister has been selected, and he’s likely to steer the French parliament further to the right.

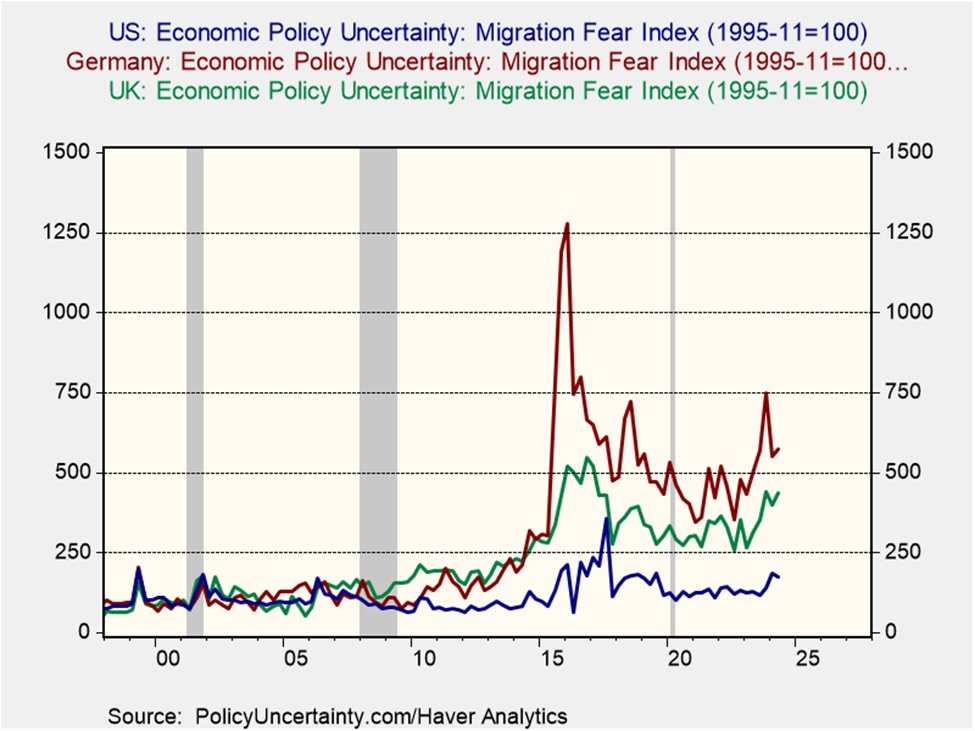

- Michael Barnier, conservative leader and former EU Brexit negotiator, has been appointed as France’s next prime minister. Speculation about his potential nomination surged after conservative Xavier Bertrand and former socialist Prime Minister Bernard Cazeneuve fell out of favor. Barnier, who kept a low profile after failing to secure his party’s 2022 presidential nomination, had taken a hardline stance on immigration during that campaign, proposing a three-to-five-year moratorium on non-EU arrivals.

- Barnier’s selection likely reflects the growing prominence of immigration as a political issue across the West. While conservative parties lacked parliamentary seats to show it, they won the popular vote in France’s July legislative elections, with a significant share going to Marine Le Pen’s anti-immigration National Rally. This trend has been evident elsewhere, such as in Germany, where a far-right party recently won a state election for the first time since WWII, and in the UK’s decision to leave the EU. Even in the US, both presidential candidates have adopted increasingly restrictive stances on immigration.

- Tougher immigration policies could hinder efforts to combat inflation. The influx of foreign workers has played a crucial role in mitigating wage pressures, which have contributed to elevated inflation. A slowdown in the growth of foreign workers could require firms to rely more heavily on productivity improvements to maintain costs. While this is achievable, the timing and nature of such technological shifts are uncertain. However, it’s highly probable that service inflation would remain elevated due to this policy change.

In Other News: President Joe Biden is expected to block Nippon Steel’s takeover of US Steel, underscoring the commitment to protecting domestic industries in the US. Meanwhile, Elon Musk’s Starlink has agreed to restrict access to X in Brazil, reflecting a growing trend of governments tightening control over tech companies. The Bank of Canada lowered its policy rate by 25 bps for a third consecutive meeting in a sign that global financial conditions are loosening.