Daily Comment (September 6, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is closely parsing through the latest jobs data. In sports news, Patrick Mahomes of the Kansas City Chiefs surpassed Len Dawson as the team’s all-time passing leader while securing a victory over the Baltimore Ravens. In today’s Comment, we discuss why the recent Services PMI data should relieve recession fears, consider the potential impact of the ECB’s reluctance to address weak GDP figures on the dollar, and explore how the coalition collapse in Canada aligns with a broader trend of dissatisfaction with ruling parties in the West. As always, the report includes a comprehensive overview of domestic and international data.

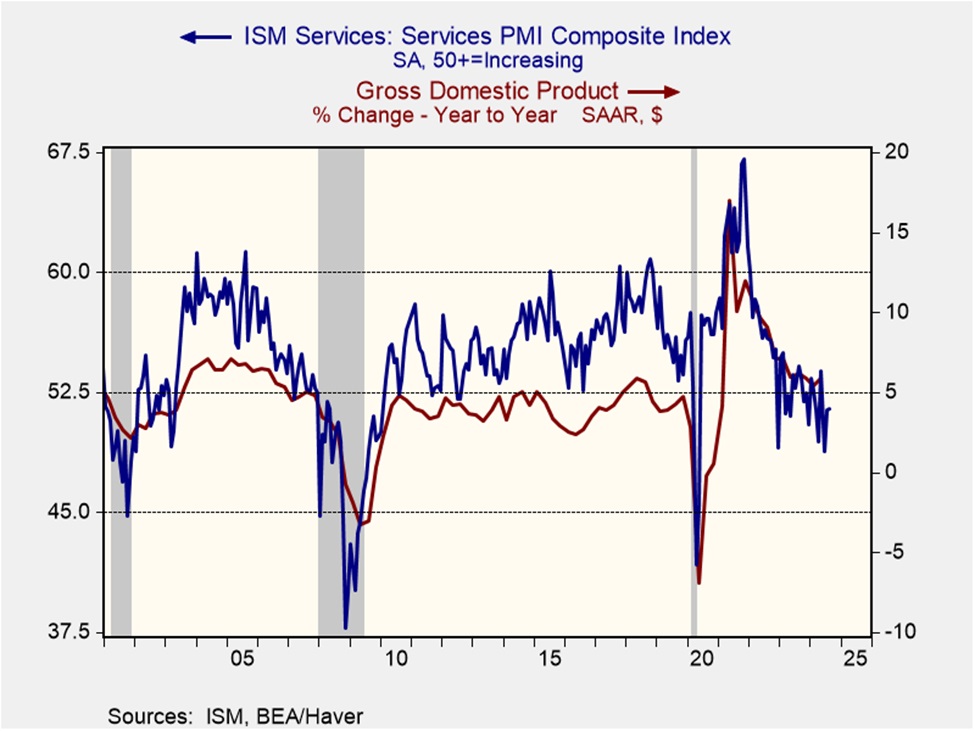

Good News, Finally! Days after the Purchasing Managers’ Index (PMI) for manufacturing raised concerns of a potential economic slowdown, the services component offered reassurance.

- Both the S&P Global and ISM Purchasing Managers’ Indexes (PMIs) for August showed an increase in service sector activity, challenging the narrative of an impending recession. The S&P Global PMI rose from 55.4 to 55.7, while the ISM PMI increased slightly from 51.4 to 51.5. The stronger pace of new orders, indicating continued demand for firms’ offerings, was the primary driver of the overall improvement. However, both PMIs showed declines in their employment components, reaffirming concerns about the cooling labor market.

- The rise in the PMI services index strongly indicates that the economy remains in expansion. Unlike manufacturing, service consumption represents nearly half of all economic output, making the economy particularly sensitive to shifts in this sector. The ISM services index, specifically, has proven to be a reliable economic predictor, explaining about half of the GDP variation over the past three decades. As a result, the latest reading suggests that, despite market concerns about an imminent downturn, the economy has enough momentum to avoid a recession.

- While recent data suggests slowing growth, it’s important to consider the historical context. The past four recessions were all triggered by unforeseen events: the 2020 pandemic, the 2008 Lehman Brothers collapse, the 9/11 attacks in 2001, and the Gulf War in 1990. Hence, a slowdown doesn’t necessarily foreshadow an immediate downturn. While the economy faces challenges, we remain cautiously optimistic that it can weather these headwinds, absent any major disruptions such as a mass mobilization war, commodity supply shock, or pandemic.

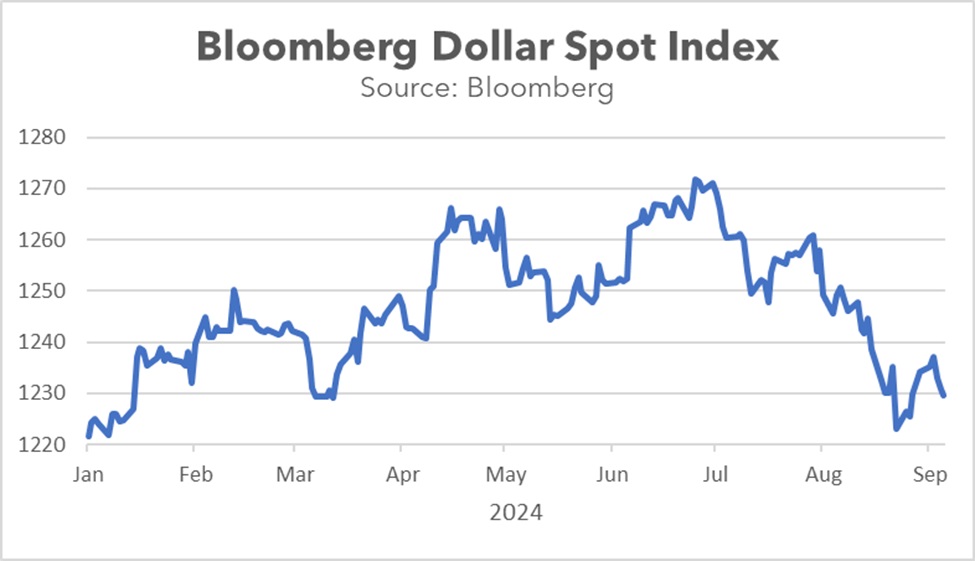

The Flat Dollar: As the global economy anticipates a convergence in interest rate differentials, the US dollar has begun to depreciate against foreign currencies.

- The Eurozone’s second quarter GDP was revised downward to 0.2% from 0.3%, indicating continued economic stagnation. This latest data is likely to fuel concerns that the region’s tight monetary policy is beginning to dampen economic activity. Household consumption and investment spending both declined, with investment spending falling by a more significant 2.2%. Germany, the bloc’s largest economy, contracted by 0.1% as its industrial sector remains under pressure. However, there were some bright spots: France and Italy both grew by 0.2%, and Spain’s economy expanded by a robust 0.8%.

- Despite growing economic concerns, there is skepticism that recent economic data will prompt the European Central Bank (ECB) to accelerate its easing policy. A survey of economists indicates that respondents anticipate the ECB will maintain its current monetary policy stance, even in the face of weakening economic indicators. As growth slowed, the region’s unemployment rate fell to a new low in July, and core inflation has shown signs of stalling. The ECB’s reluctance to respond to the slowdown mirrors the Bank of Japan’s decision to maintain its current policy path.

- The reluctance of central banks to respond to economic changes is likely to accelerate interest rate convergence. Historically, global developed central banks have been hesitant to follow the US Federal Reserve in raising rates and they have also been less willing to cut rates as aggressively. This narrowing interest rate differential, coupled with growing concerns about the US economy, is expected to weigh on the US dollar in the short to medium term. This trend has already begun to manifest itself this year, with the Bloomberg Dollar Spot Index falling from its 2024 peak in June to levels close to its value at the start of the year.

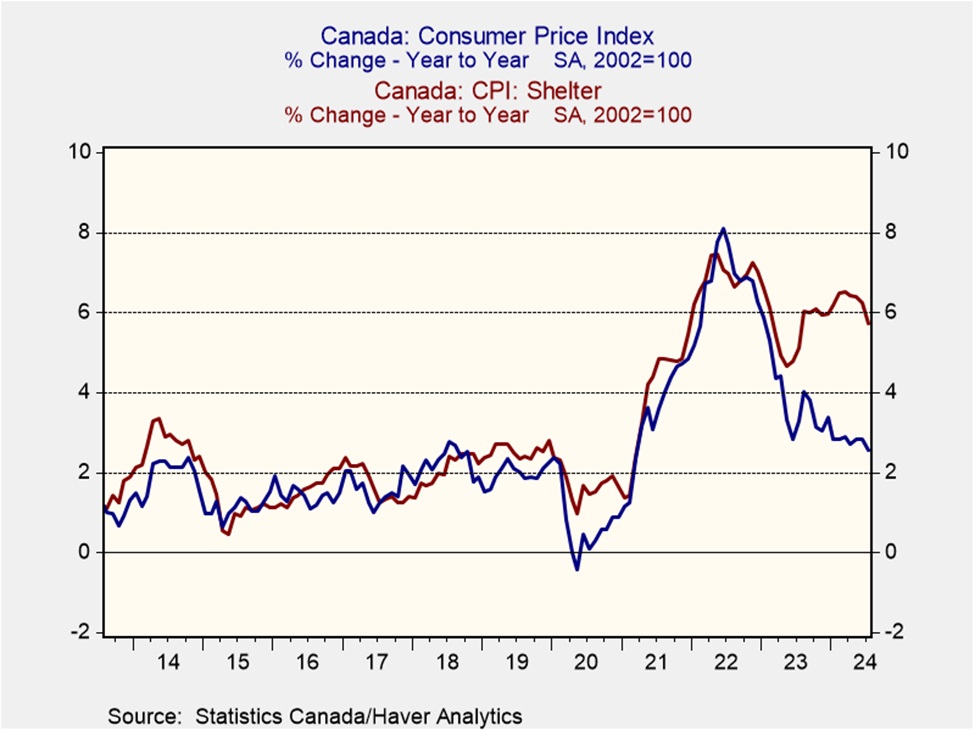

Trudeau in Trouble: As voters across the West express increasing discontent with incumbent leaders, the impending collapse of Trudeau’s coalition threatens to end his party’s nine-year reign.

- Jagmeet Singh, leader of Canada’s New Democratic Party, has ended the agreement to support the minority Liberal government, raising the likelihood of snap elections. While this doesn’t technically strip the Liberals of their position, his refusal to uphold the deal could leave PM Justin Trudeau vulnerable to a no-confidence vote, potentially triggering an early election. Additionally, Singh still requires his party’s approval to formally withdraw from the arrangement. That said, federal elections must be held by October 2025, with current polls showing the ruling Liberals trailing the Conservatives by 17 points.

- The Liberal Party is facing increasing criticism over the rising cost of living, particularly housing. While overall inflation is 2.5%, which is within the Bank of Canada’s target range of 1-3%, shelter inflation remains stubbornly high at 5.7%. Unlike in the US, where 30-year fixed mortgage rates are common, most Canadian mortgages are locked in for five years or less. This difference directly impacts inflation as mortgage interest costs account for 13% of Canada’s shelter inflation. In contrast, the US removed housing costs from its CPI measure in 1983, opting instead for owner-equivalent rent.

- One of the key issues facing Western nations as they approach elections in the coming months is public sentiment regarding inflation. While price increases have moderated substantially in recent years, consumers have found it challenging to adjust to current price levels as many had anticipated a decline. This dissatisfaction with prices is likely to influence election outcomes as voters may attribute the problem to their current leadership. As a result, we should not be surprised if opposition parties see a strong performance this election season.

In Other News: The US is growing less confident in a Gaza peace plan and is looking for alternatives, another example of the difficulty of resolving disputes in the Middle East. Republican presidential candidate Donald Trump proposes a 15% corporate tax rate as he looks to bolster his support from big business. The pledge is another sign that neither candidate will be able to solve the deficit matter. Japanese prime minister candidate Yoshimasa Hayashi is holding out hope that the Nippon Steel acquisition of US Steel can be salvaged.