Daily Comment (September 9, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with an important new speech by former Australian Prime Minister Kevin Rudd, who warns that Chinese leaders are more ideologically driven than most in the West realize and also more apt to use military aggression. We next review several other international and US developments with the potential to affect the financial markets today, including an important new report on European competitiveness and a note on last week’s record-breaking corporate bond issuance in the US.

China: Kevin Rudd, the former Australian prime minister and Canberra’s current ambassador to the US, warned in a must-read speech in Washington last week that Chinese leaders are more driven by ideology than most Westerners believe. Rudd, a Mandarin speaker with an extensive background dealing with Beijing, emphasized that because of Chinese leaders’ Marxist-Leninist view of the US and their conception of deterrence, they could soon launch what they would view as a “small war” to deter the US and its allies from further efforts to contain China.

- In Rudd’s view, Chinese General Secretary Xi has fully embraced the Marxist-Leninist view that China is at the vanguard of historically determined social revolution, and that the “East is rising, while the West is falling.” According to Rudd, this makes Xi prone to over-confidence in dealing with the US and its allies.

- Although we have been warning for some time that the worsening US-China rivalry could potentially spill into military conflict of one sort or another, it hasn’t happened yet. Rudd’s warning suggests that investors should remain aware of the risks. That mindset is consistent with our current positioning in our asset allocation strategies of keeping exposure to gold, commodities, and defense firms, which are designed to act as hedges against a potential conflict.

China-Southeast Asia: As the US and other developed countries rush to impose tariffs against the new wave of subsidized Chinese exports, new reporting shows many cheap Chinese goods are being diverted to the relatively poor, developing countries of Southeast Asia. With prices kept extremely low by Beijing’s subsidies and the massive excess capacity in China’s industrial sector, the flood of Chinese goods is putting companies out of business and destroying jobs in countries such as Thailand, Malaysia, and Indonesia.

- Just as in the developed countries, several Southeast Asian nations have responded by imposing new tariffs and other trade barriers against Chinese goods, but the effort is constrained by regional free-trade agreements and fear of retaliation from China.

- Importantly, Chinese firms are also undercutting local logistics companies, such as trucking and warehouse firms. Once Chinese competition has driven a Southeast Asian manufacturer or logistics firm into bankruptcy, a Chinese company will often swoop in to buy the business at fire-sale prices. The Chinese buyer will sometimes use a local front company to hide its ownership, and it may leverage funds from Chinese organized crime groups (a very underappreciated problem throughout the region).

- As Chinese firms take over more local producers and logistics firms, they are reportedly forming “zero dollar” supply chains in which both imports from China and exports to China and beyond are warehoused and carried by Chinese firms with no reliance on the US currency.

- This growing Chinese influence over Southeast Asia is consistent with our view that Beijing will seek to control its evolving geopolitical and economic bloc using a form of neo-colonialism, as discussed in our Bi-Weekly Geopolitical Report from January 9, 2023. In this system, Beijing will offer the countries in its bloc the opportunity to export commodities, basic materials, and low-value factory components to China, but it will treat those countries as a captive market for Chinese exports.

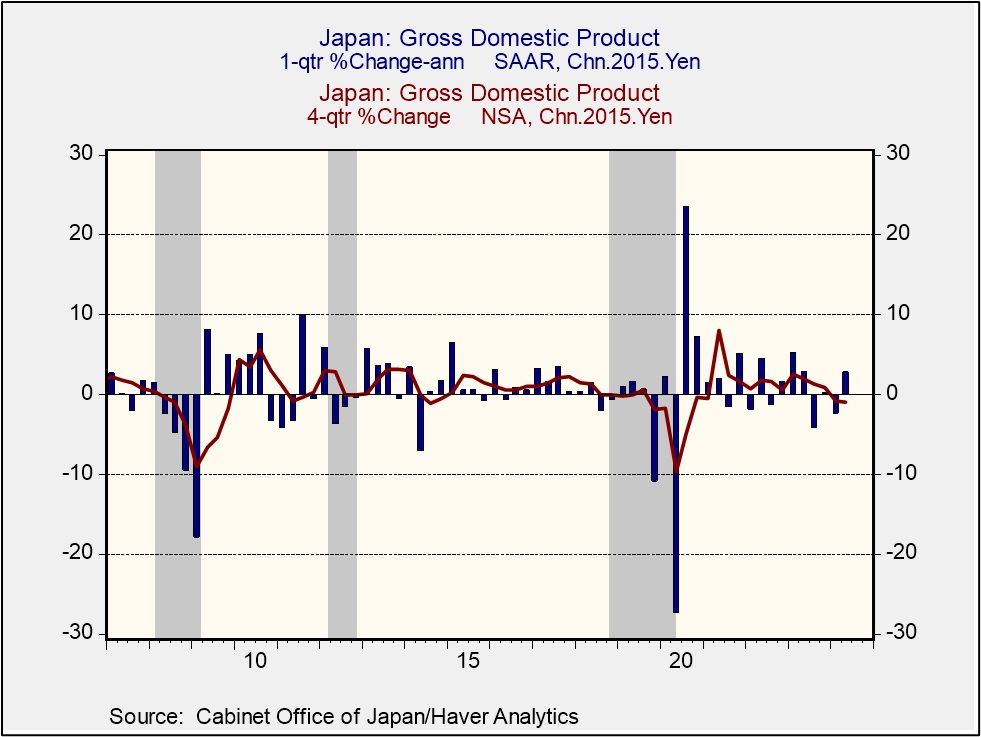

Japan: After stripping out price changes and seasonal impacts, second quarter gross domestic product grew at a robust annualized rate of 2.9%, just enough to offset the 2.4% decline in the first quarter. Japan’s GDP in April through June was still lower than in the same period one year earlier, but the rebound, which was driven by consumer spending and corporate investment, is an encouraging sign that the economy is regaining momentum. The rebound will probably also keep the Bank of Japan on track to keep raising interest rates later this year.

European Union: Former European Central Bank chief Mario Draghi, who was tapped by the European Commission last year to study the EU’s lagging economy, today issued his analysis and recommendations. According to Draghi, the EU needs a massive increase in public and private investment, financed in part by joint EU debt. To spur private investment and innovation, he calls for aggressive industrial policies and subsidies, financial market deregulation, and easier competition rules to let companies grow bigger and more powerful.

- Reporting so far suggests Draghi’s recommendations are consistent with the growing trend toward industrial policies around the world, including measures such as protectionist tariffs and tax breaks or other subsidies for favored industries.

- All the same, it is unlikely that Draghi’s entire list of recommendations will be implemented. At the very least, EU countries that are smaller and more open to trade for growth will likely resist those policies that favor bigger countries and companies or threaten trade wars that could hurt their exports.

Greece: In the latest pushback against tourists in Europe, the Greek government has proposed a series of measures to reduce visits from foreigners, including limits on cruise ship dockings, hefty increases in cruise ship disembarkation fees, and increases in lodging taxes. The moves follow similar restrictions put in place by Italy and Spain as post-pandemic wanderlust and a strong dollar encouraged waves of tourism in recent years. According to locals, excess tourism has driven up prices and disrupted communities in certain areas.

United Kingdom: Prime Minister Starmer’s government today admitted it is mulling ways to soften the blow from Starmer’s plan to reduce fuel subsidies for millions of Britons this winter. Although the government hasn’t yet decided how to soften the impact, any modification to the original plan would likely mean more spending and make it harder for the prime minister to rein in the UK’s expanding budget deficit.

Venezuela: Opposition presidential candidate Edmundo González, whom the US and other key countries consider the rightful winner of July’s election, left Venezuela on a Spanish military plane over the weekend after a Venezuelan court issued a warrant for his arrest. Venezuelan security forces have also surrounded the Argentine embassy’s residential compound, where six Venezuelan opposition leaders have decamped to avoid arrest.

- The developments show President Maduro is consolidating his power again after falsely claiming he won re-election.

- If Maduro retains power, as now looks likely, US sanctions on Venezuela’s petroleum industry are likely to remain largely in place. In turn, much of Venezuela’s oil resources will remain off the global market.

US Politics: As presidential candidates Donald Trump and Kamala Harris prepare for their televised debate tomorrow night, the Wall Street Journal today carries a detailed and useful comparison of their positions on key issues ranging from taxes to healthcare. The debate on the ABC network is Tuesday, September 10, at 9:00 pm ET.

US Bond Market: New data from LSEG show a record 60 corporate bond deals were completed last week for a total of $82 billion in borrowing. According to market participants, the flurry of deals reflects a desire by company managers to sew up their debt issuance ahead of any market volatility that could come as the economy slows, the Federal Reserve starts cutting interest rates, and the presidential election approaches.