Daily Comment (September 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a preview of tonight’s presidential debate and the latest major economic policy statement from former President Trump. We next review several other international and US developments with the potential to affect the financial markets today, including new European court decisions against major US technology companies and the broadening impacts from the re-industrialization of the US.

US Politics: Presidential candidates Donald Trump and Kamala Harris are scheduled to have their televised debate tonight on the ABC network, starting at 9:00 pm ET. Former President Trump and Vice President Harris have never met in person, so the battle could be as interesting as two unbeaten prize fighters meeting for the first time. The Wall Street Journal last night published a useful overview of the likely strategies the two candidates will use in their meeting.

- Separately, Trump made a confusing vow over the weekend to impose a 100% import tariffs against any country “leaving” the dollar. Based on the context of the statement, Trump was apparently saying that he would impose the tariffs against countries reducing their use of the dollar in international trade or investment.

- Many people are fearful that if other countries reduce their use of the dollar, its value will decline, undermining its purchasing power and boosting consumer price inflation. But Trump and his aides have previously indicated that they want to depreciate the dollar in order to bolster US exports and discourage imports. The contradictory statements suggest Trump wants to both keep demand for the dollar high and drive down its value.

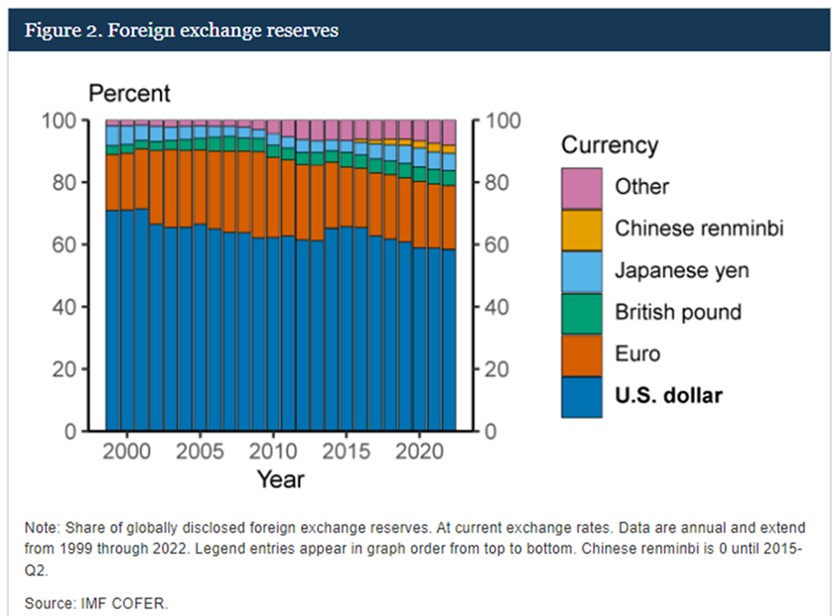

- Tracking and measuring all the different ways that the greenback is used in trade and investment is difficult, so economists look at the dollar’s share in global central bank foreign exchange reserves as a proxy. The dollar’s share in those reserves has actually been declining gradually for two decades, and yet the currency has been in a bull market and is now close to a record high.

- In our latest Bi-Weekly Geopolitical Report, published yesterday, we look at the prospects for the dollar as the world fractures into relatively separate geopolitical and economic blocs. The report notes that strong economic growth and better investment prospects in the US continue to draw in foreign capital, boosting the dollar’s exchange rate despite its reduced share in global trade and investment flows. For the time being, those factors could continue buoying the dollar.

European Union-United States: The European Court of Justice today overturned an appeals court decision and reinstated a 2016 court ruling that Ireland provided US tech giant Apple with illegal subsidies. The ruling today subjects Apple to 13 billion EUR ($14.3 billion) in back taxes. The ECJ today also affirmed a 2.4-billion EUR ($2.6 billion) fine against Google for antitrust violations. The rulings are likely to worsen US-EU economic tensions, especially if Trump is re-elected. The rulings also illustrate the growing regulatory risks for large US tech firms operating around the world.

Germany: Interior Minister Fraser yesterday said the government will extend and strengthen its border controls to reduce “irregular” migration and lower the risk that Islamist terrorists could enter the country. The move is likely a response by the centrist coalition government to the recent surge in political support for populist, anti-immigrant parties. It also illustrates how illegal immigration has become a political issue for many developed countries around the world.

United Kingdom: During the three months ended in July, average earnings excluding bonuses were up just 5.1% from the same period one year earlier, marking the weakest wage gains in two years. Average earnings in the service sector alone were up just 3.8%. The figures suggest the Bank of England’s tight monetary policy is continuing to wring price pressures out of the economy, although the policymakers are still expected to cut interest rates only slowly.

Russia-Ukraine Conflict: New polling shows the share of Ukrainians who want to compromise with Russia to end the war has risen to 26%, with younger people more inclined to negotiate. However, those in the military are least likely to want compromise. According to the report, enlisted personnel, who are influential in Ukrainian society, see any talk of compromise as an affront to those who have died resisting the Russians. They also argue that the Kremlin would only use a truce to rearm and prepare for a new attack.

Russia-Kazakhstan-China: Meirzhan Yussupov, chief of Kazakhstan’s state mining company Kazatomprom, said in a Financial Times interview that Western sanctions after Russia’s invasion of Ukraine have forced his company to favor uranium exports to Russia and China, even though it would prefer to maintain a more diversified customer base. The company, which is now the world’s largest uranium producer, earlier warned that its output would be crimped by supply shortages and delays in building new mining facilities.

- Yussupov’s effort to blame Western sanctions for crimped uranium exports, along with the firm’s statement about production challenges, may aim to mask Russian and Chinese pressure to reserve Kazatomprom’s low-cost uranium for themselves.

- As we noted in our Bi-Weekly Asset Allocation Report from April 15, 2024, the Chinese government is likely using enormous volumes of uranium as it works to massively expand its arsenal of strategic nuclear weapons. We suspect Chinese weapons demand has been a significant reason for the run-up in spot uranium prices since 2022. Beijing would want to hide where it’s getting its uranium supplies, and the statements by Yussupov and his company could be a part of that effort.

- To the extent that Russia and China can sew up Kazakhstan’s low-cost uranium ore, the result would be increased upward pressure on spot uranium prices in the West. That’s one reason why we are currently maintaining our exposure to uranium and uranium miners in Confluence’s Asset Allocation Strategies.

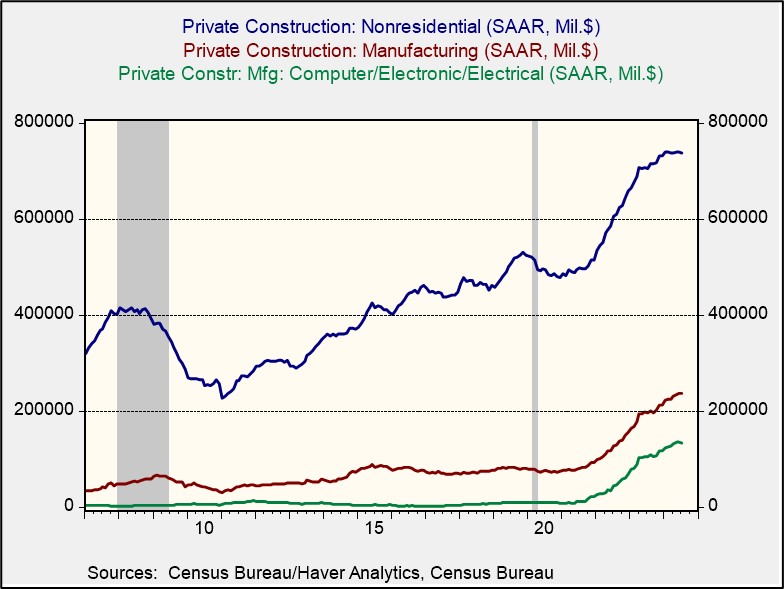

US Re-Industrialization: As the US-China rivalry and global fracturing continue to spur re-shoring and a boom in US factory construction, new data shows the long-awaited secondary effects are also becoming noticeable. The data, from real estate analytics firm Green Street, shows that investors are ramping up their plans to acquire or build warehouses, hotels, office buildings, and apartments near coming factories across the Sunbelt and Rust Belt, where most of these so-called onshoring projects are under way.

- The planned real estate development around emerging factories are an example of the “multiplier effect” of new investment.

- Although parts of the real estate sector, such as office buildings, are still broadly challenged by today’s high interest rates and the work-from-home trend, the multiplier on re-industrialization is a reminder that other types of real estate and particular localities continue to have good prospects.