Daily Comment (September 11, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently digesting the latest inflation data. In sports news, NBA Commissioner Adam Silver has hinted at the possibility of another expansion team. Today’s Comment will explore why banks remain pessimistic about the future despite a recent regulatory win, how lower oil prices could weigh on the US dollar, and the key takeaways from the second presidential debate. As always, our report will conclude with a roundup of domestic and international news releases.

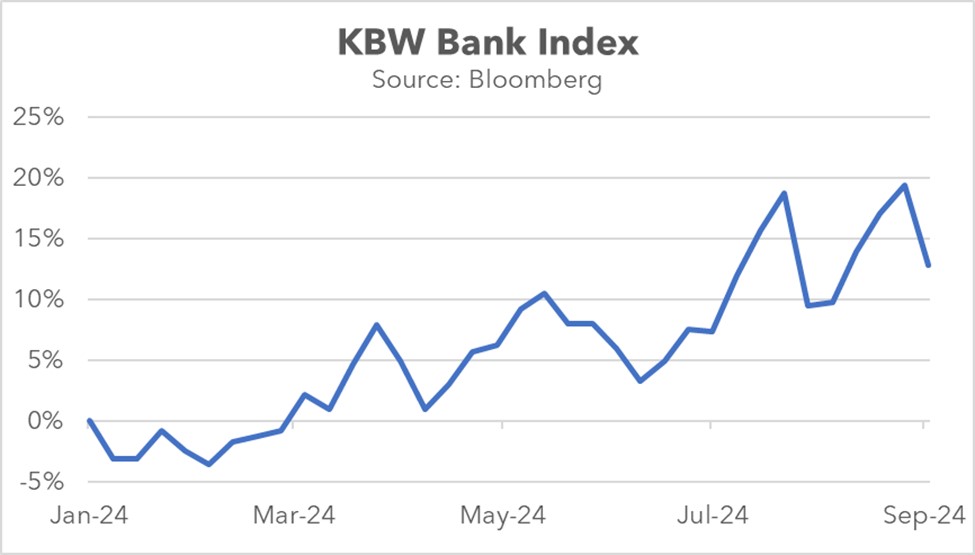

Banks Are Less Optimistic: While banks received some good news on Wednesday, the outlook for the sector remains bleak.

- In response to pressure from the financial services industry, the Federal Reserve announced a reduction in the proposed capital requirement increase on Tuesday, from 19% to 9%. While the initial proposals targeted banks with assets exceeding $100 million, the revised version primarily applies to those with assets over $250 million. The decision aims to alleviate concerns from banks about the potential impact the requirement would have on their lending capacity. However, there are concerns that relaxed rules could leave the door open for another financial crisis.

- That said, concerns persist about the outlook for financial firms. JP Morgan Chase has cautioned that anticipated earnings may be overly optimistic and cited the Federal Reserve’s expected interest rate cuts as a significant threat to net interest income, a key driver of its recent success. Meanwhile, auto lender Ally Financial has reported higher-than-expected car loan delinquency rates, raising concerns about its ability to deliver strong returns. This weaker outlook coincides with growing fears of consumer backlash as households grapple with rising prices and a deteriorating labor market.

- Despite expectations that the Federal Reserve will ease monetary policy in the near future, the impact on banks remains uncertain. While lower interest rates generally encourage lending in a strong economy, banks may now be reluctant to extend credit due to concerns about future default risk. Moreover, the recent Senior Loan Officer Opinion Survey (SLOOS) suggests that financial institutions are already tightening their lending standards. If this trend persists, we anticipate a moderation in economic growth but not a recession.

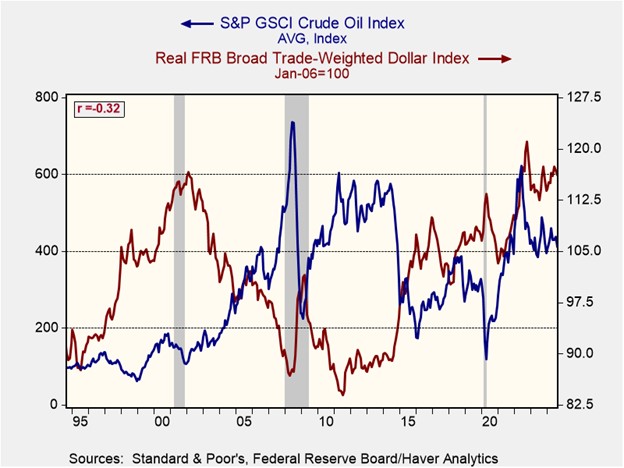

Oil Gets Cheap: Concerns about insufficient demand have pushed oil prices to their lowest level in nearly three years.

- Brent crude futures fell below $70 on Tuesday, driven by mounting global economic concerns. Weak economic data from China and a second downward revision within two months by OPEC to its demand forecast contributed to the drop. The oil-producing group now projects daily demand growth of around two million barrels, reducing its previous estimate by 80,000 barrels. This adjustment comes in the wake of reports indicating that Chinese imports increased by just 0.5% from the previous year, falling short of the anticipated 2% growth predicted by analysts.

- Declining oil prices could negatively impact the US dollar. In recent years, the United States has become a major exporter of natural gas and crude oil, a trend that accelerated after the war in Ukraine led to increased demand for alternatives to Russian oil. This shift has altered the US terms of trade, which measure the relative change in import to export prices, as the country transitioned from a net oil importer to a net exporter. As a result, the US dollar and oil prices have flipped from a negative to a positive correlation.

- Nevertheless, the 2024 oil market has been characterized by a significant supply-demand imbalance. Lackluster GDP growth in China and Europe, coupled with slowing economic momentum in the United States, has reduced global oil demand. While OPEC has reduced production to bolster price levels, increased output from Brazil, Canada, Guyana, and the United States has offset much of the supply cuts. Consequently, the combination of robust production and weakening demand has led to a surplus of fuel inventories that has kept a lid on prices, which should weigh on the dollar.

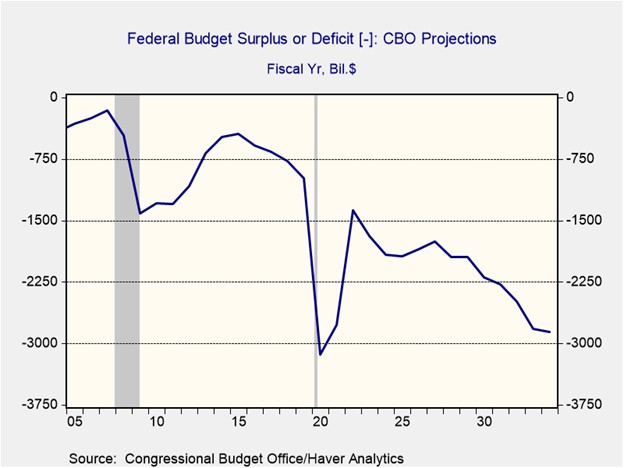

Fireworks But No Substance: Republican and Democratic presidential candidates Donald Trump and Kamala Harris debated on Tuesday but offered few insights into their planned direction for the country.

- During the debate, neither candidate was willing to delve into the specifics of their plans for the country. Harris emphasized her intention to offer tax cuts for small businesses and provide a credit to first-time homebuyers to help them purchase their first home. Meanwhile, Trump reminded Americans of his plan to significantly strengthen border security to address the immigration surge. Beyond these points, the leaders engaged in a heated exchange of insults regarding their respective records in office, which was somewhat entertaining but ultimately unproductive.

- Despite both candidates’ enthusiasm for outlining their spending plans, neither has provided a clear explanation of how they intend to finance these initiatives. Trump has proposed extending previous tax cuts, exempting Social Security and tips from taxation, and lowering corporate tax rates. In contrast, Harris has pushed for a $25,000 tax credit for first-time homebuyers, an extension of childcare tax credits, a $6,000 bonus for newborns, and the elimination of taxes on tips. While both candidates claim to have deficit-reduction plans, neither was willing to discuss these strategies during the debate.

- While Trump previously secured a decisive victory over President Joe Biden in the first debate, early assessments suggest that Harris may have gained the upper hand in the second contest. The next debate is set to take place in three weeks between Ohio Senator JD Vance and Minnesota Governor Tim Walz. Meanwhile, the Harris and Trump campaigns are discussing the possibility of another debate. Current betting odds indicate that the race remains relatively close, with Harris receiving a small bump following last night’s performance.

In Other News: The US, for the first time, accused China of directly supporting Russia’s invasion of Ukraine. This decision reflects Washington’s increasing efforts to rally European support for its isolation of China. Meanwhile, lithium share prices have surged following the closure of two Chinese mines by CATL. This event serves as a stark reminder of the volatile nature of commodity prices in a world that is becoming increasingly disconnected. Automaker Volkswagen has decided to end its job security agreement as it looks to chart a more profitable path forward.