Daily Comment (September 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are digesting the latest inflation data and closely watching for clues on the Federal Reserve’s upcoming rate decisions. In the sports world, WNBA star A’ja Wilson has etched her name in the history books by breaking the single-season scoring record and solidifying her bid for another MVP award. In today’s Comment, we will delve into the continued investor optimism surrounding AI technology, analyze the mixed implications of the CPI report on inflation, and explore the potential impact of Mexican judicial reforms on trade. As always, we’ll conclude with a review of the latest domestic and international economic indicators.

AI Hype is Back? OpenAI’s latest funding round has boosted investor confidence that AI is here to stay.

- The Microsoft-backed AI startup is in negotiations to secure $6.5 billion in new funding from investors. This significant investment could nearly double the company’s valuation from $86 billion to $150 billion. Such a valuation would further solidify the company’s position as one of the most promising startups globally. The AI company claims that the fresh capital will be used to expand its computing power and cover operational costs. However, there is speculation that this financing round could signal the company’s ambition to go public.

- OpenAI’s recent initiative underscores the surging demand for generative AI technology, a trend echoed by the escalating investments of the “Magnificent 7.” Notably, Amazon, Microsoft, Google, and Meta have all recently announced plans to significantly bolster their AI spending. While these moves have been met with a degree of skepticism from investors who would prefer a more diversified approach, they highlight the intensifying competition among these tech giants as they vie for dominance in the burgeoning AI market.

- As Big Tech companies continue to scale their AI operations, they will require access to advanced, energy-efficient chips. This surging demand has already pushed chip manufacturers like Nvidia to their limits, with the company struggling to keep up with the overwhelming demand for its latest-generation Blackwell chip. Utility companies have also faced mounting pressure to supply the substantial energy needs of these firms that are expanding their data centers. While some investors may have cooled on the Magnificent 7, it’s clear that these companies still command significant investor interest.

Shelter Still a Problem: While consumer inflation dipped in August, persistent underlying price pressures suggest that the fight against inflation is far from over.

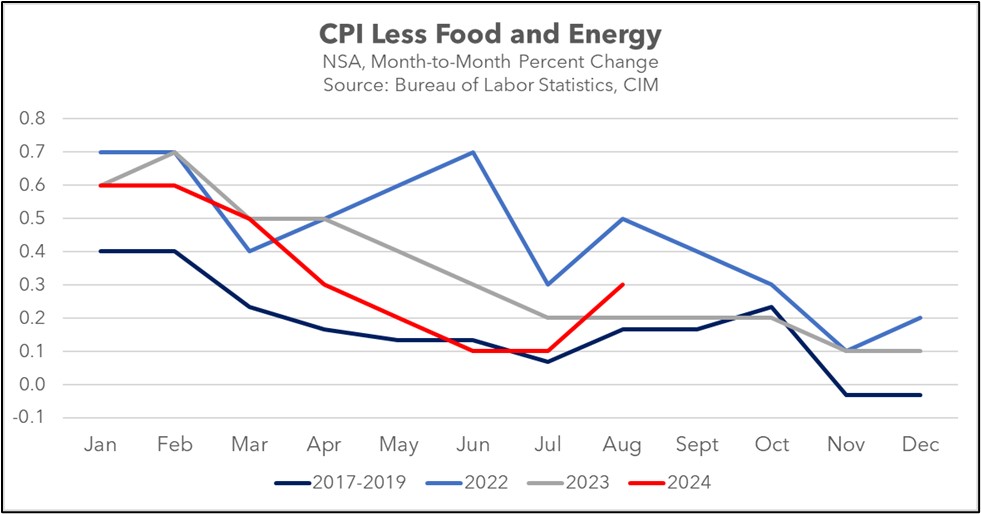

- The overall consumer price index (CPI) increased a modest 0.2% last month, while core CPI, excluding food and energy, rose 0.3%. While this data suggests a general alignment with the central bank’s inflation mandate, significant hurdles remain in achieving its ultimate goal. Commodities continue to provide a bright spot, with food at home and energy prices contracting last month. However, price pressures in services remain a major concern, particularly shelter costs, which accelerated at more than twice the pace of the overall index.

- The disproportionate impact of shelter inflation on the broader price index reflects a lingering effect of the pandemic. The government’s cautious stance on ending eviction moratoriums, coupled with uneven state-level policies, has slowed the pass-through effects of home and rent prices on the CPI. As a result, overall and core CPI have risen by 2.5% and 3.2%, respectively, compared to the previous year. In contrast, overall and core CPI excluding shelter costs reveals much smaller increases of 1.1% and 1.6%, highlighting the significant role of shelter inflation in driving up these measures.

- As a result, the Federal Reserve may be more inclined to downplay the recent sharp increase in core inflation to avoid the further cooling of the labor market. This could indicate a greater willingness to lower interest rates than previously expected, potentially revisiting the March projection of a 50-75 basis point reduction by year-end. However, due to the recent rise in month-over-month inflation figures, the Fed is likely to adopt a more cautious approach. Consequently, we anticipate that the initial interest rate cut will be a modest 25 basis points.

Mexico Judicial Reforms: Mexican President Andrés Manuel López Obrador (AMLO) has made significant progress toward consolidating his ruling party’s control over the judiciary before the end of his term.

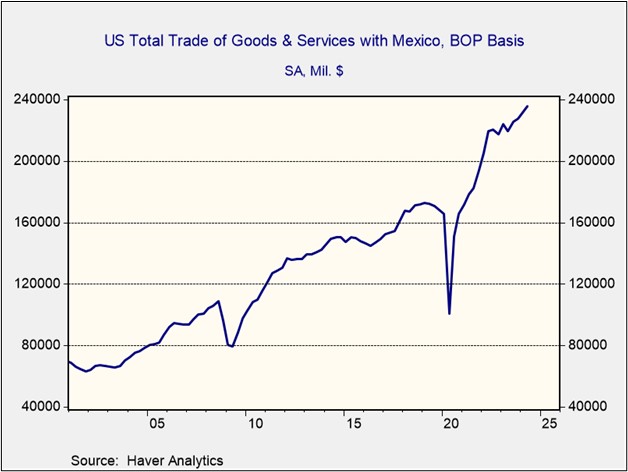

- On Wednesday, the Mexican Senate passed a significant judicial reform that would require judges at all levels, including the Supreme Court, to be elected by the public rather than appointed. This follows the lower house’s approval of the legislation last week. The reform now awaits ratification by state legislatures, which are largely controlled by AMLO’s Morena party. Once the legislation becomes law, it is likely to lead to a confrontation between Mexico and its USMCA trade partners as they seek to ensure fair arbitration mechanisms.

- Since taking office, AMLO has pursued a strategy of government control over the country’s energy market, creating conditions that favor state-owned companies in securing contracts over foreign competitors. This approach has strained Mexico’s relationship with its two major trading partners, particularly the United States, as it is in violation of the USMCA agreement. Last year, a federal court struck down an electricity law backed by AMLO, citing anti-competitive practices. Earlier this year, the Supreme Court also ruled against his initiative to grant favorable contracts to state companies.

- Incoming President Claudia Sheinbaum, who is set to assume office on October 1, has sent mixed signals to investors by affirming her commitment to judicial reforms while simultaneously pledging to protect private investors. This ambiguity has heightened investor concerns about her stance on nationalization, leading to a pause in further investments. If she continues to follow in the footsteps of her predecessor, Mexico’s reputation as a reshoring hub could be tarnished. Additionally, it may lead to a trade war and jeopardize the future of USMCA, which is scheduled for a review in July 2026.

In Other News: Canada’s defense minister has thrown cold water on the idea of an Asian NATO, as the West looks to prevent an unnecessary escalation of tensions with China. The European Central Bank cut rates by 25 bps as it looks to prevent the economy from slowing down further. Spanish Prime Minister Pedro Sánchez has urged the EU to seek a compromise on Chinese EV imports rather than to follow through on planned tariffs. His reluctance is a reminder of how divided the EU is when it comes to China.