Daily Comment (September 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets await more data to assess the economy’s health. In sports news, Dolphins quarterback Tua Tagovailoa suffered multiple concussions during the team’s loss to the Buffalo Bills. Today’s Comment delves into growing concerns about a government shutdown, explains why the Fed may not ease as aggressively as the market expects, and offers our perspective on the recent European Central Bank’s rate decision. As always, the report concludes with international and domestic data releases.

Shutdown Coming? With time running out, House officials are racing to prevent a government shutdown in October.

- House Minority Leader Hakeem Jeffries firmly stated that Democrats will not support the Republican funding bill. Earlier this week, Republican leader Mike Johnson had to withdraw a vote on the stopgap measure due to strong opposition from both House Democrats and members of his own party. A major sticking point is the proposed requirement for proof of citizenship to vote. Despite this, there is hope that a short-term funding agreement will keep the government open until mid-December.

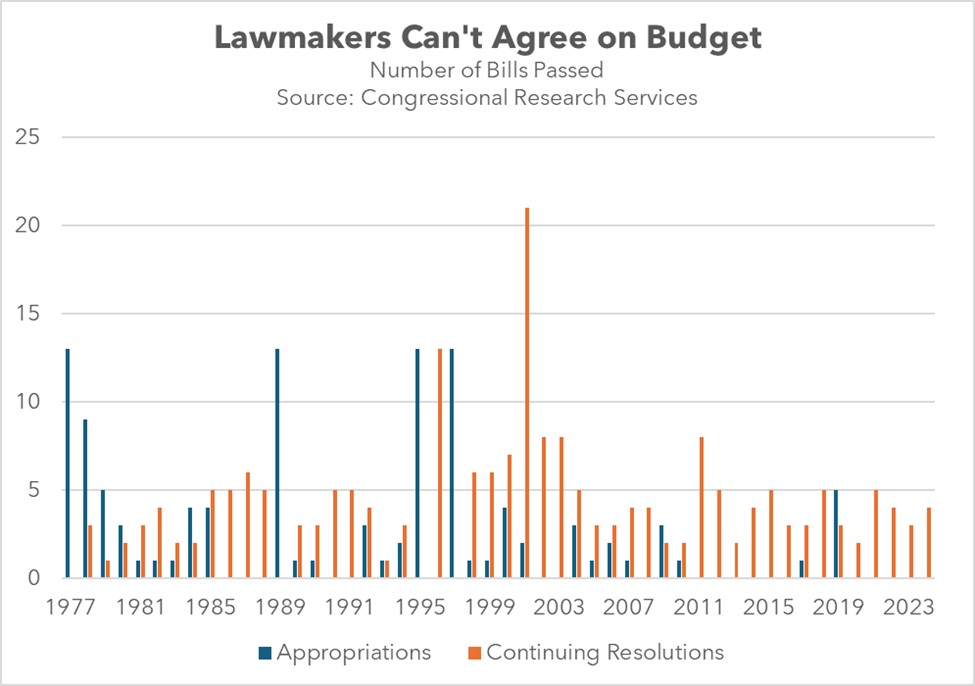

- In the post-financial crisis era, political infighting has forced lawmakers to repeatedly extend government funding with temporary measures known as continuing resolutions. Only once since 2009 has more than one appropriation bill been passed before the October 1 deadline. These stopgaps prevent government shutdowns but also prolong the appropriation process and contribute to the ballooning budget deficit. The government has already relied on four continuing resolutions this year, which have helped push the deficit to $1.9 trillion. This puts it on track to be the largest deficit outside the pandemic era.

- While budget disputes are common, there seems to be a heightened risk of a government shutdown during the election this year. The ongoing political infighting over the budget is likely to raise investor concerns about the US government’s ability to address its fiscal challenges. The two major rating agencies have already downgraded the US credit rating, citing concerns about partisan gridlock preventing an agreement to reduce the deficit. As a result, we anticipate that continued political bickering over the debt will likely impact long-term interest rates in the future.

Too Much, Too Soon: The market remains optimistic about a significant shift in monetary policy, even though the economy is still demonstrating signs of resilience.

- As of today, market sentiment suggests a nearly 60% likelihood of the Fed implementing a rate cut of 125 basis points or more before year’s end. This expectation is fueled by concerns about a potential economic slowdown, which have been exacerbated by a series of weak labor market indicators. The rise in the unemployment rate in July, which triggered the Sahm Rule, along with this month’s confirmation of slowing hiring trends, has heightened concerns. However, we remain optimistic that the market may be getting ahead of itself.

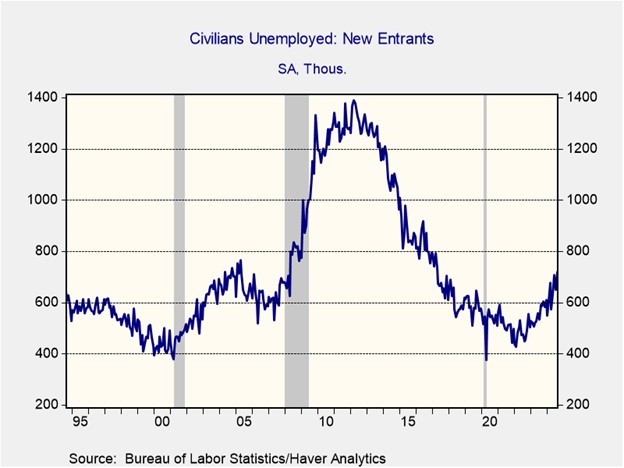

- Historically, the Fed “takes the stairs up” during rate-hike cycles and “takes the elevator down” during rate cuts, typically in response to recessions. However, there are currently no clear signs of an economic downturn. The recent uptick in the unemployment rate is largely due to new entrants into the labor force. Meanwhile, the Atlanta Fed’s GDPNow forecast indicates a modest economic slowdown in the third quarter, with growth projected at an annualized rate of 2.5%, down from 3.0% in the previous month.

- The recent market reaction aligns with a pattern observed in the past two years, where investors often overestimate the likelihood of aggressive rate cuts in response to perceived economic weakness. This tendency has consistently been met with resistance from the Fed. Despite recent unfavorable data, the economy is expected to remain in expansion, suggesting that this pattern may continue in the coming months. While we anticipate a rate cut in September, we believe the Fed will adopt a more measured approach, with less reliance on jumbo cuts than the market currently expects.

ECB Rate Decision: The European Central Bank (ECB) has lowered benchmark interest rates for the second time in three months and has signaled more to come.

- The ECB on Thursday lowered its deposit rate by 25 basis points to 3.50%, signaling a shift in focus from inflation control to economic support. ECB President Christine Lagarde emphasized during a press conference that interest rates are not predetermined but are on a downward trajectory. While the central bank has not ruled out a rate cut in October, there is speculation that it might do so at the December meeting, when the central bankers will have more data to paint a better picture of the economy.

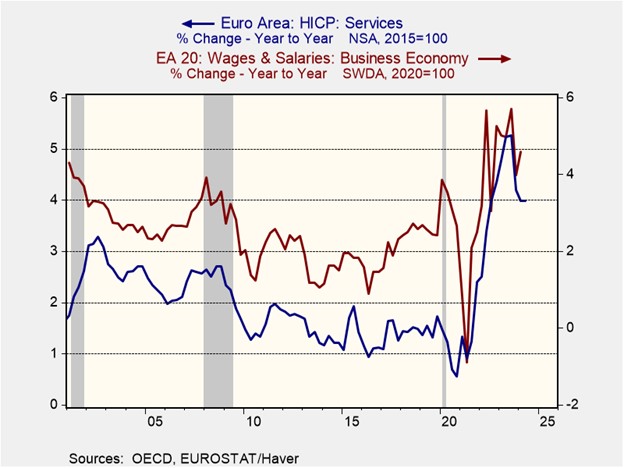

- Closely monitoring regional wage trends will provide valuable insights into the trajectory of services inflation. Unlike the US, which has experienced a steady rise in unemployment, the EU has witnessed a historic decline. This tight labor market has contributed to persistent wage pressures that have defied the central bank’s tightening efforts and the economic slowdown. This has translated to higher earnings, which explains nearly 60% of its variation of services inflation. As a result, if these wage pressures persist, the ECB may be forced to halt its easing cycle prematurely.

- Historically, the ECB has tended to be less aggressive than the US in raising rates during easing cycles but more cautious in lowering them. Given the persistent tightness of the labor market and its impact on wages, we anticipate that the ECB will likely adopt a more moderate approach to rate cuts to prevent a resurgence of inflation. This could help narrow the interest rate gap between the ECB and the US, potentially providing a boost to the euro. However, the currency could face downward pressure if inflation unexpectedly returns.

In Other News: OpenAI released a new artificial intelligence model that will help process complicated mathematical and coding problems. The development is a reminder of how AI capabilities are evolving. Former members of the Trump administration are considering selling shares in Fannie Mae and Freddie Mac in a move that could disrupt the housing market. Meanwhile, Russian President Vladimir Putin has threatened retaliation against a NATO ally if Ukraine is allowed to use US weapons to attack military bases in Russia, raising concerns about escalating tensions.