Daily Comment (September 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is eagerly anticipating the Federal Reserve’s upcoming rate decision. In sports news, Bayern Munich set a new Champions League record for most goals by a single team with a nine-goal victory over Dinamo Zagreb. Today’s Comment will explore our thoughts on the Fed’s anticipated rate cut later today, the potential implications of the ongoing dockworker labor dispute, and the Brazilian central bank’s widely expected U-turn. Finally, we’ll round out our report with a review of the latest economic data.

Inflation to Unemployment: While the market is focused on the size of today’s rate cut, it should also pay close attention to the summary of economic projections, which will outline the future path of interest rates.

- Market expectations for a significant interest rate cut have surged, with the probability of a 50 bps reduction rising from 34% to over 60% since last Tuesday. This shift has been largely driven by former New York Fed President William Dudley’s editorial, in which he expressed optimism that the Fed will take bold action at its next meeting to address labor market challenges. Prior to the July meeting, he pushed the central bank to cut rates, and although the FOMC opted against it, the minutes of the meeting revealed that some members would have supported such a move.

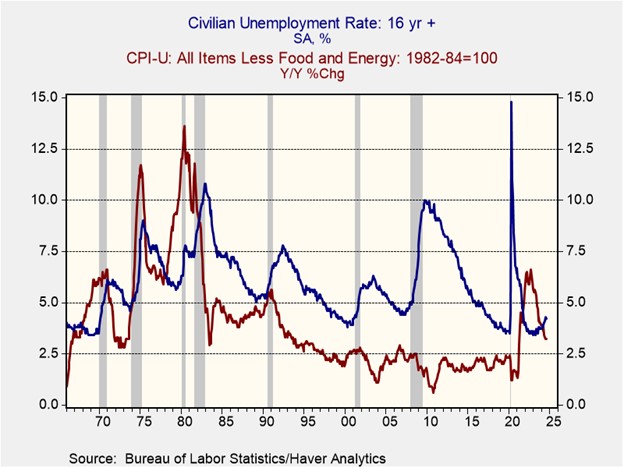

- The decision to implement rate cuts now, rather than at a later time, reflects less of the central bank’s stance on inflation and more of its growing concern about the cooling labor market. These two economic indicators have been moving in opposite directions. While core inflation has decreased from 3.9% to 3.2% since the start of the year, the unemployment rate has risen from 3.7% to 4.2%. Consequently, for the first time since 2021, the unemployment rate now exceeds the inflation rate, reinforcing the view that its mandate of price stability and maximum unemployment is balanced.

- The Federal Reserve is expected to take a nuanced approach at its upcoming meeting, as plans to implement its first rate cut with the release of its eagerly anticipated economic projections. A 50 bps rate cut today would likely prompt the Fed to express a cautious outlook for future rate reductions. Conversely, a 25 bps cut could encourage officials to signal a willingness to take more aggressive action if needed in the future. However, market sentiment could deteriorate if investors perceive that the Fed is not committed to cutting rates to safeguard the economy.

Labor Strikes Back: Just weeks before the election, the dockworkers’ unions are ready to strike in an effort to secure a better labor contract.

- The White House has announced that it will not invoke federal legislation to prevent a potential strike by dockworkers on the East and Gulf Coasts if a labor agreement is not reached by the October 1 deadline. While the US president has the authority to intervene in labor disputes deemed a threat to national security, the administration has chosen not to exercise that power in this instance. Given that over half of US-bound cargo passes through these ports, a strike could significantly disrupt supply chains nationwide and could become a political issue.

- The decision not to intervene in the labor dispute indicates that the administration is keen to avoid actions that could be perceived as anti-union. Since the pandemic, support for labor unions has increased as a tight labor market has compelled employers to offer higher wages to attract and retain workers. This has bolstered the bargaining power of unions as they push for greater concessions. The dockworkers’ labor dispute appears to have reached an impasse over wage increases, with union leaders demanding a 77% pay raise, and a ban on automated cranes, gates, and container movements.

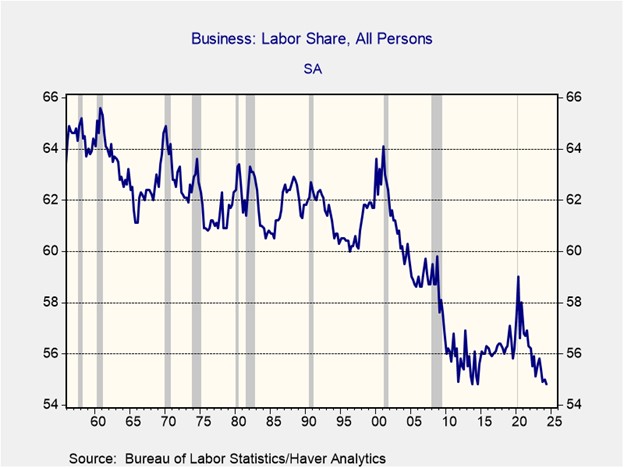

- A strike could disrupt supply chains and raise prices, but a more critical long-term concern is the potential slowdown in technological adoption. After the pandemic, workers initially gained a larger share of company earnings, but their shares sharply declined as the economy reopened. While increased immigration played a role, the rise of AI technology also contributed. The recent dispute suggests that technology could become an increasingly political issue in the coming years, especially if firms use it to offset rising labor costs.

Brazil Turns Hawkish: After being one of the first major economies to implement rate cuts, the central bank of Brazil appears to be on track to undo some of those measures later today.

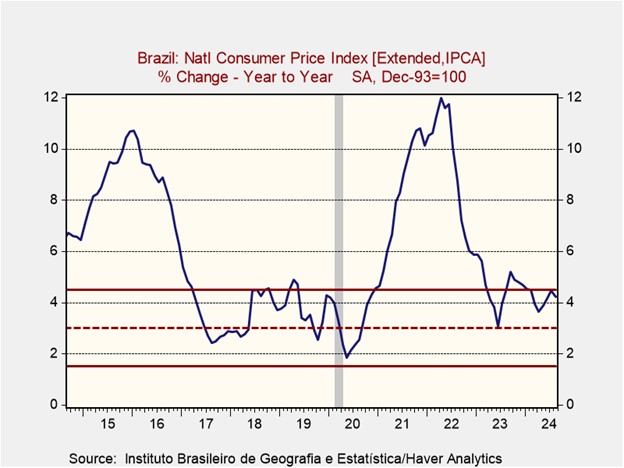

- Brazil’s central bank is expected to raise its benchmark policy rate by 25 basis points to 10.75% on Wednesday. The decision comes as the central bank looks to establish its independence after previous criticism from President Luiz Lula da Silva. Since taking office, Lula has increased public spending, particularly on social programs, raising concerns that the resulting debt could fuel inflation. His chosen successor to take over the central bank, Gabriel Galípolo, has also adopted a hawkish stance, pledging to take whatever steps are necessary to curb inflation.

- The decision to tighten monetary policy reflects the Brazilian economy’s signs of overheating. In the second quarter, the economy expanded at an annualized rate of 5.9% — the fastest pace since late 2020. This robust growth coincides with a persistently tight labor market, where the unemployment rate remains near 20-year lows. The combination of strong growth and low unemployment has likely contributed to a rise in overall inflation, which is currently above the central bank’s target rate of 3%, and risks exceeding the tolerance range of 4.5%.

- The central bank’s anticipated rate hike should serve as a warning about the dangers of excessive interest rate cuts, particularly if the country fails to rein in its spending. While we do not foresee other central banks adopting a more hawkish stance in the near term, a resurgence of inflation could force central bankers to pause and reverse earlier rate cuts to contain price pressures. Should the central bank of Brazil raise interest rates as expected, the country’s currency is likely to appreciate relative to its peers.

In Other News: Republican presidential candidate Donald Trump has pledged to restore SALT if elected to a second term, aiming to appeal to high-income suburban voters. Meanwhile, Nippon Steel’s merger plans gained momentum as the Biden administration extended its bid for US Steel, despite delays due to national security concerns and bipartisan opposition. In another development, Google successfully appealed its 1.5 billion EUR ($1.67 billion) competition fine, signaling that big tech may be able to fend off further regulatory crackdowns.