Daily Comment (September 20, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Today’s market is still grappling with the implications of the recent rate decision. In sports news, Tina Charles etched her name in WNBA history, setting new records for career rebounds and double-doubles. Today’s Comment examines the market’s guarded optimism amidst the recent milestone of the S&P 500, the EU’s tightening regulations on US tech, and the implications of Japan’s monetary policy. As always, the report will include a comprehensive overview of domestic and international economic data releases.

S&P 500 Hits Highs: Equities continue to march forward as investors believe that a soft landing is possible.

- The S&P 500 reached an all-time high by surpassing 5700 on Thursday, marking its 39th record of the year. The market’s buoyant sentiment was fueled by optimism that the Federal Reserve might have pivoted in time to avert a recession. Thursday’s decline in weekly jobless claims signaled continued reluctance among firms to lay off workers and showed a strong labor market. Meanwhile, the Atlanta GDPNow forecast model’s positive outlook also adds to the market’s optimism. Consequently, nearly every sector experienced gains, with technology stocks leading the way.

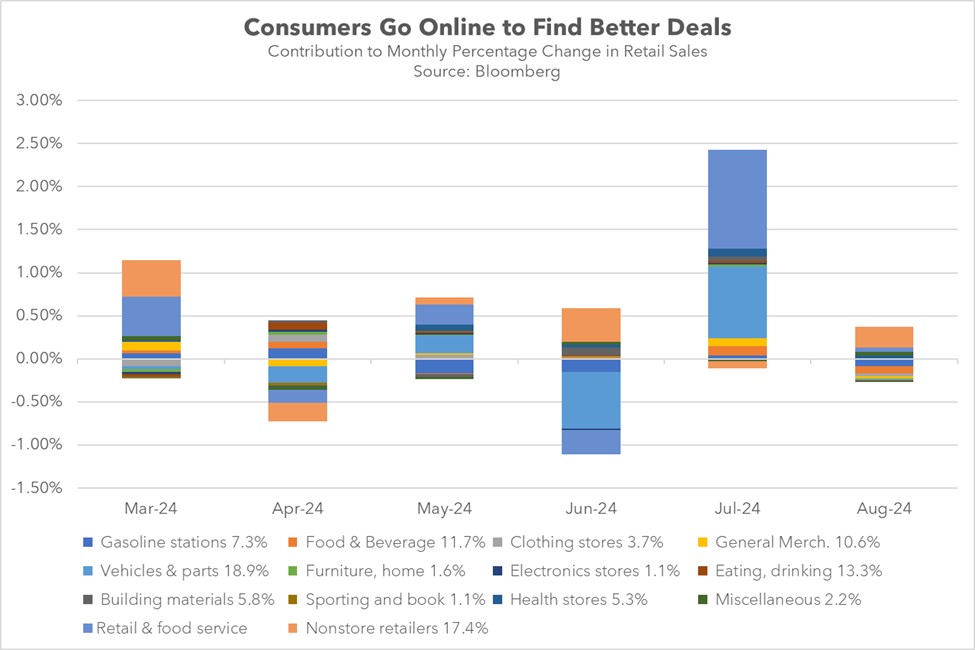

- However, beneath the surface, recessionary concerns linger. Despite recent mortgage rate decreases, existing home sales plummeted to a post-pandemic low in August. Moreover, FedEx, seen as an economic bellwether, missed profit targets and issued a warning of potential business slowdown in the coming quarters. The company attributed this to waning consumer demand for expedited shipping, further signaling rising price sensitivity within households. This sentiment was echoed in retail sales data released by the Commerce Department, indicating a growing number of online deal-seekers.

- The Fed’s recent shift in focus toward maximum employment over price stability will be tested next week by the PCE price index report. Recent data suggests that core inflation has made significant progress toward the Fed’s target, easing concerns about inflation risks. If core inflation rises modestly in August as expected, investors may become more confident in the Fed’s ability to achieve a soft landing. Fed speeches over the next week should also help guide market expectations as officials look to make their case that the central bank is not worried about recession.

The EU’s Digital Hurdle: The bloc has initiated a crackdown on foreign tech firms to bolster its regional presence in the industry.

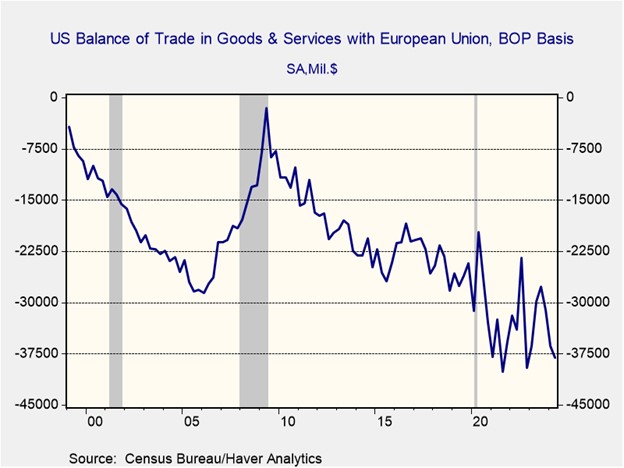

- The EU has intensified its scrutiny of US tech giants under the Digital Markets Act. On Thursday, regulators cautioned Apple that it must allow competing tech firms access to its iPhone and iPad operating systems or face substantial fines. This warning reflects the EU’s broader effort to dismantle the dominance of foreign tech companies within the European technology market. Earlier this week, Google successfully appealed a $1.7 billion fine levied against its advertising business but agreed to divest this section of its company in order to resolve the ongoing antitrust probe.

- The EU’s escalating regulatory oversight of US companies signals a strategic pivot towards bolstering domestic industrial capabilities. As geopolitical tensions rise, the region is positioning itself for a more self-reliant future. A recent EU Commission study emphasized the imperative of developing a robust domestic technological infrastructure to mitigate risks associated with over-reliance on potential trade rivals, including China and the US. This shift is reflected in the region’s increased investment in military technology, which will rise from 142 million EUR ($158 million) to 1 billion EUR ($1.1 billion) a year over the next few years.

- A more assertive EU is expected to maintain its alliance with the US, driven by strong ties and shared interests. However, amid rising geopolitical tensions, EU governments are likely to prioritize industrial policies that bolster domestic firms. This strategic shift could lead to increased investment and higher debt levels for EU countries, but the long-term benefits may include greater corporate competitiveness. Meanwhile, US firms may need to adapt their business models to focus more on domestic markets, as access to foreign markets could become more challenging.

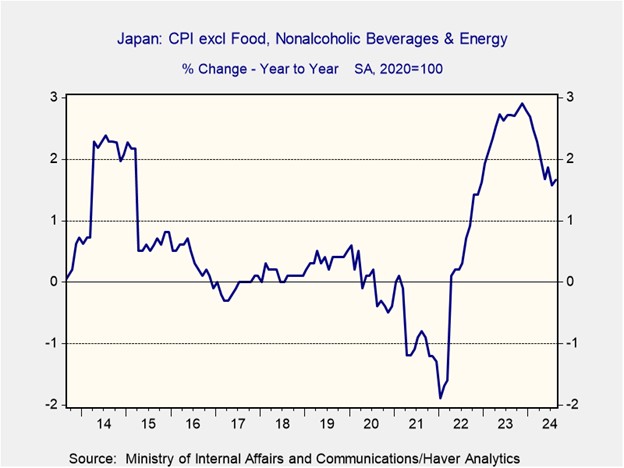

Bank of Japan Holds: The BOJ opted to maintain a patient stance on monetary tightening, awaiting the potential inflationary effects of the yen’s (JPY) recent appreciation.

- On Friday, the central bank announced it would keep interest rates unchanged, signaling that further hikes are unlikely in the near term. During a press conference, BOJ Governor Kazuo Ueda stated that the bank would consider raising rates if inflation and economic conditions remain on their current path. He expressed optimism that the recent appreciation of the yen has provided more flexibility for policy decisions. Ueda also cited uncertainty around a potential US soft landing as a key factor in the rate decision.

- While inflation has been steadily rising, there are indications that underlying price pressures remain relatively contained. Although the central bank’s headline inflation rate reached 2.8% in August, a substantial increase from the year’s beginning, core inflation, excluding volatile food and energy components, remains below the target of 2%. This reinforces the central bank’s stance that it can delay interest rate hikes, given that the recent currency appreciation is expected to place downward pressure on import prices. Japan’s heavy reliance on imports for energy and food makes this particularly beneficial.

- The Federal Reserve’s perceived delayed response to labor market pressures may have influenced the BOJ’s decision to maintain a patient stance. Last month’s market selloff was triggered by the BOJ’s unexpected rate hike and the Sahm Rule activation. The event highlighted the financial markets’ vulnerability to abrupt currency fluctuations, particularly in the context of yen carry trade unwinding. The BOJ’s cautious approach may ultimately enhance financial stability, particularly if inflationary risks remain contained in both countries.

In Other News: The Biden administration admitted that it no longer believes it will be able to negotiate a peace agreement between Israel and Hamas, which may lead to the possibility of escalating tensions in the Middle East. A bipartisan group of lawmakers bypassed House Majority Leader Mike Johnson to force a vote on a bill to expand Social Security access, in a strong sign that his party is losing faith in him. Brazil fined X for defying a platform ban, demonstrating the escalating rift between the two sides.