Daily Comment (September 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news of a new economic stimulus program in China, although economists are already panning it as insufficient to significantly boost growth. We next review several other international and US developments with the potential to affect the financial markets today, including signs of stable interest rates in Japan and Australia and an update on the threat of a major strike at the US’s East Coast and Gulf Coast ports in just one week.

Chinese Economy: In a new effort to boost flagging economic growth, the Chinese government today unveiled a large package of stimulus measures. For example, the People’s Bank of China cut its benchmark interest rate and reduced bank reserve requirements to free up cash for lending. The central bank will also provide the equivalent of about $70 billion to funds, brokers, and insurers to buy Chinese stocks, along with about $40 billion to banks to finance stock buybacks by listed firms. For consumers, interest rates on existing mortgagees will be reduced.

- While today’s stimulus package is bigger than recent ones, economists so far are dubious that it will be enough to offset the strong structural impediments to growth in China, such as weak consumer demand, poor demographics, and excess capacity and debt. The central government’s crackdown on excessive housing investment and the poor state of provincial and local government finances are especially problematic.

- If the new measures fail to spur much growth, China’s economic slowdown will continue to weigh on the global economy and geopolitics. For example, weak Chinese demand would weigh on imports and put additional downward pressure on many commodity prices. It would also incentivize Beijing to spur more factory investment and boost exports, leading to protectionist measures abroad and new trade tensions.

- All the same, the broad stimulus package and the stock-specific measures in particular have given a strong boost to Chinese stocks so far today.

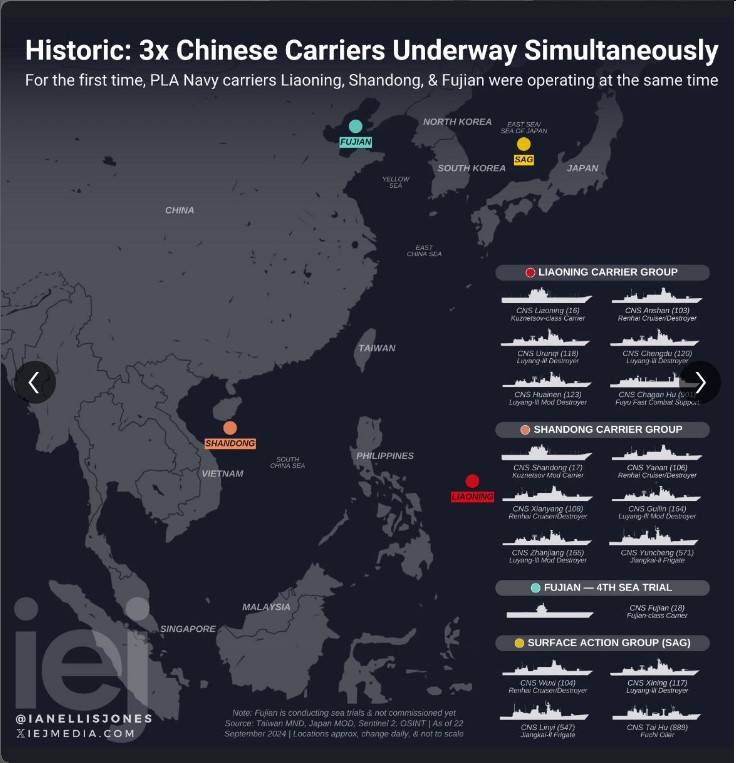

Chinese Military: Illustrating China’s rapid military buildup, Beijing this week had three aircraft carriers underway simultaneously for the first time in history. The fully commissioned Liaoning and her battle group are operating east of the Philippines, while the Shandong and her battle group are in the South China Sea. Meanwhile, China’s newest and most technologically advanced carrier, the Fujian, is on her fourth sea trial in the Yellow Sea. The only US carrier in the region, the Theodore Roosevelt, is operating east of the Philippines.

Israel-Hezbollah: Over the last day, Israel has unleashed a massive campaign of air attacks against Hezbollah targets in Lebanon, destroying large numbers of Hezbollah missile launchers, weapons caches, and other military equipment. However, the campaign has also resulted in the deaths of almost 500 people. The escalating violence continues to present the risk of a wider, highly destabilizing regional war that could draw in the US.

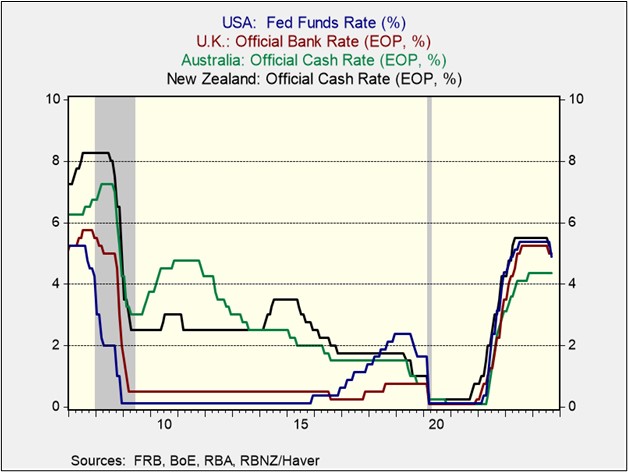

Japan: Despite investor expectations for another interest-rate hike next month, Bank of Japan Governor Ueda said in a speech today that the policymakers can wait to gather more data on economic developments. Importantly, he stressed that the yen’s (JPY) recent appreciation could help hold down import prices and overall inflation. The statement suggests the BOJ may hold rates steady at its October policy meeting, just as it did at its meeting last week. In response, the yen has weakened by about 0.3% so far today to trade at 144.01 per dollar ($0.0069).

Australia: The Reserve Bank of Australia today held its benchmark short-term interest rate unchanged at 4.35%, as expected. The decision reflects how Australian policymakers remain wary about the country’s tight labor market and still-elevated price inflation. It also makes Australia an outlier among major central banks other than the BOJ, most of which have now begun to cut rates. As a result, the Australian dollar (AUD) today has strengthened 0.2% to $0.6855.

France: The new French government, which is under an “excessive deficit” procedure by the European Union, has reportedly asked Brussels for two extra weeks to deliver its plan for reducing its budget shortfall and bringing its debt under control. If approved, the new deadline would be October 31. The French deficit procedure is being seen as a test of how strongly Brussels will act to enforce fiscal discipline among EU member countries.

- Reflecting investor concern about France’s debt levels, the country’s 10-year government bond yield of 2.98% is now as high as Spain’s for the first time since 2008.

- French government bond yields are also now trading at a spread of 0.79% over the benchmark German yield.

United States-Turkey: Washington and Ankara are reportedly close to a deal in which Turkey will end its acquisition of Russian-made S-400 air defense systems in return for the US allowing it back into the F-35 fighter program, both as a purchaser and a components producer. The deal would also transfer the S-400 systems already acquired to the US sector of the Incirlik Air Base, where the US military could presumably test them and figure out how to defeat them.

- Until now, Turkish President Erdoğan had exemplified the “border lands” leader who tried to play the US and its bloc off against the China/Russia bloc.

- It now appears the US was able to bring Turkey to heel by cutting it off from acquiring or helping to manufacture the F-35, which is widely recognized as the world’s most advanced jet fighter. If so, the incident highlights how the US is likely to leverage access to its advanced technologies to keep allies in line or punish its adversaries.

US Politics: At a campaign rally in Pennsylvania yesterday, former President Trump warned farm equipment maker Deere & Co. that, if elected in November, he would impose 200% tariffs on any of the firm’s made-in-Mexico equipment that had previously been made in the US. While it is unclear whether US law would allow for such a tariff hike on a single company, the threat illustrates how protectionism in the interest of preserving US jobs has become accepted policy for both Republicans and Democrats.

US Shipping Industry: The US is now just one week away from a potential major strike at dozens of East Coast and Gulf Coast ports. If the US Maritime Alliance, which represents carriers and marine terminal operators, and the International Longshoremen’s Association do not agree on a new contract before the current one expires on September 30, the resulting work stoppage would affect about 41% of the country’s containerized shipping volume.