Daily Comment (September 25, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Global markets are closely monitoring the impact of China’s recent stimulus measures. In sports news, the New York Liberty have taken a commanding lead over the Atlanta Dream in the first round of the WNBA playoffs. Today’s Comment will delve into why the Federal Reserve’s rate cut has failed to inspire market confidence in a soft economic landing, how India’s actions have been driving up silver prices, and the potential consequences of the Argentine president’s declining popularity due to his economic reforms. As usual, this report will conclude with a review of domestic and international data releases.

Market Not Convinced: Despite the Fed’s rate cut that was aimed at fostering a soft landing, concerns persist about the ongoing need to tame inflation.

- The Federal Reserve’s unexpected 50 basis point interest rate cut last week continues to move markets, as investors are uncertain about the path of future policy. There was a bear steepening of the yield curve following the cut, with long-term interest rates rising rather than falling. This unexpected move fueled concerns that the Fed may be declaring victory prematurely. These fears were echoed by Federal Reserve Governor Michelle Bowman, who dissented from the rate cut, advocating for a more measured approach to monetary policy.

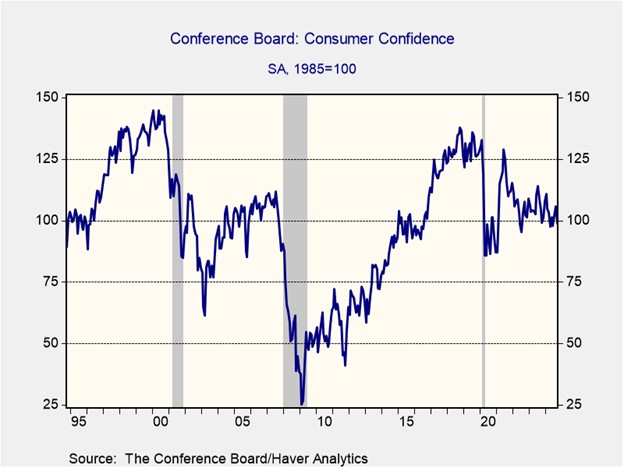

- Despite the Fed’s efforts to stimulate a soft landing, the labor market remains a growing concern. The September Consumer Confidence Index plummeted to 98.7 from 124.3, marking its sharpest decline in three years. This downturn was primarily driven by rising anxieties about the job market, with fewer respondents perceiving it as plentiful and more reporting difficulty in finding employment. While these labor market indicators have deteriorated, consumer optimism about the overall business cycle persists, largely due to the expectation of lower interest rates.

- The lack of downward movement in long-term interest rates could have a negative impact on the economy but may also provide the Federal Reserve with room for further monetary easing. As Dallas Fed President Lorie Logan suggested last October, higher term premiums could be used as a justification for less restrictive monetary policy. If inflation continues to decline and the labor market shows signs of cooling, this strategy may become more likely. While we don’t anticipate another large rate cut, it’s not entirely out of the question if economic data continues to follow current trends.

Silver on the Rise: While China has been a major buyer of gold, India has been steadily accumulating silver.

- India’s silver imports are skyrocketing, driven by a combination of cultural tradition and industrial growth. The recent reduction in trade duties has further fueled India’s longstanding demand for silver, particularly during the lead-up to Diwali. Additionally, the drop in duties has amplified the country’s expanding solar panel and electronics industries as India looks to compete as a manufacturing power. Despite China’s dominance in solar cell manufacturing, India’s share of US imports has surged from less than 1% six years ago to nearly 11% in the second quarter of 2024.

- The escalating demand for silver, driven by countries’ intensified efforts to expand solar cell production, is an important factor behind the widening silver deficit. The Silver Institute projects a 17% increase in this deficit, fueled by a 2% rise in demand and a 1% decline in supply. Silver’s indispensable role in solar cell manufacturing, due to its superior electrical conductivity, thermal efficiency, and optical reflectivity, has contributed significantly to its outperformance of both the S&P 500 and gold so far this year.

- Despite potential upward pressure on both gold and silver prices due to heightened global power competition, silver may have a slight edge. The gold-to-silver price ratio currently exceeds its historical average of 70, suggesting a possible correction in the coming months. Furthermore, silver’s industrial applications, particularly in green energy initiatives, provide a strong foundation for its price support. As a result, we do not expect silver to fall below the psychological barrier of $30 an ounce any time soon, especially as investors look to real assets due to rising geopolitical tensions.

Milei Losing His Hold: The Argentine president has seen his popularity fall as his economic policies have started to take hold.

- Support for Milei’s government declined by 15% in September, in the sharpest decline since he took office. His approval rating now stands at 44.8% of the population, with 50.7% expressing dissatisfaction. His declining popularity has been linked to his pro-market reforms, which have received applause from investors but also pushed the country into recession. The drop in support comes as he struggles to manage a small minority government while attempting to address the country’s ailing fiscal deficit and attract foreign investment.

- Despite the initial economic hardship, the government’s reforms are beginning to yield positive results. While inflation in Argentina remains one of the world’s highest, it has shown noticeable signs of easing over the last few months, with nearly all components of its inflation index moderating. Moreover, the country has achieved consecutive budget surpluses for the first time since 2010. These achievements have helped show that his policies, while not conventional, have the potential to put the country on the right track for growth, assuming that they can stay in place.

- Argentina’s long-term outlook will continue to improve as long as Milei can help the country regain legitimacy following its 2020 sovereign default. Despite Argentina’s history of market reforms, its sustainability remains uncertain. If Milei’s popularity continues to decline, he may be forced to delay or abandon further reforms. If conditions deteriorate enough, it is possible that he may be pushed out of office in the next election, mirroring the fate of previous pro-market Argentine presidents. Therefore, it’s crucial to consider the broader political landscape when evaluating the potential impact of a new leader on the market.

In Other News: Former President Donald Trump and Vice President Kamala Harris have committed to participating in town halls for Univision, which are aimed at providing voters with a deeper understanding of the presidential candidates. Meanwhile, optimism is rising that Congress will reach an agreement on a stopgap spending bill to avert a government shutdown ahead of the election. Additionally, the Department of Justice has announced plans to file a lawsuit against Visa, alleging that it holds a monopoly over debit card transactions.