Daily Comment (September 26, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Financial markets are reacting to more stimulus news from China. In sports news, the Connecticut Sun clinched a dominant sweep over the Indiana Fever, securing their place in the WNBA semifinals. Today’s Comment will delve into the recent shake-up at OpenAI, explore the potential limitations that the Federal Reserve rate cuts will have on the housing market resurgence, and provide an update on the ongoing conflict in Israel. As always, we’ll conclude with a roundup of key international and domestic data releases.

OpenAI Goes Mainstream: The brawl over the direction of the firm has taken a new turn as the company looks to take its product global.

- The developer of ChatGPT is seeking to transform from a nonprofit to a for-profit entity in order to attract greater investor interest. As part of this transition, the company is offering its current nonprofit board a reduced role in exchange for a minority stake. Following the announcement of this shift, the company’s CTO, Mira Murati, and two other executives have resigned. Furthermore, the company’s CEO, Sam Altman, is anticipated to receive a 7% stake upon completion of the transition. The shake-up of the company’s leadership is a signal that the company is likely to alter its governance regarding AI risks.

- Since extending its partnership with Microsoft in early 2023, OpenAI has sought to integrate its technology into the global infrastructure. Altman has embarked on a world tour to encourage countries to expand their chip manufacturing facilities and data centers to facilitate the development of more powerful AI. He has even likened data centers to the essential nature of electricity. Despite the company’s growing fame, its expenses have outpaced its income, leading to speculation that it might seek a public offering.

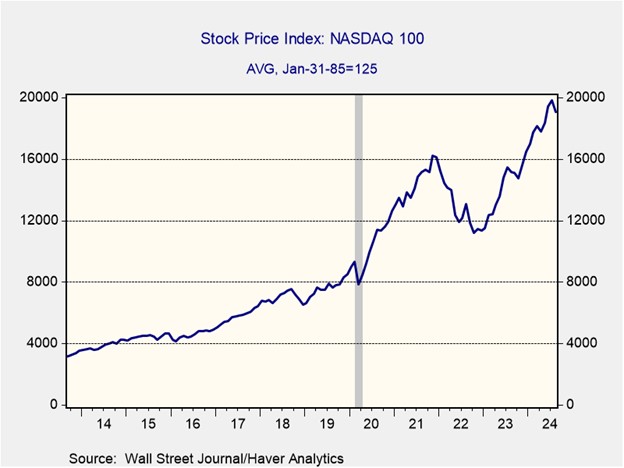

- The escalating prominence of OpenAI is anticipated to bolster the sentiment surrounding tech companies and reinforce the belief that AI technology is a permanent fixture. However, a growing concern is the increasing resistance from labor unions and workers against the widespread adoption of automation and AI as a means to replace human workers. While there is a burgeoning momentum to expand the integration of this technology, investors should be prepared for potential public backlash in response to these concerns regarding worker displacement.

The Housing Market Shrugs: While there has been optimism that a lower policy rate could boost housing demand, we suspect that accommodative policy will have a more mixed impact.

- The Fed’s recent jumbo rate cut had a negligible effect on the mortgage market last week. According to the Mortgage Bankers Association, the average 30-year fixed mortgage rate fell by only 2 basis points from 6.16% to 6.14%. While loan applications experienced a surge, the majority of this increase was attributable to refinancing activity as homeowners sought to tap into their home equity. Although it’s too early to gauge the full impact of the rate cut on the housing market, there’s reason to believe that it may not provide the anticipated boost to home prices to which we have become accustomed.

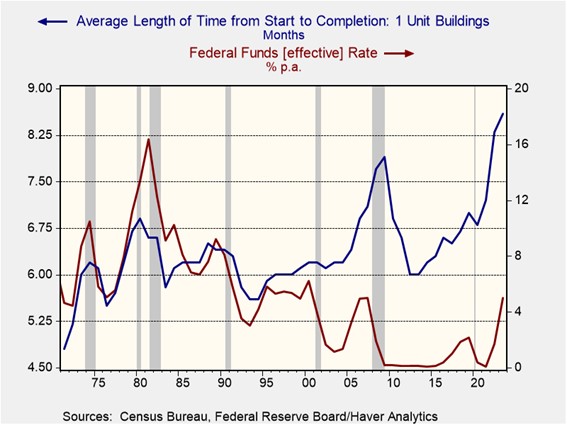

- One reason for our doubts is the uncertainty over whether interest rates influence demand or supply more. Lower borrowing costs typically make it easier for homebuyers to secure loans, which, in theory, should drive up home prices. However, reduced rates also benefit homebuilders by lowering their costs. As shown in the chart below, a drop in the fed funds rate correlates with faster construction times for new homes, suggesting that lower rates could increase supply by bringing more homes to the market.

- Given the Fed’s decision to cut rates during a period of continued economic expansion, the overall stimulative impact may be less pronounced than in previous easing cycles. The limited impact can be partly attributed to the fact that rate cuts have not been fully transmitted to the longer end of the yield curve. This lack of transmission is unlikely to result in mortgage rates falling to a level that significantly attracts homebuyers, but it could make it easier for homebuilders to finance new projects. Consequently, we suspect that home price increases could begin to slow down over the next few months.

Tensions in the Middle East: Israel is preparing for a potential invasion of Lebanon to counter Hezbollah’s aggression; however, the oil market remains unaffected.

- Israel’s decision to prepare for escalation follows the Israeli air defense’s interception of a Hezbollah ballistic missile aimed at Tel Aviv. This comes after Israel warned its northern border troops that the ongoing airstrikes are meant to pave the way for a possible ground invasion. Meanwhile, US and French envoys are pushing for negotiations to broker a ceasefire and prevent a broader regional conflict, with hopes of reaching a peace agreement that could end the fighting in Gaza as well. While there remains optimism that tensions will calm, the prospect of war remains elevated.

- Despite historical links between Middle Eastern conflicts and higher oil prices, current supply dynamics seem to be preventing such a correlation. Saudi Arabia’s recent announcement that it is abandoning its unofficial $100/barrel price target suggests a strategic shift. By seeking to lower prices, the Kingdom aims to increase its market share, potentially foreshadowing another price war with US shale producers. Although the implementation of this strategy is not anticipated until December, the declaration indicates Saudi Arabia’s preparedness for such a confrontation.

- An Israeli invasion of Lebanon would likely put upward pressure on oil prices, although the precise magnitude of this increase remains uncertain. A crucial factor influencing the situation is Iran’s potential response. If Iran were to blockade the Strait of Hormuz, a vital oil shipping route, crude prices could surge dramatically. However, given Iran’s recent willingness to resume nuclear negotiations with the US, the likelihood of such a blockade appears to be low. In the near term, anticipated increases in oil production by OPEC countries could help mitigate some upward pressure on prices related to conflict.

In Other News: The Chinese Politburo has committed to implementing another round of stimulus measures, signaling its determination to reignite the faltering economy. Over six years since the Brexit vote, the European Union and the United Kingdom have seemingly rekindled open dialogue, as the two sides look to reset ties. Micron’s better-than-anticipated quarterly results suggest that AI-related stocks may still possess upward momentum.