Daily Comment (October 4, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are currently reacting to the fresh jobs report. In sports news, Caitlin Clark of the Indiana Fever has been named the WNBA Rookie of the Year. Today’s Comment will delve into the ongoing Israel-Iran conflict, explore why a soft economic landing is beneficial for speculative bonds, and discuss the rise of European protectionism. As always, we will conclude our report with a comprehensive overview of international and domestic data releases.

Israel-Iran: The prospect of Israel bombing oil patches in Iran has led to concerns of a broadening war in the Middle East.

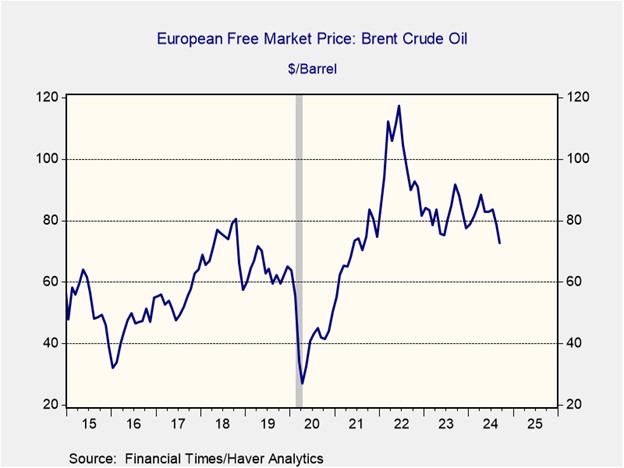

- President Biden suggested that a potential strike on Iran’s oil fields is under discussion between the US and Israel in response to Iran’s missile barrage. While details remain unclear, the possibility of Israeli strikes fueled a surge in global oil prices and pushed the VIX above 20. Rising tensions between Israel and Iran, along with fears of disrupted Iranian oil production and further conflict escalation, have driven the increase in market volatility. Meanwhile, Israel escalated its offensive in Lebanon, launching airstrikes near Beirut Airport and targeting Hezbollah’s potential successors.

- The ongoing conflict has challenged the traditional safe-haven paradigm. While the 10-year Treasury and gold have historically been considered reliable during times of fear, the US dollar has emerged as the dominant safe-haven asset, consistently maintaining its value. Despite the dollar’s recent rally, bond prices have declined, and gold has relinquished some gains. This shift in investor sentiment likely reflects a reassessment of relative valuations, with gold and bonds perceived as overvalued compared to the dollar amid concerns about central bank monetary policies.

- In the coming weeks, we should gain clearer insights into how US monetary policy compares to its global peers. The Bank of England and European Central Bank have indicated a readiness to implement more aggressive rate cuts if inflation aligns with projections. Conversely, the Bank of Japan faces pressure to refrain from further tightening. The US is prepared to adjust its policy if necessary, but its decisions are likely to continue to be more sensitive to evidence of weakness in the labor market rather than to cooling inflationary pressures.

Soft Landing and Credit Spreads: Recent ISM and S&P Global data confirms a strong economy, narrowing high-yield bond spreads.

- The purchasing managers indexes (PMI) for the two most well-known reporting agencies suggest that service activity remained comfortably above the contraction threshold of 50 in September. The service index from the Institute of Supply Management increased from 51.5 in August to 54.9 in the following month. Meanwhile, the S&P Global index decreased modestly from 55.7 to 55.2. These reports reinforce the notion that despite weakness in the labor market, the economy is still on solid footing, which has boosted confidence in a soft landing.

- The positive economic outlook has led to a sharp increase in the demand for speculative bonds. This trend has coincided with a decrease in credit spreads to their lowest level since 2021, as investors expect a gentle economic slowdown. The decrease in spreads is influenced by the potential interest rate cuts by the Federal Reserve and the ongoing strong demand for credit, especially from companies looking to refinance expiring debts. This is likely to continue as long as the market maintains confidence in the Fed’s ability to control inflation and prevent a recession.

- The positive readings from the two PMIs are encouraging, but only time will determine whether the Federal Reserve can successfully navigate a soft landing. Despite the thriving service sector, manufacturing continues to struggle. Furthermore, concerns about a potential resurgence of inflation persist. As a result, a hard landing or a possible Fed U-turn remains a distinct possibility. Consequently, while credit spreads are currently tight, they may widen if economic conditions deteriorate. This may mean that investors should be patient before going into speculative grade bonds.

Europe’s Protectionist Shift: EU officials have crossed a key hurdle as they try to decide whether to impose tariffs on Chinese EVs.

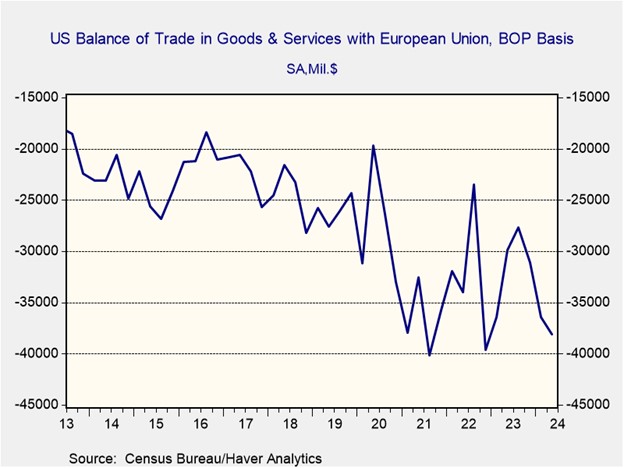

- Amid ongoing trade negotiations with China, the EU has announced its intention to impose tariffs of up to 45% on Chinese electric vehicles. This reflects a growing desire to protect domestic industries. Additionally, the EU has been positioning itself for the possible return of Donald Trump as president, since he has warned of a more hostile trade relationship with the bloc. This move aligns with recent warnings from French President Macron about the need for fairer trade rules to prevent the EU from falling behind the US and China.

- The EU’s increasing vulnerability has spurred a drive for greater independence. Although the bloc aspires to be a pioneer in the green energy shift, it continues to be heavily reliant on China for renewable technology and remains a major buyer of US natural gas. Eurostat data reveals that Europe imported 93% of its solar panels. Moreover, its imports of Chinese vehicles surged from 3.5% in 2020 to 27.2% by the second quarter of 2024. This dependence has impeded the growth of domestic industries and left the bloc exposed to external threats.

- While we expect the EU to retain strong ties with the US due to its historical and security interests, we believe the increasing competition between the two has become more understated. This tension is evident in the bloc’s crackdown on US big tech firms and its calls for issuing its own bonds. The EU’s growing assertiveness could compel the US to have less influence in shaping EU affairs, especially as these countries begin to contribute more to their joint defense. In the long run, this could have an impact on firms with foreign revenue exposure.

In Other News: Dockworkers and operators have agreed to put the strike on hold until January 15. The UK has struck a deal with Mauritius in which it gave back the islands but was able keep the region that holds a UK military base. Italy is looking to raise taxes on corporations earning windfall profits as it looks to tackle its growing deficit.