Daily Comment (October 10, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is still processing the latest inflation data. In sports news, the New York Mets defeated the Philadelphia Phillies to move on to the NLCS. Today’s Comment will discuss the latest FOMC meeting minutes, explain why the dollar is strengthening, and give our thoughts about Japanese elections later this month. As usual, our report will conclude with a round up international and domestic data releases.

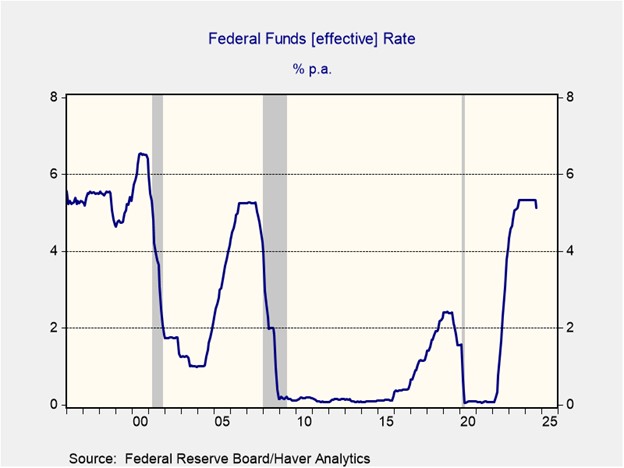

Employment Not Inflation: The Federal Reserve cut interest rates by 50 basis points due to concerns about a weakening labor market and confidence in ongoing inflation progress.

- As detailed in the September 17-18 meeting minutes, Fed officials expressed concern about the labor market following two consecutive jobs reports that indicated a slowdown in hiring and job openings, with a rise in the unemployment rate. Additionally, the recent summer PCE price index reports, which showed that inflation rates were aligning with the 2% target, reinforced the Fed’s belief that inflation was making steady strides towards its goal. As a result, the FOMC determined that the risk to its maximum employment mandate had risen to the same level as its price stability mandate.

- Although Michelle Bowman was the lone dissenter who advocated instead for a smaller rate cut, several other Fed members also expressed support for a more measured approach. Their reluctance stemmed from concerns about the reliability of the labor market data, given the influx of immigration and the frequent revisions to the payroll data. Additionally, uncertainty surrounding the determination of the neutral interest rate — the level at which the economy neither expands nor contracts — contributed to their cautious stance, as many believed it could send the wrong signal about the pace of the Fed’s easing cycle.

- Based on the meeting minutes, we anticipate that the Fed will gradually loosen monetary policy in the coming months, contingent upon the ongoing deceleration of inflation toward the 2% target. However, a more aggressive rate cut would likely be triggered by a deterioration in the labor market rather than by more progress toward the inflation target. As a result, we project that the Fed could decrease rates by an additional 25-50 basis points this year. This is likely not going to have a major impact on equities but could affect short to intermediate bonds.

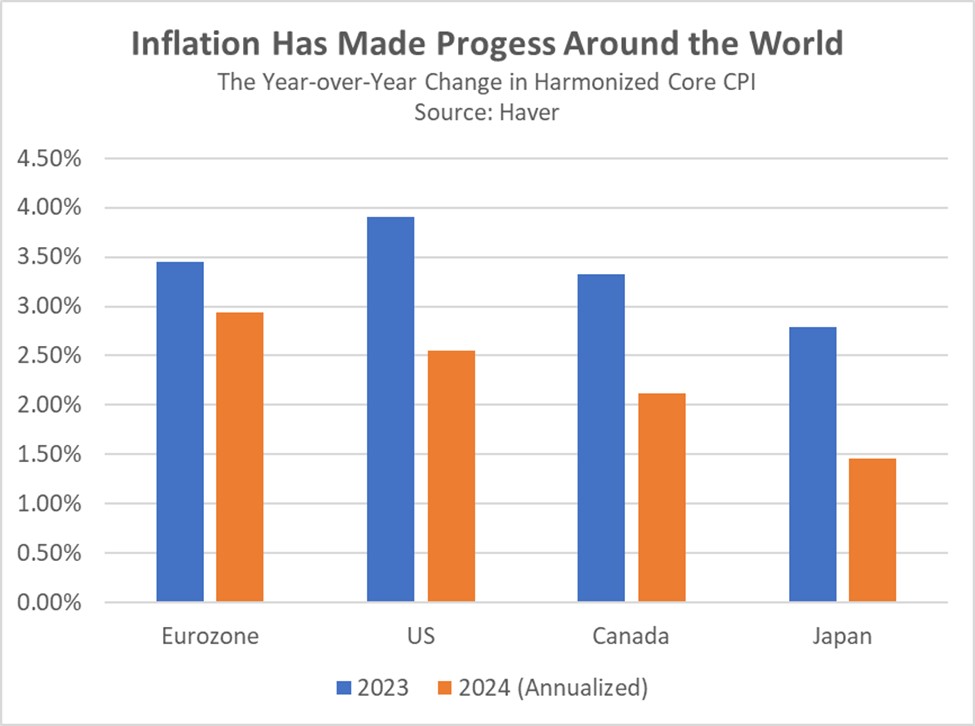

Attitudes Are Changing: While the Fed has tapered expectations of policy easing, other central banks have gone in the opposite direction.

- The European Central Bank (ECB) is expected to cut interest rates for a third time this year at its October 17 meeting. The drop in interest rates comes as the region suffers through an economic slowdown, but inflation is still making progress toward its 2% target. Germany, the largest economy in the region, has lowered its GDP growth forecast as it braces for a deeper economic downturn in the coming months. Meanwhile, the EU’s headline inflation has dropped below 2% for the first time since July 2021.

- Central banks worldwide are increasingly adopting a more accommodative monetary stance. It is anticipated that the Bank of Canada will reduce interest rates by 50 basis points in both October and December, reflecting concerns over slowing economic growth. In Japan, despite rising inflation, concerns about consumer spending have prompted the central bank to consider postponing further rate hikes until January 2025. This change in sentiment has boosted the US dollar as investors have become less confident in the narrowing of interest rate differentials with the United States.

- With the initial phase of interest rate cuts behind us, central bankers are likely to prioritize the future trajectory of monetary policy. Given the current inflation rate and poor economic outlook, the ECB and the Bank of Canada are expected to implement most of their rate cuts early in this cycle. In contrast, the Bank of Japan may resume rate hikes at the beginning of the year. Assuming the Federal Reserve does not reverse course due to an unexpected rise in inflation, the US dollar is likely to weaken slightly during this monetary cycle.

Elections in Japan: A week after taking over, Prime Minister Shigeru Ishiba is already looking to consolidate his party’s hold on the lower house.

- Ishiba dissolved the lower house of parliament on Wednesday, paving the way for snap elections on October 27. The swift decision aims to capitalize on a recent surge of optimism following his rise to leadership. Seen as having a cleaner image than his predecessor Fumio Kishida (who resigned after a series of political scandals), Ishiba enjoys an approval rating of around 50%, significantly higher than Kishida’s, which fell below 20% in some polls. Despite the uptick in sentiment, his approval rating remains low when compared to previous leaders in Japan after taking office.

- Japan is experiencing an economic slowdown, with over a third of companies expecting to miss their first-half earnings projections, according to a Reuters survey. This downturn aligns with the highest number of bankruptcies since 2013, which was recorded this month. Small businesses have been hit particularly hard and are facing sluggish sales and rising costs that squeeze profit margins. In response to the economic weakness, Ishiba, known for his hawkish stance, has advised the Bank of Japan to pause any further rate hikes as households are still reluctant to spend after years of deflation.

- The upcoming election this month is not expected to significantly change the composition of the lower house, but it could provide momentum for the upper house elections next year. The ruling LDP currently holds 258 seats and has a coalition with an additional 28 seats, surpassing the 233 seats needed to maintain majority in the lower house. If the party can retain its majority, it will be well-positioned to maintain power in the upcoming contests next year. Given that Ishiba is expected to carry out the mission of his predecessor, this should be favorable to markets.

In Other News: FTC Chair Lina Khan’s position will be uncertain under the next administration, as some donors push for her removal while lawmakers advocate for her to stay. In Florida, widespread blackouts followed Hurricane Milton, and the damage is expected to affect this month’s payroll data. Meanwhile, former President Donald Trump has pledged to eliminate double taxation on foreign expats, signaling plans to expand his tax cut agenda if he wins the November election.