Daily Comment (October 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with yet another disappointing press conference by a top Chinese economic official. We next review several other international and US developments with the potential to affect the financial markets today, including a cut in France’s debt rating outlook and another study looking at US economic prospects in a new term for former President Trump or under Vice President Harris.

Chinese Economic Policy: At a news conference on Saturday, Finance Minister Lan Fo’an said the central government will issue special bonds in 2025 to fund new fiscal support for local governments and banks, but he gave no figure for the new spending and provided no detail on how much of it would go to boost consumer spending. As with the National Development and Reform Commission’s disappointing news conference last week, the lack of detail miffed foreign investors. Local buyers were more positive, pushing China’s markets higher today.

- When the government announced its big monetary stimulus last month, sources said it would also soon release a plan to issue the equivalent of $284 billion in special bonds to help local governments and banks. However, no official announcement has been made. That has prompted rabid speculation about how aggressive the government will be. Some observers are looking (or hoping) for a program of up to $425 billion, with significant amounts going to boost consumption spending.

- For now, the Chinese economy continues to struggle against big structural problems, including weak consumer demand, excess capacity and high debt, poor demographics, decoupling by the West, and disincentives from the Communist Party’s intrusions into the free market. Without a strong dose of fiscal stimulus and new policies to promote consumer spending, Beijing may fail to generate lasting optimism among investors and consumers, with negative implications for global economic growth.

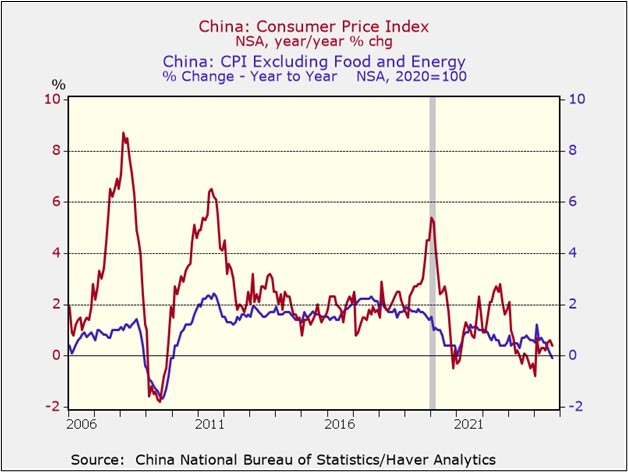

- In the latest piece of evidence showing China’s economic weakness, the September consumer price index was up just 0.4% from the same month one year earlier, decelerating from a 0.6% rise in the year to August. Excluding the volatile food and energy components, China’s “Core CPI” is already in deflation.

Chinese Financial Industry: The Supreme People’s Procuratorate said on Saturday that it has arrested Li Quan, former chief executive of the New China Life Insurance Company for embezzlement and bribery. Along with other recent arrests, the action against Li shows how Beijing has focused on cleaning up the country’s financial industry as part of its program to make China a “financial superpower.” Cleaning up the industry would probably be positive in the long run, but it also presents regulatory risk for Chinese financial firms in the near term.

Russia-Ukraine Conflict: The Russian military has increased its attacks in recent days on Ukraine’s Black Sea granaries, ports, and civilian ships serving them. The attacks appear to be an effort to undermine Ukraine’s ability to export grain and hurt its economy. If Russian forces can cut Ukrainian exports in a meaningful way, the shock to supply could lead to higher grain prices worldwide. So far this morning, however, US corn and wheat futures are trading slightly lower.

Broader Emerging Markets: Although major central banks have finally started cutting interest rates, S&P Global Ratings today issued a report warning that sovereign bond defaults will likely accelerate in the coming decade. The report argues that when today’s cutting cycle ends, interest rates will remain relatively high. Many emerging markets will also be left with higher debt and lower financial reserves, making them more susceptible to default.

France: On Friday, just a day after Prime Minister Barnier proposed an austere 2025 budget aimed at reining in the burgeoning fiscal deficit, Fitch cut France’s bond rating outlook to negative. Although the firm kept France’s overall sovereign rating unchanged at AA-, it warned that the rating could be reduced if the budget plan fails in the severely divided parliament. The move by Fitch follows an outright rating cut by S&P and an outlook cut by Moody’s earlier in the year.

- France’s public debt has now risen to more than 110% of gross domestic product, making it the third-most indebted country in the European Union after Greece and Italy. Clearly, emerging markets aren’t the only ones that can face debt problems!

- The country’s rapidly expanding debt reflects a range of factors, such as increased fuel subsidies, economic stimulus spending, rising interest rates, and tax cuts aimed at making the country more attractive for investment.

United Kingdom: At an investment conference in London today, Prime Minister Starmer promised to develop an industrial strategy, slash regulation, and get control of the country’s fiscal situation to spur economic growth. As Starmer put it to the assembled executives, “You have to grow your business, I have to grow my country . . . We are determined to improve it and repair Britain’s brand as an open, outward looking, confident, trading nation.” Still, corporate confidence may not improve much if Starmer’s government hikes taxes as expected.

Japan: With campaigning for the snap October 31 parliamentary elections due to start Tuesday, Prime Minister Ishiba said he is not contemplating raising or lowering the country’s 10% sales tax “for the time being.” The new prime minister and his cabinet have been criticized for making contradictory statements on economic policy, but Ishiba’s statement appears to be a clear sign that he is looking for stability in tax policy. That will likely be celebrated by investors, although it also suggests Japan will face continued budget deficits and growing debt.

United States-Israel-Iran: As the Israeli government continues planning for a strike against Iran to retaliate for its recent missile attack, the US Defense Department yesterday said it will deploy an advanced missile defense system to Israel, including about 100 troops to operate it. Deploying the Terminal High Altitude Area Defense system, or THAAD, along with its crew, will raise the risk of the US getting directly involved in the conflict, especially if Iranian missiles or drones injure any US troops.

US Politics: Scott Bessent, the former hedge fund manager for liberal philanthropist George Soros, who has become a top economic advisor to former President Trump, said in an interview with the Financial Times that Trump’s threats to weaken the dollar and impose big import tariffs on US allies are just bargaining positions. Bessent insisted that Trump would stand by the traditional US policy of keeping the dollar strong and maintaining its position as the world’s key reserve currency.

- While Bessent cautioned that he does not speak for Trump, he asserted that the former president, at the end of the day, is a “free trader.”

- Despite Bessent’s assertions, Trump has shown that he is highly populist, with a focus on protecting blue-collar workers even if it imposes costs on capital owners and business managers. Bessent’s comments may be aimed at shoring up support for Trump among business executives. Nevertheless, we suspect that if Trump is elected to a new term, he would indeed pursue populist policies, including high, protectionist import tariffs, a weaker dollar, and expansive fiscal spending for the working class.

- On that note, the latest study comparing economic prospects under Trump or Harris is out. In a Wall Street Journal survey of 50 economists, 68% predicted consumer price inflation would be higher under Trump than under Harris, while 12% thought inflation would be higher under Harris. Most of the respondents also expected higher interest rates and budget deficits under Trump, which is consistent with other recent studies.

- Of course, much will depend on what actually gets passed by Congress. In any case, the clear pattern in all these studies is that inflation, interest rates, and budget deficits are expected to be higher no matter who wins the presidency.

Nobel Prize: Finally, this year’s Nobel Prize in economics was awarded today to Turkey’s Daron Acemoglu, the UK’s Simon Johnson, and the US’s James Robinson for their analyses of why some countries are more prosperous than others. In their 2012 book “Why Nations Fail: The Origins of Power, Prosperity, and Poverty,” the authors stress that prosperity relies largely on having good institutions that protect private property, allow free markets to work efficiently, mediate disputes, and promote innovation. Nations fail if they lack such institutions.