Daily Comment (October 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Investors are eagerly awaiting more earnings reports to assess the underlying strength of the financial markets. In sports news, Argentine midfielder Lionel Messi scored a hat trick against Bolivia as he prepares for retirement. Today’s Comment will delve into our takeaways from the latest Trump interview with Bloomberg, our thoughts on how government restrictions can impact earnings for chip-related companies, and an explanation of why the Bank of England’s rate decision will affect the UK pound sterling. As usual, the report includes both domestic and international data releases.

Trump’s Agenda: Republican candidate and former President Donald Trump has conducted another interview outlining his plans if elected.

- In a one-hour interview, Trump championed his economic policies, touting their benefits for small businesses and workers. He stood firm in his belief that he should have a say in monetary policy and asserted that new tariffs would incentivize companies to reshore jobs lost to globalization. Additionally, he argued that his crackdown on illegal immigration would be counterbalanced by an influx of legal, documented workers. While the audience seemed to largely support his views, the interviewer raised concerns about potential negative economic consequences, as highlighted by economists.

- While theoretical criticisms hold weight, their real-world impact is contingent on various factors. For instance, a stronger dollar could mitigate many of the inflationary pressures from tariffs. Moreover, price elasticity, which measures consumer sensitivity to price changes, may compel foreign firms to absorb a portion of the increased costs. Also, although the Fed is independent, policy coordination with the executive branch is not unusual. Finally, while the crackdown on immigration could reduce the labor supply, it should also alleviate pressure on public resources.

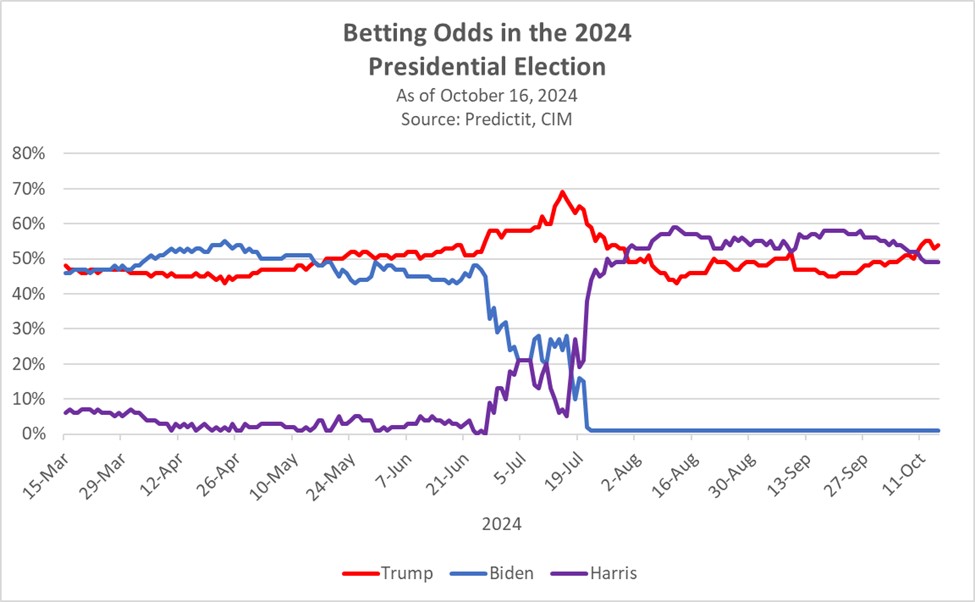

- Betting markets currently favor President Trump to win in November, but polls indicate that the race remains close. Investors should instead focus on broader trends rather than individual candidates. Both Trump and Vice President Harris agree on reshoring manufacturing jobs. But while Trump supports tariffs to limit imports, Harris favors stimulus packages to boost domestic competitiveness. Still, assuming these efforts achieve their long-term objective of raising wages for US workers, we would expect higher inflation and higher interest rates on long-term bonds no matter the victor.

Chip Wars! Chipmakers have been impacted by increasing concerns about weak demand in China.

- ASML Holding, a leading chip equipment maker, had its worst day in 26 years after the company reported a significant decline in orders and lowered its 2025 guidance. While the specific reasons for this miss weren’t explicitly stated, increasing concerns are mounting that global chip restrictions on sales to China are negatively impacting the company’s earnings. Last month, the Netherlands mandated that ASML obtain export licenses to sell older machines and provide repair and maintenance services to China. This further highlights the challenges posed by these restrictions.

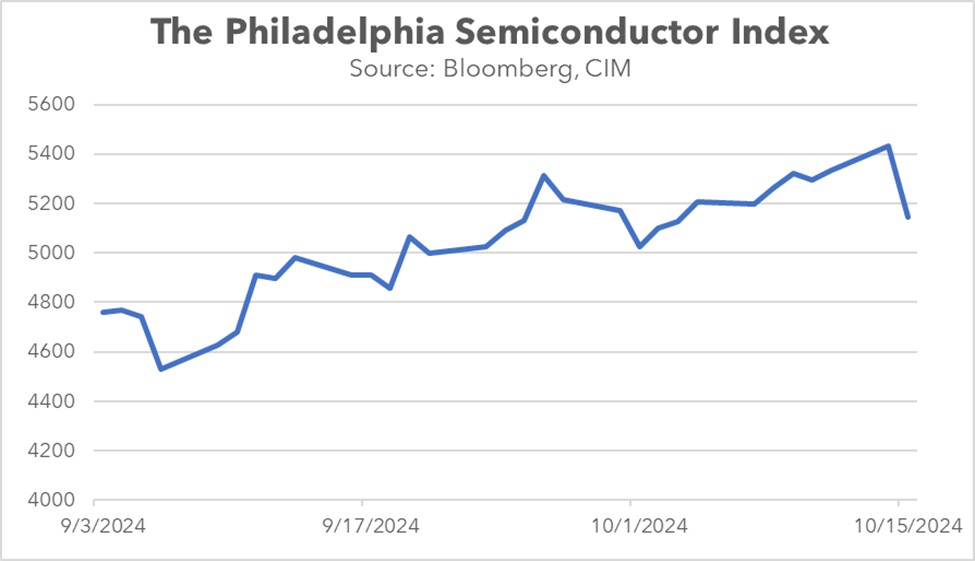

- The uncertainty surrounding ASML has sent shockwaves through the broader semiconductor industry, as other companies grapple with similar headwinds. The Philadelphia Semiconductor Index plummeted by 5.3% on the day, far outpacing the S&P 500’s modest decline of 0.8%. Investors are reevaluating the earnings potential of these firms, driven by growing concerns over their ability to sell to China, a critical market for chips and related products. ASML is particularly exposed to these restrictions, with 47% of its quarterly sales tied to the country.

- Chipmakers and related equipment manufacturers are likely to face headwinds as these regulations will complicate their efforts to expand into foreign markets. While China will be a strong focus, other countries may also be included. The Biden administration is currently considering implementing export controls for Nvidia and AMD chips on a case-by-case basis, targeting specific countries. While many of these firms are expected to adapt to the regulatory environment, their high valuations suggest that there may be better investment opportunities in other sectors.

Dovish BOE: The British currency has hit a near two-month low amid market expectations that the central bank will implement more aggressive monetary easing than previously anticipated.

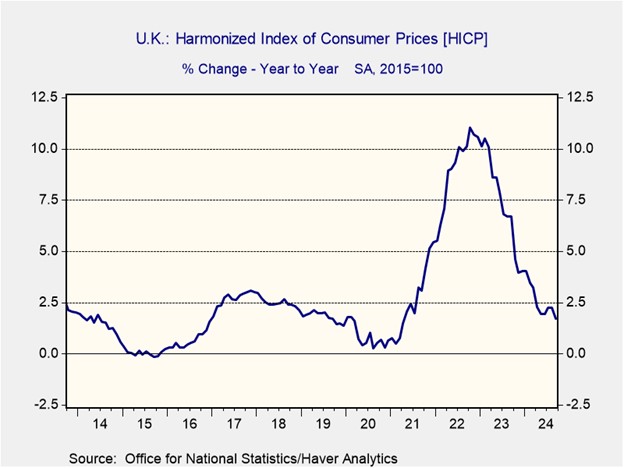

- UK inflation fell below 2% for the first time in 3.5 years. In September, the Consumer Price Index (CPI) rose 1.7% from the previous month, much lower than the prior month’s increase of 2.2% and the consensus forecast of 1.9%. Meanwhile, core inflation moderated from an increase of 3.6% to 3.2%, and services inflation, a particular concern for policymakers, fell from 5.6% to 4.9%. However, not all the news was positive, as the core measure of services inflation (excluding volatile elements like airfares, packaged holidays, and education) indicated that underlying pressures persist.

- A lower-than-expected inflation report has paved the way for the Bank of England to potentially implement its second, and possibly third, interest rate cuts this year. While the central bank previously signaled a cautious approach to rate cuts following its initial cut in August, BOE Governor Andrew Bailey suggested earlier this month that the central bank could become more aggressive if inflation cooled more than anticipated. Nevertheless, the latest inflation reading has likely secured another 25-basis-point cut for November and increased the likelihood of another cut the following month.

- While the inflation report is encouraging, investors should closely monitor exchange rates, as rising import prices could offset some of the progress. The narrowing interest rate differential between the US and UK is likely to put downward pressure on the pound sterling (GBP), as the two central banks pursue divergent monetary policies. The Federal Reserve’s focus on the labor market means that a strong US jobs report in October could further weaken the case for another Fed rate cut. If this were to happen, the GBP could sink further relative to the dollar and push up the price of energy imports.

In Other News: The UK is considering imposing sanctions on Israel over its conduct in Gaza, indicating that other countries are seeking an end to the conflict. Ukrainian President Volodymyr Zelensky has shared his “Victory Plan” with EU officials as he seeks to reassure Western allies that he understands the war cannot continue indefinitely. Financial firms are starting off the earning’s season strong, with Morgan Stanley continuing the streak of Wall Street banks posting better-than-expected revenue.