Daily Comment (October 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently analyzing the latest retail sales data. In sports news, the New York Liberty secured a victory against the Minnesota Lynx in Game 3 of the WNBA Finals, taking a 2-1 lead in the series. Today’s Comment will discuss why small cap stock indexes are gaining attention, explore the strategic shift toward clean energy sources, and provide an overview of North Korea’s increasing assertiveness. As usual, the report will conclude with a roundup of international and domestic news releases.

The Rally Broadens: The market has changed its equity sector preference as it embraces the possibility of a soft landing.

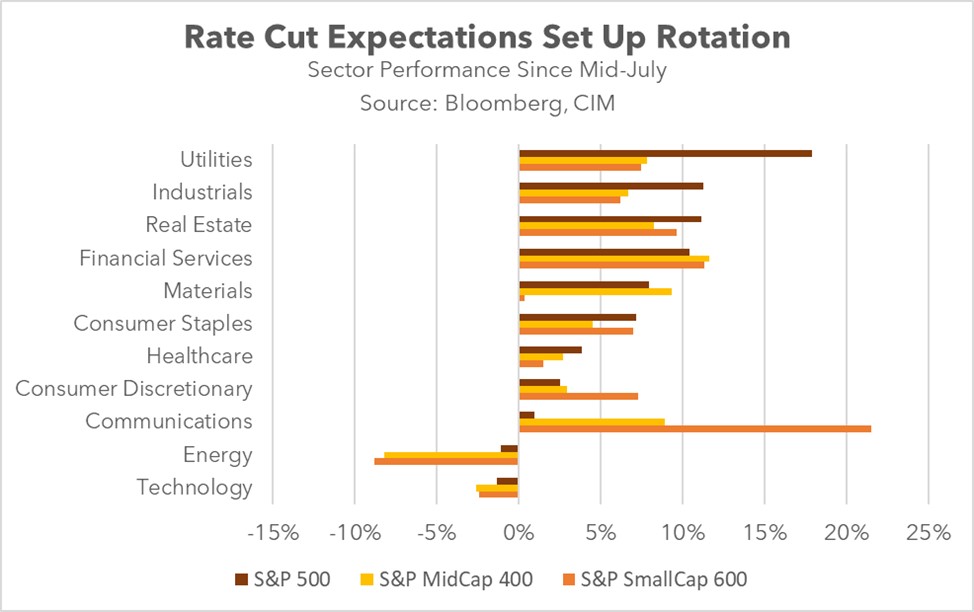

- A broad-based rally over the past four months has pushed small cap indexes, such as the Russell 2000 and S&P SmallCap 600, close to all-time highs. Investors are increasingly willing to take risks, shifting their focus to smaller cap stocks that were often overlooked in the early half of the year. This shift in sentiment started when rising market expectations of a rate cut encouraged investors to move away from the tech sector in mid-July.

- The two best performing sectors over the past four months have been large cap utility companies and small cap communication firms. This shift comes as investors seek to maintain limited exposure to AI-related companies without incurring significant downside risk. Utility companies in the S&P 500 have gained appeal due to AI’s energy demands, their relatively high dividend yields, and their negative correlation with interest rates. Meanwhile, small cap communication companies within the S&P SmallCap 600 index have attracted investors seeking bargains.

- The overall broadening of the market should continue as long as investors remain confident in a soft landing. A continued decline in inflation, which would keep the Fed on track to lower rates, should be supportive of not only the sectors outlined above but also Real Estate and Financials, which had been shunned by investors during the Fed’s hiking cycle. However, any indication of a recession could lead investors to seek shelter in safer assets. At this time, we remain confident that if current conditions persist over the next few months, small cap stocks should perform relatively well.

Battery Superpower? As the US looks to build out its supply chain diversification, it is starting to focus on resources in its own backyard.

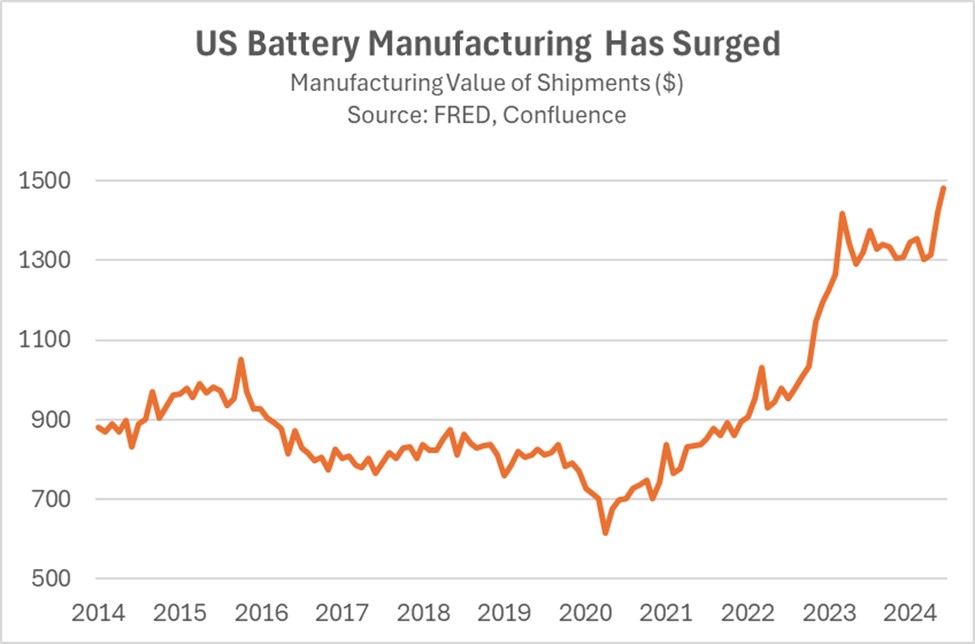

- A Silicon Valley startup, Lyten, has announced that it plans to invest over $1 billion in a lithium battery factory in Reno, Nevada. This area has become known as one of the key regions that will be used to build out the capacity of the US battery manufacturing industry. It is estimated that the state may be sitting on the largest deposit of lithium found anywhere in the world, at around 20 to 40 million metric tons.

- In recent years, the US has been ramping up its battery manufacturing capacity to diversify its energy resources. This effort is evident in the surge in the value of shipments from battery factories. A key component of this strategy involves securing critical mineral resources, which is why it has expanded investment lithium and cobalt production. Earlier this year, the US made its first major investment in Ottawa since WWII in order to gain access to its cobalt, while President Biden is scheduled to visit Angola in December to explore similar investment opportunities.

- While renewable technologies won’t supplant traditional fossil fuels as the primary energy source, their increased utilization will contribute to diversifying the US energy portfolio. This shift is essential as the US seeks to reduce its dependence on energy cartels like OPEC, whose member countries may be hostile to US interests. Consequently, the development of renewable resources will be a cornerstone of America’s energy strategy.

South Korea-North Korea: The two sides are feuding again as North Korea issues new threats to invade its southern neighbor.

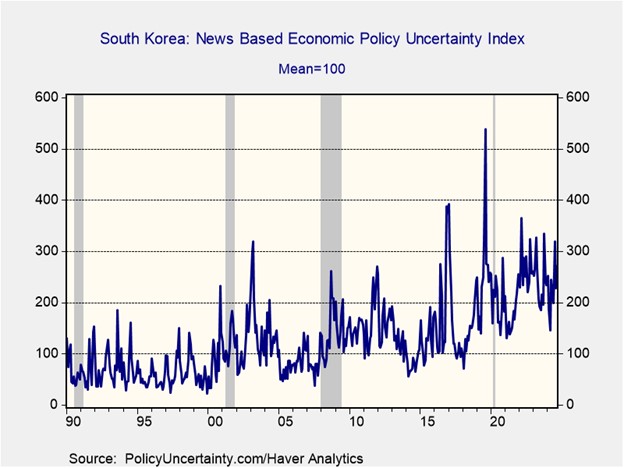

- The new dispute arose after North Korea accused South Korean drones of flying into North Korean territory and dropping propaganda leaflets, which Pyongyang labeled as an act of war. In retaliation, North Korea destroyed parts of an unused bridge and railway connecting the two countries and warned that the escalating tensions had prompted 1.4 million people to sign up for military service. While the possibility of North Korea launching an imminent large-scale attack on its southern neighbor appears to be unlikely, the country does seem to be acting more hostile.

- Since the collapse of the nuclear agreement under the previous US administration, which would have lifted sanctions, North Korea has sought to strengthen its ties with some of America’s rivals, namely Russia and Iran. These relationships have likely contributed to the development of North Korea’s military capabilities, as the three countries have been known to exchange military expertise and weapons. Most recently, reports indicate that North Korea sent troops to assist Russia in its war against Ukraine, suggesting that its military is now gaining firsthand combat experience.

- Rising tensions on the Korean Peninsula have largely gone unnoticed as news coverage has focused primarily on the wars in Ukraine and Gaza. However, there are growing concerns that the possibility of conflict is at its highest level in recent memory. North Korea’s growing ties with hostile actors such as Iran and Russia suggest that the US will need to seek greater coordination with its allies within the Indo-Pacific to deter conflict. While we do not think a war is imminent, the risk is elevated.

In Other News: The Mexican peso (MXN) has dropped significantly as investors continue to factor in the possibility of a Trump victory in November. Chinese President Xi Jinping has urged officials to make every effort to ensure that the country meets its 5% annual growth target. Meanwhile, Meta has laid off employees who misused its $25 meal credit, indicating that the company may be preparing for a smaller workforce. The European Central Bank cut its rate by 25 bps, which is in line with expectations, as inflation continues to move downward.