Daily Comment (October 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

The market is currently processing the recent GDP data from China. In sports news, the Cleveland Guardians stunned the New York Yankees with a 10th-inning home run to win Game 3 of the ALCS. Today’s Comment will discuss why consumer spending has remained resilient, the essential role of drones in modern warfare, and our thoughts on the European Central Bank’s latest rate decision. As usual, our report includes a roundup of domestic and international data releases.

The Strong US Consumer: Despite concerns over rising prices, households are still managing to increase their spending on everyday goods and services.

- Retail sales for September exceeded all expectations, surging from a 0.1% increase in August to a robust 0.4% the following month. Consumer spending has surged, particularly in the Retail Sales Control group, which excludes food services, autos, gasoline, and building materials. This category, which feeds into the GDP numbers, increased from 0.3% to 0.7%, marking the fastest growth in three months. This strong report boosted the Atlanta GDPNow forecast for the third quarter, projecting an annualized rate of 3.6%, a significant increase from the previous quarter’s rise of 3.0%.

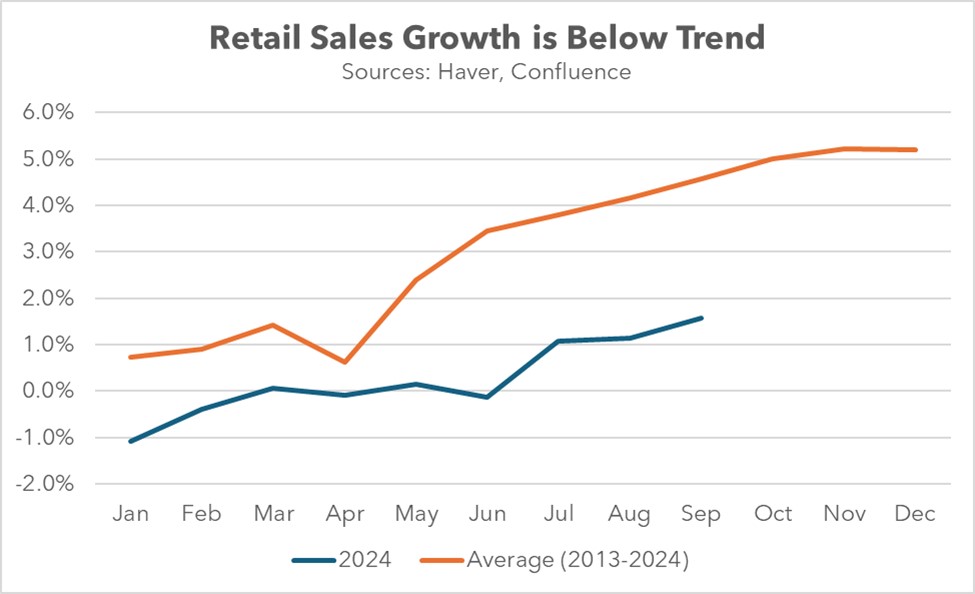

- Despite the positive headline, the underlying data suggests growing consumer frugality. Households have shifted their spending towards everyday essentials while curtailing major purchases. Grocery stores, online retailers, and miscellaneous retailers like florists and pet stores were the biggest contributors to the strong retail sales figures. In contrast, big-ticket items, such as vehicles, have experienced muted sales, and home furnishing sales have declined for two consecutive months. Additionally, sales seem to be rising below their historical pace.

- The resilient labor market has enabled consumers to maintain spending despite rising inflation. As long as employment remains robust, consumer spending will likely continue to support the economy. The recent positive retail sales data reinforces the expectation that the Federal Reserve will either cut interest rates by 25 basis points at its next meeting or pause until economic indicators weaken. However, concerns about a potential resurgence of inflation may provide a floor in 10-year Treasury yields at 4% in the coming weeks.

The Rise of the Drone: The use of drones has become increasingly valuable in modern warfare as countries aim to reduce costs and yet remain effective in taking on larger rivals.

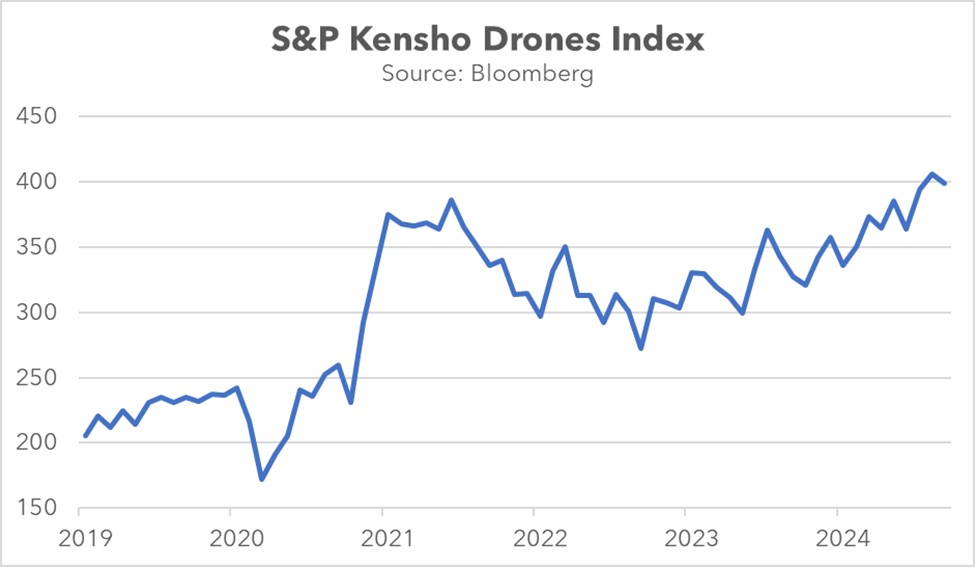

- The wars in Ukraine and Lebanon have demonstrated the crucial role of drones in modern warfare, particularly for smaller militaries. In its conflict with Russia, Ukraine has successfully developed a domestic drone industry that rivals imported models from the United States, bolstering its ability to strike Russian targets. Meanwhile, Hezbollah has employed drones to defend against Israeli attacks. These examples underscore the strategic importance of drone technology in contemporary combat.

- The drone revolution is a threat to global stability that shouldn’t be underestimated. Iran’s cheap, combat-proven drones are captivating developing nations, bolstering defenses, and aiding militaries like those in Ukraine and Sudan. The global production network of drones, spanning South America and Central Asia (including some US parts), raises questions about the effectiveness of sanctions. Meanwhile, Ukraine’s experience exposes limitations in US drone capabilities, prompting them, in some cases, to explore Chinese alternatives for reconnaissance. This highlights how any nation, regardless of size, can exploit niche strengths, reshaping the modern military landscape.

- The changing face of warfare favors smaller, stealthier equipment over traditional, heavy-duty hardware. This shift offers a strategic opportunity for the United States. By capitalizing on its advanced semiconductor industry, the US can not only improve drone performance but also develop counter-drone measures. This technological pivot could potentially reduce military expenditures, addressing budgetary concerns amidst a rising fiscal deficit. Moreover, these investments will likely stimulate growth in tech and defense companies with close ties to the government.

The Dovish Tilt: The European Central Bank (ECB) has reiterated its desire to ease policy as it looks to boost its flagging economy.

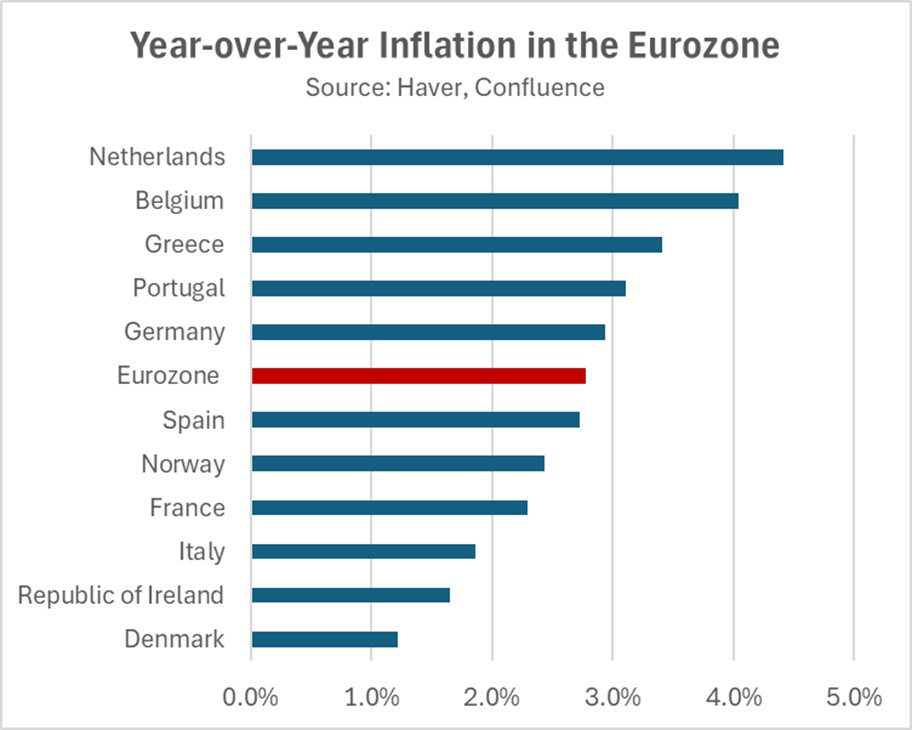

- On Thursday, the ECB lowered its benchmark policy rate by 25 basis points for the third time this year. Following the rate decision, the central bank observed that inflation was moving in the right direction, but it had growing concerns about the economy. This combination gave it the confidence to lower rates further. While there was no indication of future policy actions for December, it is speculated that they may reduce rates at the next meeting if inflation continues to decline and economic conditions deteriorate.

- Despite a general easing of eurozone inflation, several countries continue to face stubbornly high rates. In September, harmonized core inflation for the eurozone rose to 2.8%, significantly lower than the Netherlands and Belgium, where rates remain above 4% year-over-year. Greece’s rate was also notably higher. This discrepancy is primarily due to increased demand for services and the end of energy price control measures. As the price control information is phased out of the data, these countries could experience even more intense inflation in the coming months due to base effect changes.

- The ECB’s aggressive interest rate cuts are focused more on preventing a recession than a display of confidence that it has achieved its price stability objective. That said, while additional monetary easing is expected to continue into 2025, policymakers may slow the pace of cuts as signs of economic growth and rising inflation emerge. In the short to medium term, the ECB’s dovish stance could bolster the US dollar, especially as robust US economic data reinforces the Fed’s cautious approach to future rate cuts.

In Other News: Hamas leader Yahya Sinwar was killed on Thursday by Israel; his death has likely added pressure for an end to the conflict in Gaza. The US has eased restrictions on space technology exports as it looks to expand its foot print in the industry. China’s GDP growth increased 4.6% from the previous year, aligning with market expectations but marking its slowest rate of growth since Q1 2023.