Daily Comment (October 21, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a statement from a European monetary policymaker that suggests the European Central Bank could cut its benchmark short-term interest rates more slowly than investors expect, just as we think the Federal Reserve could cut US rates more slowly than anticipated. We next review several other international and US developments with the potential to affect the financial markets today, including a new competitive threat from Chinese electric vehicle makers and a tentative deal to end the Boeing strike in the US.

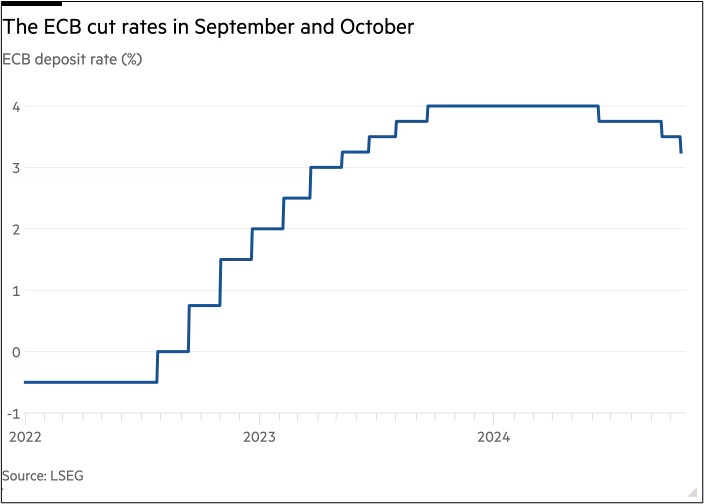

Eurozone: Slovenian central bank governor Boštjan Vasle, who is also on the European Central Bank’s policy committee, has warned that the ECB’s back-to-back interest rate cuts in September and October do not necessarily portend further cuts at each upcoming policy meeting. European swap markets suggest investors expect an aggressive pace of cuts, but Vasle said the policymakers will need to be convinced by the economic data. The statement suggests that the ECB will cut rates only slowly from here, just as the Fed might do with US rates.

France: Economy Minister Armond yesterday said state-investment bank Bpifrance will take a stake of about 1% in Sanofi’s consumer health business as part of its sale to a US private-equity firm. That will give the French government a seat on the health company’s board and ensure it has influence over the unit’s production, investment strategy, and employment policies. The move shows how the French government continues to prioritize maintaining control over what it considers strategic industries.

Moldova: In presidential elections yesterday, incumbent Maia Sandu came in first but failed to win an outright majority. She will therefore compete in a run-off on November 3, facing main rival Alexandr Stoianoglo, whose candidacy was backed by the pro-Russia Socialist party. Also in the elections, voters only barely approved a referendum supporting future accession to the European Union. The disappointing results for Sandu followed weeks of reports that Russian operatives were working to throw the elections into the Kremlin’s favor.

China: In a sign that China has expanded its lead in electric-vehicle technology, almost all major Chinese EV makers have now developed or are starting to develop extended-range EVs. The new Chinese EREVs can go more than 600 miles on a single charge and cost about 10% less than regular EVs. They not only accommodate a power cable to recharge the battery, but they also have a small internal-combustion engine to generate electricity for the battery when needed.

- The new Chinese EREVs may be an additional competitive threat to traditional and electric vehicle manufacturers around the world.

- Therefore, they are likely to further spur protectionist measures against Chinese EVs in the US and the rest of its geopolitical and economic bloc.

China-India: Ahead of the big BRICS summit opening tomorrow, China and India have reportedly reached a deal on military patrols along their disputed border in the Himalayan mountains. After deadly clashes along the “actual line of control” in 2020, tensions have been high in the area, raising the risk of a broader, more dangerous conflict between the countries. Although we haven’t yet seen any details on the deal, a solid agreement that cools tensions over the long term would therefore be a positive for global stability.

- We suspect the new deal was at least partly aimed at getting the BRICS summit off on the right foot. We also suspect Beijing might have made concessions to New Delhi to slow its growing ties to Washington, Tokyo, and Canberra.

- Separately, we note that the BRICS summit is due to discuss further de-dollarization efforts. So far today, the risk that the BRICS countries will further reduce their use of the greenback is giving a boost to gold prices. Near gold futures today have reached a new record high and are currently trading at about $2,752.40 per ounce.

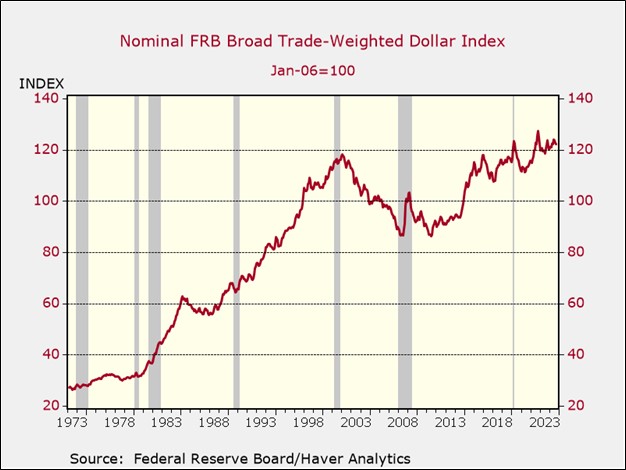

- As a reminder, our Bi-Weekly Geopolitical Report from September 9 discussed prospects for the dollar as the world fractures into relatively separate geopolitical and economic blocs. The report shows how the dollar has kept appreciating against most other fiat currencies even as some countries have tried to reduce their use of it, in large part because of continued strong capital flows into the US.

United States-Russia: More than 50 members of the US Congress from both parties have written a letter to the Biden administration to protest SLB’s continued work in support of Russia’s oil industry. The letter to Secretary of State Blinken and Treasury Secretary Yellen demands the administration tighten its sanction rules so that US firms aren’t helping Russia earn oil revenues, which in turn can be used to finance its war against Ukraine.

- The move suggests SLB and other Western firms still operating in Russia could soon be forced to retreat from the market.

- Exemptions for oil service firms like SLB were initially put in place to avoid a collapse in Russian oil output. If Western oil service firms are forced to pull out of the country, there is some risk that Russian oil output could fall, pushing up global energy prices.

United States-Israel-Iran: Two classified US intelligence reports on Israeli preparations for a military strike against Iran have reportedly been leaked and posted on pro-Iranian internet platforms. Based on press reports, the two reports appear to be relatively raw, first-cut analyses of spy-satellite imagery collected by the National Geospatial-Intelligence Agency last week.

- The intelligence summaries do not appear to be comprehensive, well-vetted discussions of Israel’s attack plans. However, since they raise concerns about Israel’s operational security, they could potentially prompt Israel to delay its attack.

- Some commentators will likely decry the reports as new evidence that the US spies on its allies, but we don’t see that as a major story. More importantly, the reports may have been deliberately released by a lower-level employee in the US government or military who is disgruntled or seeking to undermine Israel. In that case, further embarrassing or damaging reports could be released in the coming days.

US Military: The Defense Department is reportedly developing a new program in which chief technology officers and other senior tech professionals in the private sector could take positions in the reserves. The initiative would be similar to existing programs in which medical and legal professionals serve as part-time military officers. The tech reserve officers would help the armed services with short-term projects in cybersecurity, data analytics, and other areas, illustrating how the modern military is built around information processing and other advanced technologies.

US Labor Market: Over the weekend, Boeing and the International Association of Machinists and Aerospace Workers reached a tentative deal for a new contract, potentially ending the union’s month-long strike against the company. Under the deal, workers represented by the union would receive a 35% pay hike spread over four years, an up-front bonus of $7,000, and increased company contributions to their retirement accounts.

- The workers are due to vote on the deal this Wednesday. If they vote to approve, Boeing could start producing its key airframes over the coming weeks and begin to stem the big financial losses it has incurred because of the strike.

- Settlement of the strike could also remove one important risk to US economic growth. Not only has Boeing shut down much of its production and announced layoffs, but key suppliers have started to do the same. If the new contract is approved, it could prevent any further production stoppages and layoffs in the key aerospace sector.

US Oil Services Industry: As it released a disappointing report on third-quarter revenue and profit growth last Friday, oilfield services giant SLB warned that energy firms are becoming more cautious about spending both in the US and abroad. According to CEO Olivier Le Peuch, the spending restraint reflects low global oil prices, which he in turn attributed to weak economic growth in China and elsewhere, surging rising oil production outside the Organization of the Petroleum Exporting Countries, and uncertainty about OPEC+ supply releases.