Daily Comment (October 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a preview of the big BRICS summit of emerging-market nations such as China, Russia, and Iran. Since the group includes key countries in China’s geopolitical bloc, we’ll be looking to see how much General Secretary Xi dominates the meeting, despite it being hosted by Russian President Putin. We next review several other international and US developments that could affect the financial markets today, including an important new IPO on the Indian stock market and a court ruling that favors the US oil and gas industry.

BRICS Summit: A summit of the BRICS emerging-market countries kicks off today in Russia. While the group is led by Brazil, Russia, India, China, and South Africa (accounting for its acronym), this will be the first summit since the group was expanded to include Saudi Arabia, Iran, the United Arab Emirates, Egypt, and Ethiopia. Importantly, leading countries in the group say the summit will discuss further steps to reduce use of the US dollar in international trade and develop a BRICS currency and non-dollar international payments system.

- The discussions on moving further away from the dollar and Western systems will likely play into investor concerns about the greenback’s value going forward. That could weigh on the dollar and boost gold prices in the coming days.

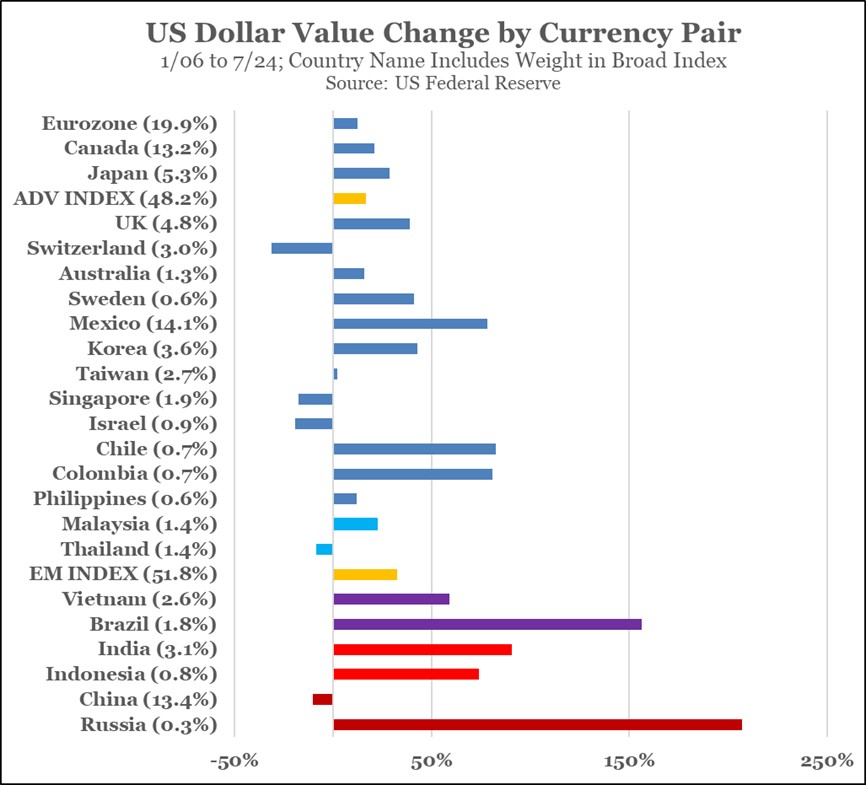

- Nevertheless, as we noted in our Comment yesterday, the effort by some countries to cut their use of the dollar hasn’t stopped it from appreciating against most other major currencies for the last decade and a half. The chart below shows how the greenback’s value has changed against each currency in the Federal Reserve’s broad dollar index since roughly the beginning of its long bull market.

China: According to market data provider Wind, share buybacks by companies listed on China’s domestic stock exchanges have reached the equivalent of $33 billion for the year to date, almost double the record amount in all of 2022. The buybacks have been driven by a special lending facility that was part of last month’s economic stimulus program. If the strong buybacks continue, they could help buoy the market even as investors begin to question the efficacy of the overall stimulus program.

India: South Korean auto maker Hyundai Motors today raised the equivalent of $3.3 billion by listing 18% of its local unit on India’s main stock exchanges. Even though the share price fell modestly by day’s end, the rich IPO valuation for the unit is expected to entice other global companies to consider listing their Indian units as well. That prospect underscores India’s attractiveness as one of the world’s few large, fast-growing economies.

European Union: For the first time since Russia invaded Ukraine in 2022, leading to shortages of natural gas in the EU, we’ve noticed that media concerns about gas storage have fallen off sharply. Nevertheless, we think it’s important to note that EU gas storage is now more than 95% full, above the five-year average of around 92% for this time of year. That has kept a lid on EU gas prices and should help limit the damage if geopolitical events disrupt international supplies this winter.

United Kingdom: Bank of England Chief Economist Huw Pill has reportedly sent a private letter to the Office of National Statistics complaining that the agency still hasn’t fixed its problem with unreliable estimates regarding employment and other aspects of the labor market. The episode shows how statistics agencies, including in the US, have struggled with falling survey response rates, which have led to big data revisions and called into question the accuracy of economic data. (Of course, the same dynamic has rendered political polls less reliable.)

US Economic Policy: With exactly two weeks to go before the presidential election, we still consider the contest too close to call. Nevertheless, we’re intrigued by an article in today’s Financial Times that looks at the possible economic policies of Vice President Harris if she were to win. The article is useful because, as we noted in our recent Bi-Weekly Geopolitical Report comparing US foreign policy under Trump versus Harris, the vice president’s policy views are hard to read, based on her relatively low profile in the Biden administration and her own campaign strategy.

- The article claims Harris’s most likely picks for Treasury Secretary would be current Deputy Treasury Secretary Wally Adeyemo, current Commerce Secretary Gina Raimondo, or current White House Chief of Staff Jeff Zients.

- The article says Harris might also consider Federal Reserve board member Lael Brainard as Treasury secretary, but she may prefer to have her replace Jerome Powell as Fed chair when his term expires in 2026.

- The article also notes that Harris has much closer ties to top business leaders than President Biden does. The article therefore suggests Harris would listen more closely to business concerns about the economy and move away from some of Biden’s more progressive policies.

US Oil Industry: A federal judge yesterday ruled that a regulation friendly to the offshore oil industry should remain in place until next May, rather than expiring as scheduled in December. The regulation exempts the industry from a rule protecting a nearly extinct whale species, and industry lobbyists had argued that if the exemption expires, all US oil rigs in the Gulf of Mexico would have to shut down. Environmentalists have argued that the industry position amounts to fear mongering.

US Spirits Industry: According to industry data provider IWSR, the volume of alcoholic spirits sold in the US from January through July was down 3.0% from the same period one year earlier, accelerating from a 2.9% decline in full-year 2023 and a flat performance in 2022. For comparison, US spirits consumption had increased at an average annual rate of 2.6% per year in the two decades to 2019, and the growth rate nearly doubled in the pandemic years of 2020 and 2021. What’s unclear is whether the recent declines are structural or merely cyclical.