Daily Comment (October 23, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is eagerly awaiting the latest wave of earnings reports. In sports news, Real Madrid staged a remarkable comeback and defeated Borussia Dortmund 5-2 with five unanswered second-half goals. Today’s Comment will explore the market’s anticipation of a Republican sweep in the upcoming election, analyze the economic indicators suggesting a more dovish ECB compared to the Federal Reserve, and delve into the ongoing reluctance of Western companies to sever ties with China despite escalating tensions. As always, the report will include a summary of key domestic and international economic data releases.

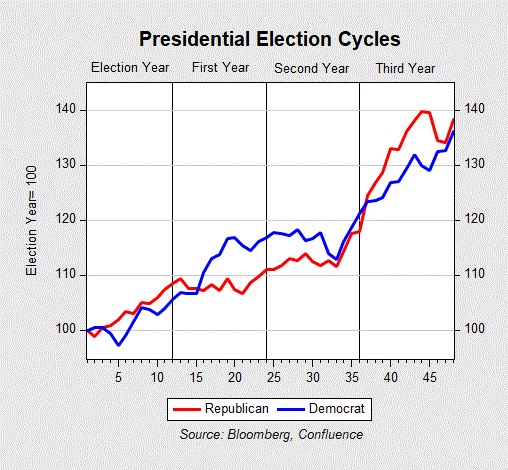

Red Wave is Coming? Election jitters are starting to make their way into the market as investors grow bullish about a potential Republican sweep in November.

- Though the election remains a toss-up, markets seem to be preparing for a potential Republican victory. The 10-year Treasury yield has been the most noticeably hit by concerns over higher inflation expectations driven by tariffs and rising deficits, triggering some selloffs. Meanwhile, the Mexican peso (MXN) has plunged amid fears that a new government could strain relations over trade, border security, and recent judicial reforms. The movement is likely a reflection of investors not wanting to hold on to certain assets until there is certainty regarding the outcome.

- The greatest uncertainty stems from how a Republican-controlled government will act on campaign promises. President Trump’s tax proposals, including eliminating taxes on tips, lowering corporate taxes, and offering exemptions for military personnel, police, and firefighters, are expected to significantly increase the national deficit. There is also uncertainty surrounding tariffs, which have ranged from 10% on all imports to as high as 2000% on specific Chinese goods. Moreover, doubts persist about the seriousness of some of these proposals as there are concerns about their feasibility.

- The outcome of the congressional and presidential elections will likely depend on a few key votes, so investors should be cautious about assuming a clear winner and avoid being surprised by an unexpected result. The red wave optimism of 2022 serves as a reminder that polls can be unreliable. While we can anticipate some market volatility around election day, it is unlikely to significantly impact the long-term trends of Treasury yields or equity performance. Regardless of the outcome in November, the winning party is likely to scale back on campaign promises quickly.

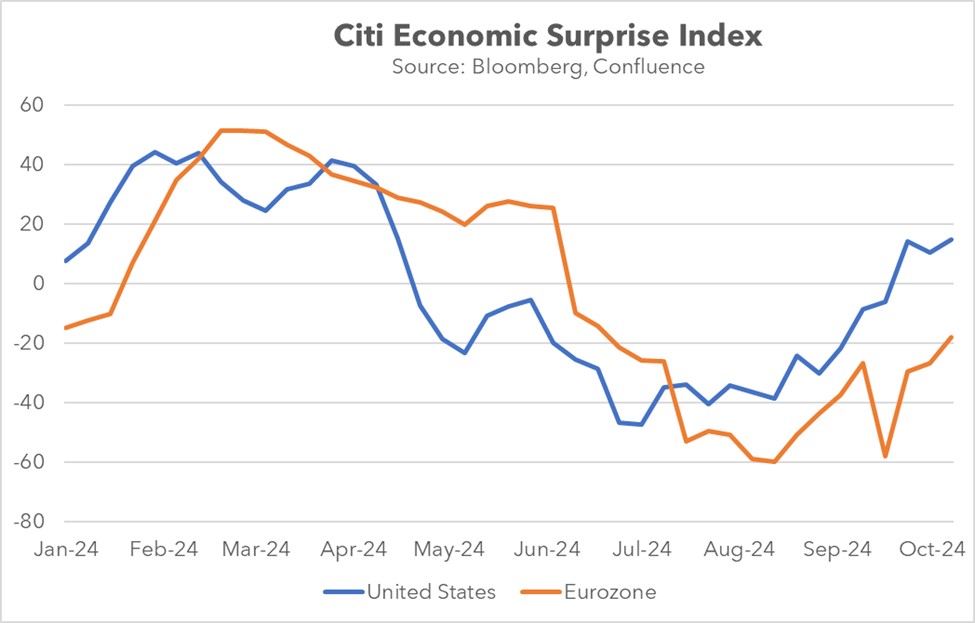

Leading the Pack: While the eurozone’s growth remains uncertain, the US economy is beginning to gain traction.

- The United States was the only developed country to have its economic growth outlook upgraded by the International Monetary Fund for the next two years. According to the supranational agency, the US is expected to maintain its position as the driving force of global growth, fueled by consumer spending this year and next. In contrast, the eurozone’s growth outlook has been downgraded for the coming two years, weighed down primarily by a slowing in manufacturing, tightening of fiscal policy, and cooling of the labor market.

- Recent data suggests the ECB and Fed will ease at different rates. The US Citigroup Economic Surprise Index entered positive territory earlier this month, as economic data has consistently exceeded expectations. In contrast, the eurozone’s economic surprise data, while improving, remains negative. The more robust US performance has led Fed officials to advocate for a more gradual approach to rate cuts. Meanwhile, the continued weakness in the eurozone has prompted ECB officials to push for aggressive easing to prevent the region from slipping into recession.

- Despite differing outlooks, the IMF maintains that global inflation has largely been defeated. This suggests that central banks should continue their easing cycles in the coming months. We anticipate that the Fed will likely cut rates by at least 25 basis points before the year’s end, assuming there are no inflationary setbacks. Meanwhile, the European Central Bank could reduce rates by 50 basis points at its next meeting. The ECB’s relatively dovish stance and economic weakness should lead the euro (EUR) to depreciate against the dollar.

Middle Ground on China: Firms appear to be unwilling to readily give up ties with China even as the West continues to reduce ties with the second largest economy.

- Apple CEO Tim Cook has reaffirmed the company’s commitment to investing in China, highlighting the country’s crucial role in its supply chain. This statement follows a recent meeting with a top Chinese technology official to discuss strengthening bilateral ties as the Chinese economy has struggled to regain its footing following the pandemic. In the meeting, the Chinese officials pushed Cook to agree to invest in some of its key industries, such as cloud services and the secure management of data.

- Despite Beijing’s reassurances of its commitment to prevent a prolonged economic slowdown, foreign direct investment in China has declined. Investors remain concerned about the potential for deflation and increased Western scrutiny of Chinese exports. In recent years, China’s trade relationship with the United States has faced challenges as officials have raised import tariffs and tightened export restrictions on companies. As a result, trade activity between the US and China remains well below its long-term trend.

- Economic decoupling between the United States and China is likely to occur, despite potential resistance from some companies. While the transition may be slower than anticipated, the overall trend remains clear as both sides don’t trust one another. US companies with significant revenue or supply chain exposure to China are particularly vulnerable to the disruptions associated with this shift. Investors should consider adjusting their portfolios accordingly to mitigate these risks.

In Other News: The latest AI processors for Huawei Technologies were developed by TSMC, indicating that the company is circumventing some of the export restrictions imposed by the US. Additionally, US officials have confirmed that they believe Russia has used North Korean troops in its conflict with Ukraine. This decision exemplifies the growing threat posed by this new axis of evil. Lastly, Israel has confirmed the killing of a potential successor to Hezbollah, signaling that it is closer to achieving its objectives in Lebanon.