Daily Comment (October 24, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently processing new earnings data. In sports news, Barcelona convincingly defeated Bayern Munich in the Champions League this week. Today’s Comment will begin with our analysis of the latest Federal Reserve Beige Book. We will then share our thoughts on the housing market and provide an overview of why Brazil finds itself caught in the middle of the conflict between the US and China. As always, the report will conclude with a roundup of economic and domestic data releases.

Fed’s Beige Book: The latest survey of business contacts in the Fed’s twelve districts indicates that economic growth has begun to slow.

- The latest Fed Beige Book supports the central bank’s recent decision to pivot, as contacts indicate a slowing economy. Nearly all Fed districts reported no change in economic activity since the previous September survey. Weakness was most evident in the manufacturing sector, with agriculture also showing signs of decline. In relation to the Fed’s dual mandate, over half of the firms reported slight to moderate hiring growth, while most noted a moderation in selling prices. That said, despite the dim outlook from business contacts, Fed officials remain positive.

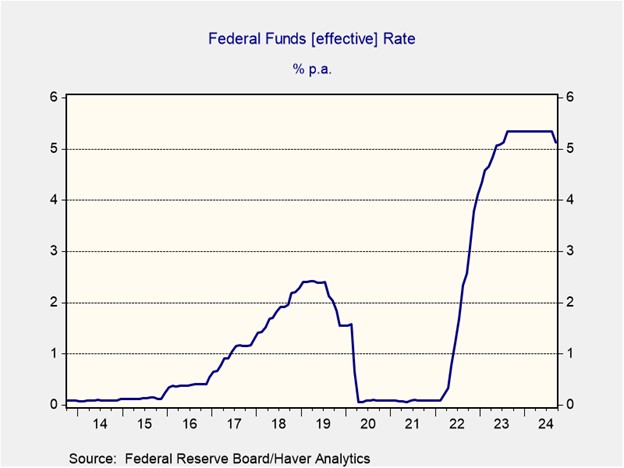

- On Monday, Federal Reserve officials expressed optimism about the economy’s resilience, suggesting a cautious approach to interest rate cuts. While some favored a gradual reduction, others indicated that rate cuts could continue even in a strong economy. The latest dot plot reflects this divergence, showing a median expectation of 50 basis points in cuts for the rest of the year, but with nearly half of the committee favoring a more modest 25 basis point reduction. This varying degree of policy accommodation is likely to complicate the Fed’s efforts to coordinate monetary policy.

- While the Fed Beige Book may have emboldened dovish committee members, we believe the timing of the next rate cut hinges on the labor market’s strength and the level of inflation. The upcoming jobs report is projected to show 135,000 jobs added in October, with the unemployment rate remaining at 4.1%. Stronger-than-expected job growth or a falling unemployment rate could lead officials to skip a rate cut at their November meeting. Moreover, a 0.4% month-over-month increase in the core PCE price index, may necessitate a reassessment of the easing cycle altogether.

Residential Market: It has been over a month since the Fed cut rates, and the housing market has not rebounded.

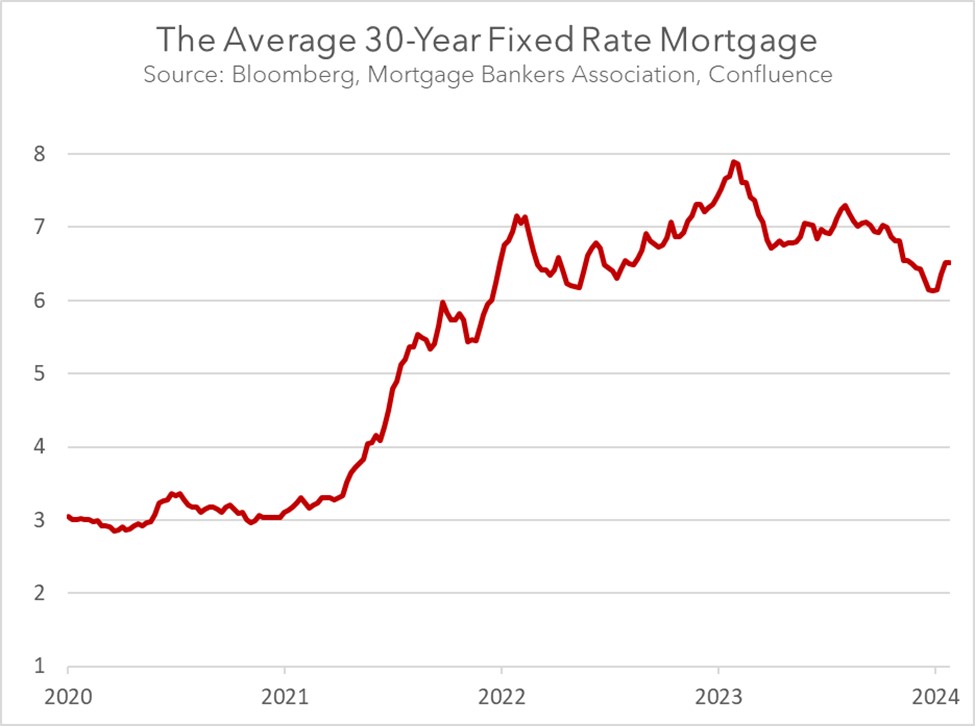

- US sales of existing homes dropped to a 14-year low in September, with a 1.0% decline bringing sales to a seasonally adjusted annual rate of 3.84 million units. The subdued demand is likely tied to elevated home prices, despite borrowing costs reaching their lowest level in two years. The average home price is now roughly 6.3 times the average income, up from five times a decade ago. While lower borrowing costs have made homes more attractive, the main beneficiaries have been existing homeowners refinancing their mortgages to lower rates.

- Many potential homebuyers remain on the sidelines, waiting for mortgage rates to drop further and offset high home prices. This stems from the belief that rates will decline, mirroring their sharp rise during the Federal Reserve’s tightening cycle. In the first year of rate hikes, mortgage rates jumped from 3.5% to a peak of 7.2%, driven largely by uncertainty over how aggressively the Fed would raise rates. For rates to fall significantly, the Fed must clearly indicate how far it plans to cut interest rates. This is why rates have stopped their descent following the Fed’s first rate cut.

- The uncertainty surrounding the neutral interest rate (estimated to be between 2.25% and 4.00% according to the latest economic projections), complicates the outlook for mortgage rates. Inflation expectations, particularly the concerns about whether inflation will sustainably fall below 2%, play a significant role in determining the long-run path of Fed policy. As a result, mortgage rates are unlikely to decline significantly in the coming months, even if the central bank begins to cut rates. This could weigh on consumer sentiment and residential investment, hindering economic growth.

Brazil-China: Latin America’s largest economy appears to be under pressure to take sides in the US-China rift.

- On Wednesday, a US official urged Brazil to reconsider its plans to join China’s Belt and Road Initiative (BRI), cautioning that the agreement might not serve Brazil’s best interests as it could lead to a loss of sovereignty. This warning came in response to Brazil’s statements about potentially joining the initiative to counter protectionist measures from the US and the European Union. China remains one of Brazil’s top trading partners, while the US is one of the biggest contributors of foreign direct investment.

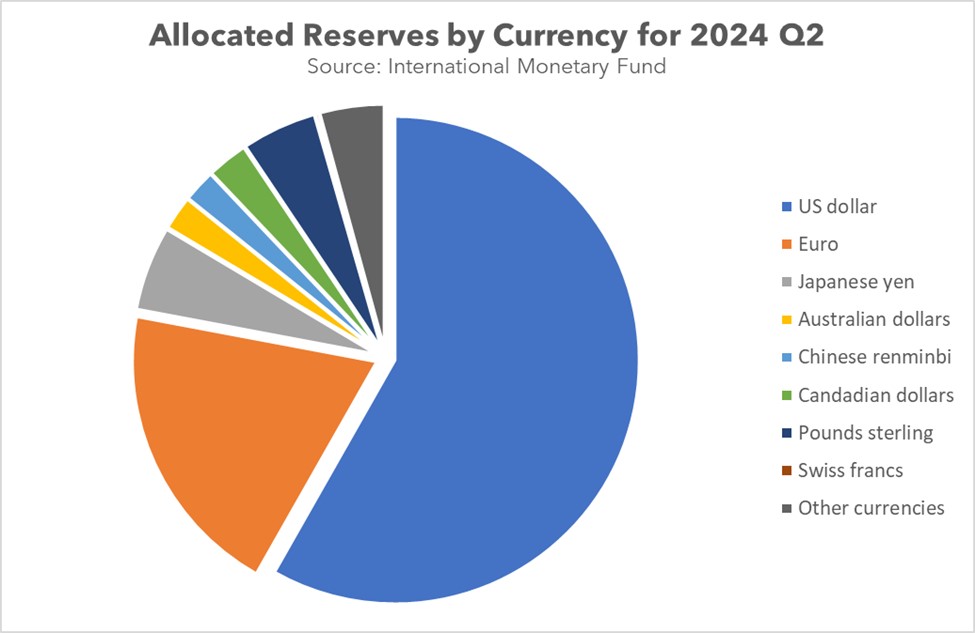

- The escalating dispute underscores growing concerns about the diminishing interconnectedness of the global economy. The West’s deliberate effort to reduce its role as the importer of last resort has prompted countries in the Global South to seek alternatives. Many are diversifying their currency reserves, including gold, and some are exploring regional currencies tied to their key commodities. This trend suggests that these countries are increasingly looking to offset the loss of trade with the West by trading with one another.

- As countries like Brazil navigate a less globalized world, we believe they will increasingly move away from using the US dollar. This shift is driven not only by the recent weaponization of the dollar but also by the desire to strengthen ties with other nations. In particular, countries aligned with China are likely to explore alternative currencies for trade as they reduce their reliance on the US. Although we don’t expect the dollar to lose its dominance, its influence may diminish over the next decade.

In Other News: The Bank of Canada cut its benchmark rate by 50 basis points, reflecting the global shift towards disinflation as it aims to normalize policy and shield Canada’s economy from further decline. Boeing workers voted against the latest wage agreement, likely setting the stage for an extended strike. Additionally, Tesla’s earnings report exceeded expectations, indicating that the worst may be over for the company.