Daily Comment (October 25, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is eagerly awaiting the latest University of Michigan survey data to assess consumer sentiment ahead of the election. In sports news, the New York Yankees are set to take on the Los Angeles Dodgers in the first game of the World Series. Today’s Comment will explore what the strong October Purchasing Managers’ Index (PMI) indicates about corporate earnings. Next, we will provide an update on US chip production, followed by a discussion of Canada’s new immigration policy. As usual, our report will conclude with a roundup of international and domestic data releases.

US Shows Resilience: The latest S&P Global survey suggests that the economy is off to a robust start this quarter, indicating the potential for stable earnings growth.

- The October flash index showed an increase in business activity, with the composite PMI rising from 54.0 to 54.3. The services sector remained a key driver of the economy, while manufacturing continued to lag. Notably, firms raised prices for goods and services at the slowest pace in nearly 4.5 years. However, the employment component pointed to a slowdown in hiring for the third consecutive month. Despite weakness in exports, firms saw a sharp increase in new business, driven largely by strong domestic demand.

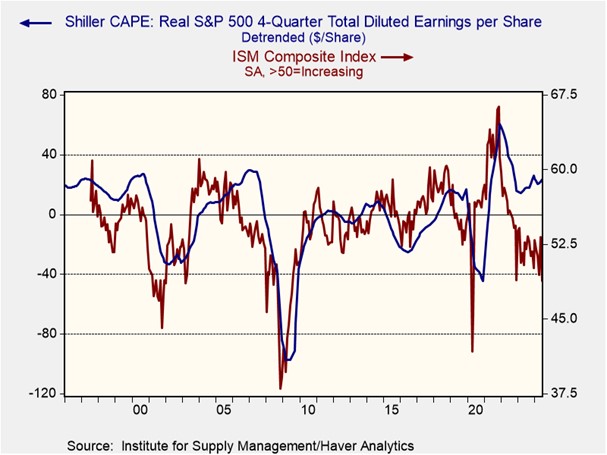

- The strong PMI data is a positive indicator for S&P earnings. As the accompanying chart demonstrates, a correlation exists between rising PMI values and improving corporate profitability. This relationship is likely due to the survey’s comprehensive tracking of key business metrics, including new orders, input and output prices, inventory levels, and overall business activity, which provides a valuable snapshot of the operational health of firms. As a result, the PMI has often been a good indicator when tracking the momentum of future corporate earnings.

- While the sideways movement in the index suggests that the economy is solidly in expansion, it also signals that significant earnings growth is unlikely in the near term. Nonetheless, this environment favors high-quality stocks with strong profitability and low debt levels, as they are better positioned to deliver sustainable dividends to investors. However, as confidence in a soft landing strengthens and the Fed begins to lower interest rates, we anticipate investors becoming more willing to take on risk.

US Chip Power: Taiwan Semiconductor Manufacturing Co (TSMC) has achieved a significant milestone at its US-based facility, bringing the United States one step closer to domestic chip manufacturing capabilities.

- TSMC’s Arizona plant has surpassed expectations, achieving production yields 4% higher than comparable facilities in Taiwan. This achievement, accomplished despite overcoming challenges such as labor disputes and construction delays, is a promising sign for US semiconductor independence. As the primary chip provider for Nvidia and Apple, TSMC’s increased domestic production capacity strengthens the company’s case for further government support under the CHIPS and Science Act. The company is expected to receive $6.6 billion in grants under this legislation.

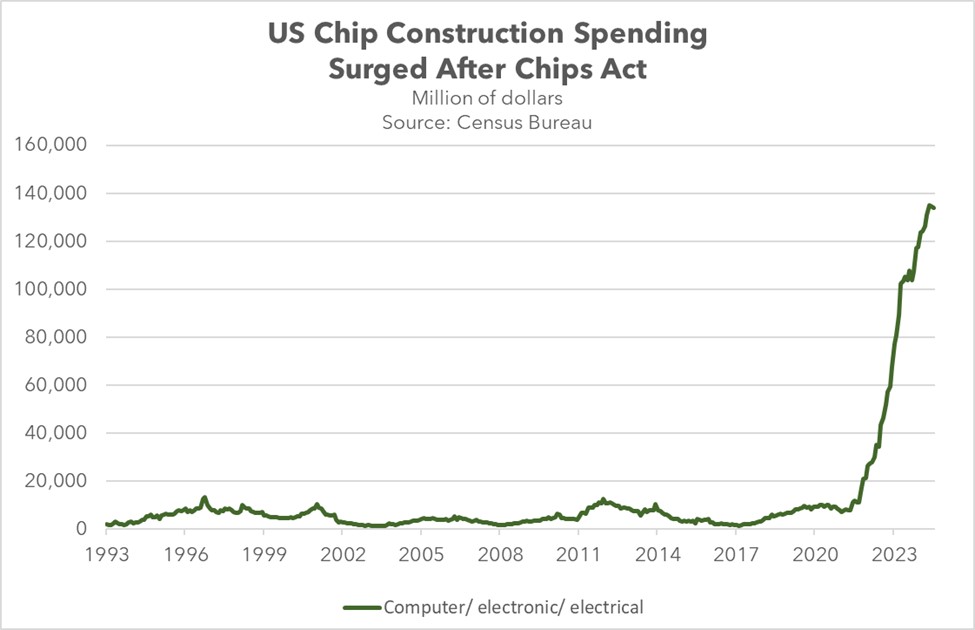

- The expansion of semiconductor manufacturing hubs is at its most robust level in nearly half a century. Investments in facilities dedicated to computer, electronics, and electrical manufacturing now account for nearly 60% of total US construction spending, a significant increase from the approximately 8% share observed a decade ago. The new facilities are expected to triple the US’s chipmaking capacity by 2032, elevating its market share from 10% to 14% of global chip production. As a result, the US is better suited to be able to meet its growing demand for chips as it looks to dominate the AI space.

- The development of domestic semiconductor fabrication plants is likely to continue for national security reasons, but their long-term viability may be a concern if firms cannot significantly reduce costs. It has been widely speculated that firms may rely heavily on automation in these new facilities to maintain profitability. However, this could lead to pushback from lawmakers who want firms receiving funding to increase hiring for manufacturing workers. While we do not currently see this as a significant issue, it could become a potential problem in the future.

Canada Immigration Crackdown: Although the increase in foreign workers has bolstered the country’s economy, concerns over the rising costs of living have prompted a reassessment of immigration policy.

- On Thursday, the country released its Immigration Levels Plan, which aims to reduce the number of permanent residents by 20% by 2025. The new restrictions will cap the number of immigrants, leading to a contraction in the overall population over the next two years. Moderate growth is expected to resume in the third year. This policy change comes amid a growing backlash against the country’s immigration policies, which have allowed over 2.35 million people to immigrate since mid-2022, roughly the population of Houston.

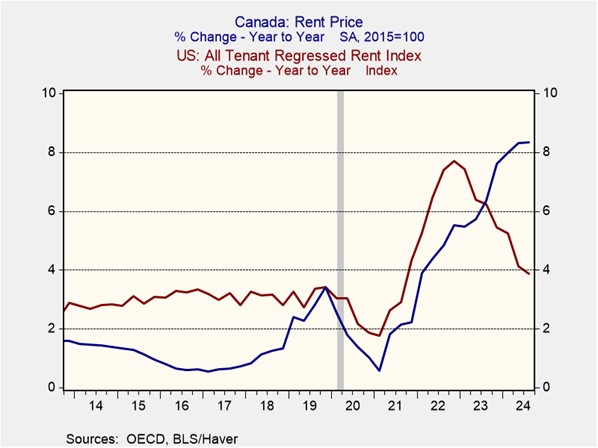

- The surge in immigration has contributed to economic overheating, with rental inflation being a particular concern. Despite moderation in other areas and a decline in overall inflation, rental inflation has continued to accelerate, rising over 8% in Q3 2024 from the previous year. However, immigration has also helped boost Canada’s economic growth to match that of the US, at just over 2% per year over the past decade. As a result, there is an expectation that the restrictions could also slow the overall economy.

- The economic impact of immigration restrictions will depend largely on their effect on labor productivity. A significant increase in the labor supply can sometimes lead firms to become less inclined to adopt new technologies and improve their processes, which could potentially offset some of the production gaps caused by labor shortages. However, we believe that Canadian financial assets may benefit from the potential boost to consumer sentiment and spending resulting from these restrictions. Therefore, we maintain a cautiously optimistic outlook for the country.

In Other News: Cleveland Fed President Beth Hammack has reiterated that the central bank has more work to do before declaring victory over inflation, further indicating that many Fed officials favor a gradual approach to interest rate cuts. Meanwhile, new home sales increased in September as prospective buyers took advantage of the drop in mortgage rates. Russian President Vladimir Putin’s ambiguous explanation for the presence of North Korean troops in Russia suggests that he may be using the additional manpower to demonstrate his willingness to escalate the conflict in Ukraine.