Daily Comment (October 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently awaiting the latest earnings reports from several mega-cap tech companies. In sports news, Rodri from Manchester City has been awarded the Ballon d’Or for the 2023/2024 season. Today’s Comment will address rising concerns about financing the US deficit, explore the efforts to increase restrictions on US investments in China, and provide an update on Russia’s use of North Korean troops in its war against Ukraine. As usual, our report will include a roundup of both international and domestic data releases.

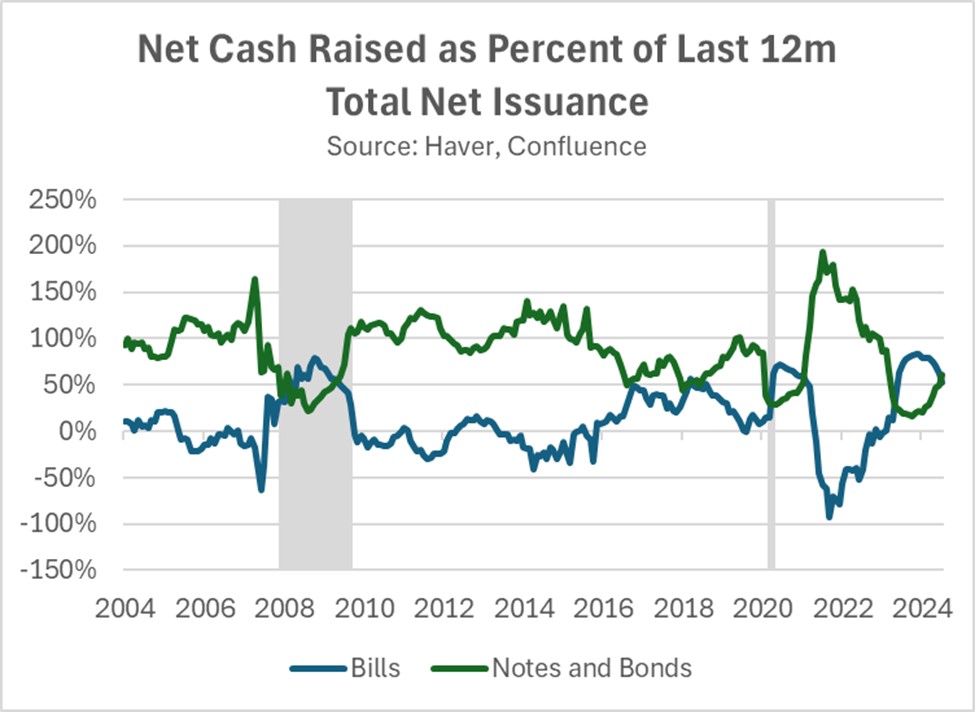

Treasury Supply Unease: US bond yields have increased due to a disappointing Treasury auction and concerns about financing the federal deficit.

- The US Treasury Department forecasts borrowing $546 billion in the final quarter of the year, which is a $19 billion decrease from the previous quarter’s estimate. This projection assumes a year-end cash balance of $700 billion. While the decrease in borrowing was a welcome sign, markets are still grappling with how to absorb the substantial debt. Monday’s weak auctions for two- and five-year Treasurys underscore these worries as investors have started to price in the possibility of rising inflation expectations and less dovish Fed policy.

- Bond yields on Wednesday are expected to respond to the Treasury Department’s guidance on debt financing for the upcoming year. Investors anticipate that the quarterly refunding announcement will indicate a need for around $125 billion, consistent with May’s announcement, which maintained auction sizes for the next few quarters. With auction sizes at record highs — particularly for the 10-year Treasury — any increase above this level could drive yields higher, while a reduction might prompt a retreat. Additionally, a miss could further lead to a decline in US government bond liquidity.

- The nation’s debt remains a persistent challenge, as neither presidential candidate has offered a specific plan to tackle the deficit. Instead, their proposals rely on general and potentially contentious measures such as tax hikes and spending reductions. This absence of a clear fiscal strategy is anticipated to drive up bond yields. However, if inflation continues to moderate or the job market weakens, this upward pressure could diminish. Recent estimates from the Cleveland Fed suggest that core PCE inflation may stabilize in the near term, while unemployment rates are expected to remain at 4.1%.

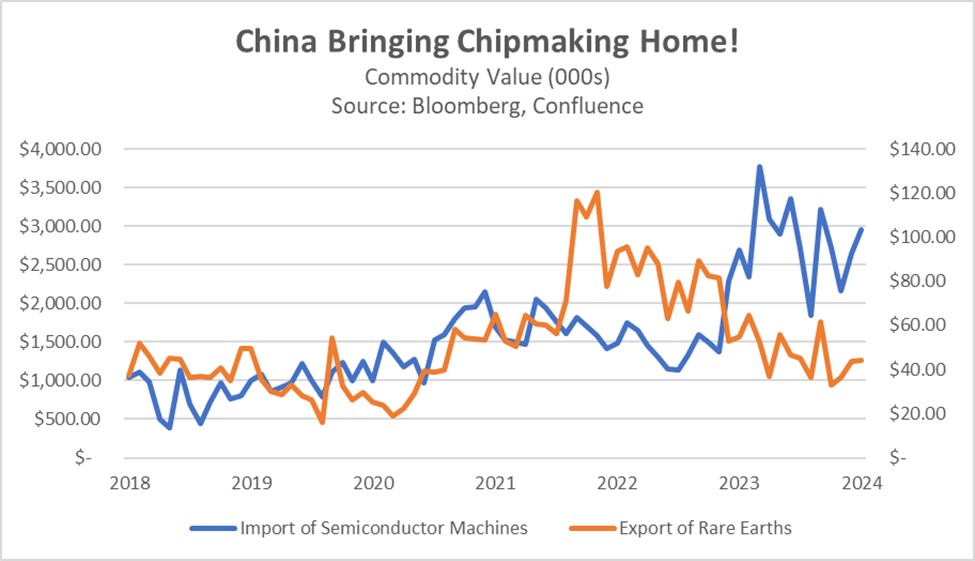

Chip Wars: The White House has unveiled new restrictions on US investments in Chinese companies, aiming to curb the development of critical technologies that could potentially be used by the Chinese military.

- The new restrictions, set to take effect on January 2, will limit US investment in Chinese semiconductor and artificial intelligence companies. Additionally, investors will be required to report certain other forms of assistance to regulators. While the US has already imposed export controls on specific technologies, these new measures aim to prevent US investors from holding equity in companies with ties to the Chinese military. This move comes as a recent report revealed that American investors participated in 17% of global transactions involving Chinese AI companies.

- The restriction on US investments into China comes as Beijing looks to shore up its domestic industry. In recent years, China has aggressively sought to develop its domestic semiconductor industry through substantial investments and the acquisition of advanced manufacturing equipment. Simultaneously, China has imposed export controls on critical minerals essential for chip production, aiming to secure a reliable supply for its domestic industry and potentially limiting access for the US and other Western nations. Although China still trails the US in advanced chipmaking, it is steadily narrowing the gap.

- The escalating semiconductor rivalry is creating headwinds for US tech firms. Apple, for instance, is facing obstacles in launching Apple Intelligence in China due to stringent AI regulations. This could prompt other US AI companies to form partnerships with Chinese firms, despite increased US regulatory scrutiny. To mitigate supply chain risks, Apple has invested in India to diversify its manufacturing base. However, ongoing trade tensions remain a significant challenge for mega-cap tech companies, prompting investors to consider opportunities in other sectors.

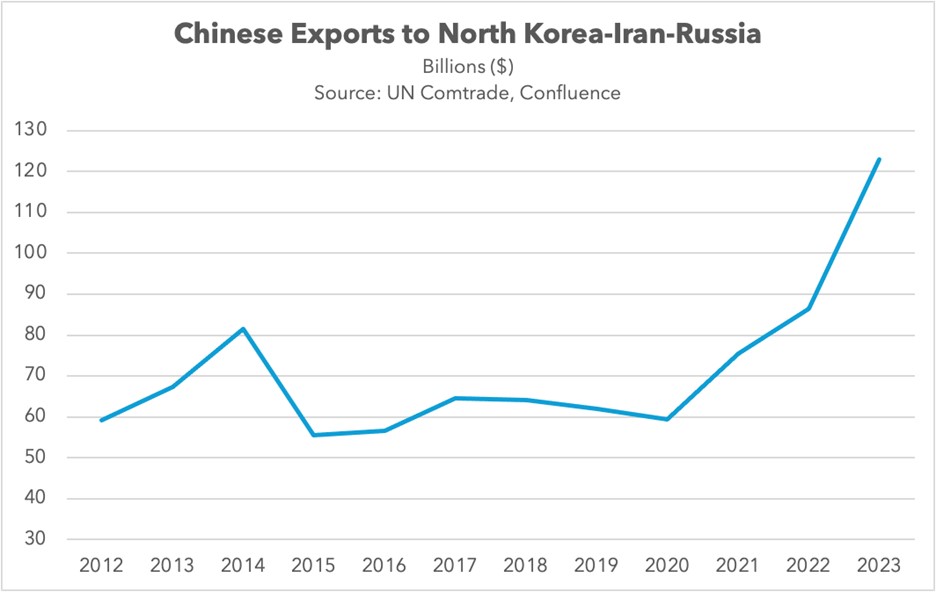

The Korea Problem: The prospect of North Korean troops being deployed in Ukraine has raised the likelihood of a broadening war.

- The Pentagon estimates that over 10,000 North Korean troops have been deployed to Russia. While it remains unclear if these soldiers have engaged in combat, US intelligence indicates a significant presence in Russia’s embattled Kursk region, which borders Ukraine. In response to these reports, Ukraine has pressed Western allies to supply weapons capable of striking deep within Russia. Such a move, according to Russian President Vladimir Putin, would be seen as direct NATO involvement in the conflict.

- The potential involvement of North Korean troops in Russia’s war against Ukraine has raised serious concerns about further destabilizing Europe and could have broader implications for the Indo-Pacific region. Following these reports, there have been renewed calls for deploying EU troops to Ukraine. This idea, initially suggested by French President Emmanuel Macron, was previously rejected by German Chancellor Olaf Scholz. In response to the growing threat posed by North Korea, South Korea has agreed to share intelligence with NATO to coordinate a more effective response.

- The ongoing conflict in Ukraine underscores the increasing importance of military cooperation, even as geopolitical tensions drive global decoupling. Russia’s strengthened trade ties with Iran, North Korea, and China, coupled with Beijing’s increased export allocation to the region, have enabled these countries to mitigate the impact of Western sanctions. This growing economic and geopolitical alliance could lead to further collaboration on initiatives beyond Ukraine, potentially including actions on the Korean Peninsula or regarding Taiwan.

In Other News: US natural gas prices plummeted 11% on Monday, driven by expectations of warmer-than-usual autumn temperatures, increased domestic production, and easing geopolitical tensions. There is growing skepticism as to whether the Fed will be able to cut rates two more times this year as the economy proves to be very resilient in spite of elevated interest rates.