Daily Comment (October 30, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is still processing the latest earnings data from Alphabet. In sports news, the New York Yankees managed to avoid being swept by the LA Dodgers. Today’s Comment will discuss why consumers remain content despite a cooling labor market. We will also review the latest earnings report from tech companies and explain why the EU is starting to get tough on trade. As usual, our report will include a roundup of international and domestic data releases.

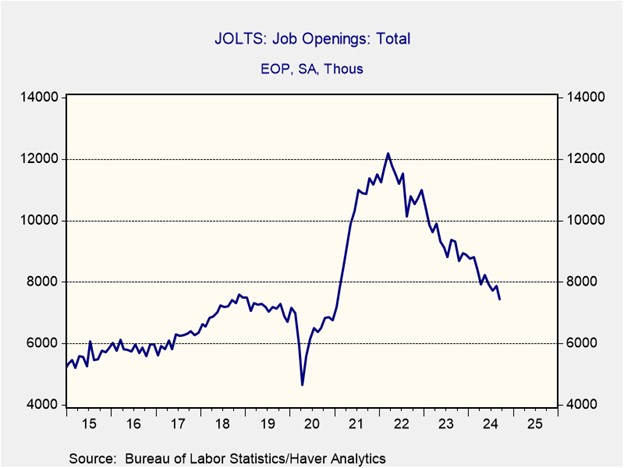

The Job Market: As a precautionary measure against additional layoffs, employers are beginning to reduce the number of job postings.

- The Bureau of Labor Statistics reported a surprising decline in job openings to a three-year low in September. Last month, job postings fell from 7.861 million to 7.443 million, significantly below the consensus estimate of 7.990 million. Despite this decrease, the report also contained some positive news — hiring actually increased from 5.43 million to 5.55 million. The combination of fewer openings and an increase in hiring suggests that the labor market may be cooling but remains relatively tight.

- Even as job openings decline, consumers’ confidence in their job prospects has seen a significant uptick, reaching its highest point since March 2021. The Conference Board’s Consumer Confidence Index rose from 99.2 to 108.7, primarily fueled by consumers’ growing optimism about their present situation given the overall economy and the strength of the labor market. This positive sentiment is further underscored by the widening gap between those who perceive jobs as plentiful and those who believe jobs are scarce, a trend not observed since January.

- The data on job openings and consumer confidence aligns with our view of a resilient economy. While the decline in openings indicates cooling labor demand, it also reinforces our belief that firms are hesitant to lay off workers. This sentiment has likely translated into increased job security for consumers. However, a key question remains: How will this impact wage growth? If wages continue to rise above historical trends, it could exert upward pressure on inflation. Conversely, if wage growth moderates, it may alleviate price pressures and potentially prompt the Fed to ease monetary policy.

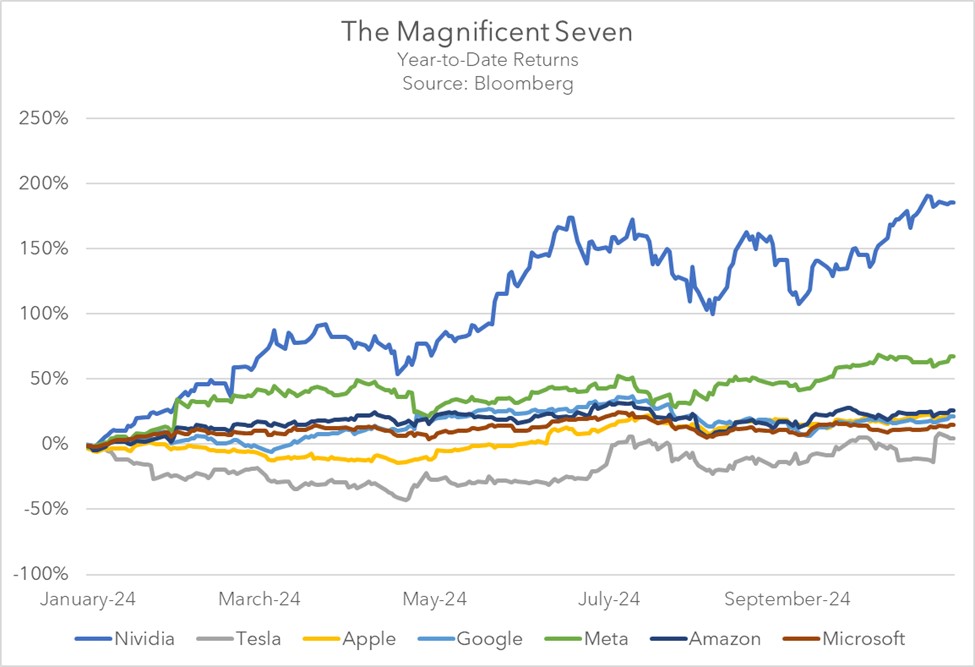

AI Is Back: After concerns about overspending on AI, Google’s parent company Alphabet demonstrated that its investments may be paying off.

- On Thursday, the tech giant exceeded expectations for both profit and revenue, driven by strong growth in its cloud business. The company has faced significant pressure due to concerns about excessive spending to compete with Microsoft following its partnership with OpenAI. Despite increased capital spending in the third quarter, Google’s cloud division saw a 35% growth in revenue year-over-year. Additionally, the company has been able to reduce the cost of its search engine business by over 90% in 18 months.

- Alphabet was the second of the Magnificent 7 companies, after Tesla, to report stronger-than-expected third-quarter earnings. This robust performance is likely to bolster investor optimism for the broader index further, as investors seek signs that mega-cap tech companies can sustain their momentum despite concerns about AI-related overspending that have plagued other companies within the index. While the Magnificent 7 index has surged nearly 50% year-to-date, Nvidia and Meta have been the primary drivers, accounting for over 60% of the gains.

- Alphabet’s strong performance bodes well for other mega-cap tech companies. Last quarter, Google, Microsoft, Meta, and Amazon increased their AI investments, betting on significant untapped demand for these services. Increased capital spending reflects their belief in the potential for future revenue growth. If other companies report similar sales growth this quarter, investors may take a closer look at the Magnificent 7 stocks, especially if interest rates rise. However, we believe that other non-tech sectors offer more long-term value.

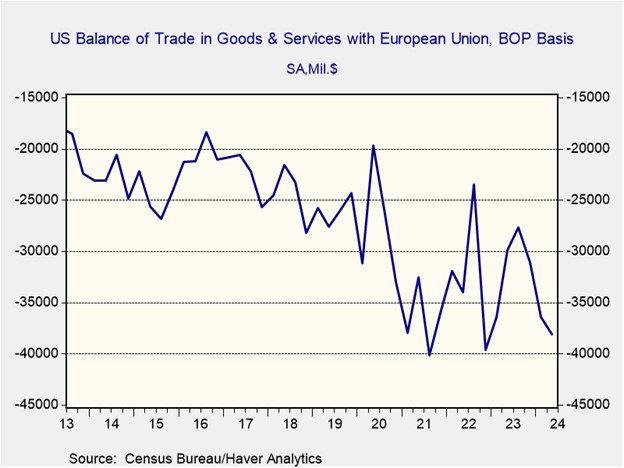

European Protectionism: The EU has started to crack down on Chinese dumping as it looks to protect its own domestic industries.

- The EU will impose tariffs on Chinese electric vehicles (EV) on Thursday, as negotiations to resolve trade disputes between the two sides have failed. These tariffs aim to prevent China from dominating the region’s EV market. EU regulators have accused Beijing of unfair trade practices, such as providing substantial subsidies, which have allowed Chinese EVs to undercut prices of domestically produced cars. The rapid growth of Chinese EV sales is evident, increasing from a mere 3.9% of the market in 2020 to a significant 25% in 2023.

- The decision to impose tariffs comes as the West’s efforts to develop its own green technology industry have faced significant headwinds. The region has struggled to nurture domestic firms, unable to compete with the lower prices of Chinese imports or the generous incentives offered by the US to boost clean-tech manufacturing. For instance, since the passage of the Inflation Reduction Act, US solar investments have surged from $200 million to over $2 billion, while EU investments have declined to $141 million, despite starting from a similar level.

- The EU tariffs on Chinese electric vehicles sends a clear signal that the EU intends to bolster its domestic clean-tech industry. This move could also foreshadow potential retaliatory measures by the EU against the US if the next administration imposes tariffs on EU goods. While the EU may seek to retaliate, it is also likely to pressure the US to reduce tax incentives and subsidies for foreign firms building factories domestically. While a trade war between the US and EU may not be desirable for either party, it is something that could be an issue as it is unclear which side will back down.

In Other News: Israeli Prime Minister Benjamin Netanyahu has expressed interest in negotiating a short truce with Hamas. The German economy unexpectedly grew in the third quarter in a sign that the worst of the downturn may be behind it. Russia has fined Google $2.5 decillion for not allowing propaganda on its YouTube platform.