Daily Comment (November 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently processing the latest jobs data. In sports news, Carlos Alcaraz was eliminated from the Paris Masters’ quarterfinals in a surprising upset. Today’s Comment will discuss why the latest inflation figures further strengthen the Federal Reserve’s case for achieving a soft landing. We will also share our thoughts on how OPEC may respond to the US’s growing influence in the oil markets and conclude with a report on why the yen has begun to appreciate against the dollar. As always, our report includes both international and domestic data releases.

Inflation Cooling: The Fed’s preferred inflation and wage indexes both showed signs of cooling, suggesting that the central bank may be on track for a soft landing.

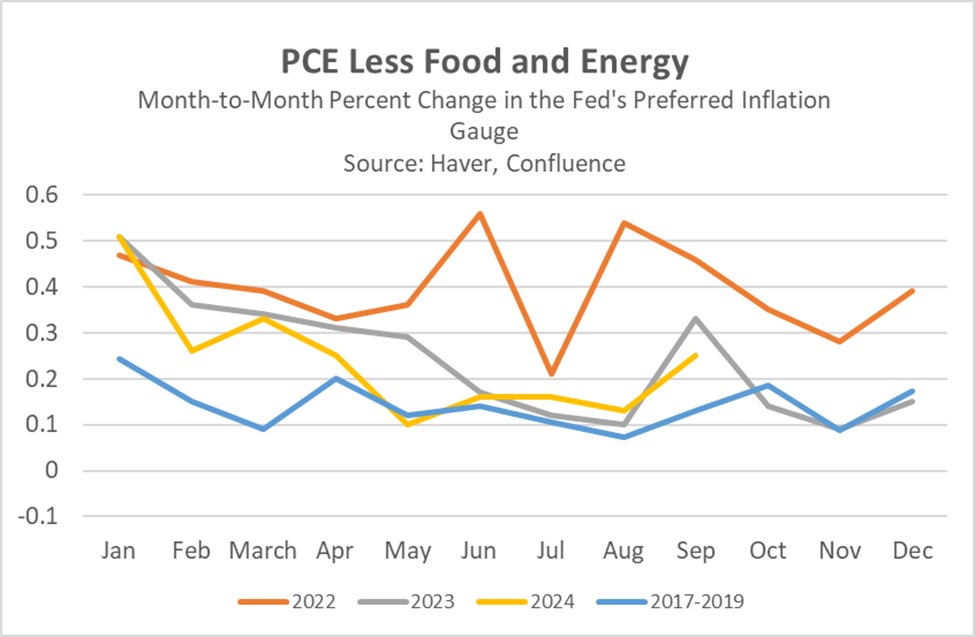

- The Personal Consumption Expenditure (PCE) Price Index, a key inflation gauge, increased 2.1% year-over-year in September. This represents a slight deceleration from the previous month’s 2.3% increase and aligns with market expectations. Core PCE, excluding volatile food and energy prices, remained stable at 2.7%. Meanwhile, the Employment Cost index, which tracks wage pressures, increased at an annualized rate of 0.8%, down from 0.9% in the previous quarter. The combined easing of inflation and wage growth provides further evidence that the Fed is closer to achieving its mandate.

- The Federal Reserve’s potential for multiple rate cuts remains on the table as wage and price pressures ease. Market expectations, as reflected in the CME FedWatch Tool, currently point to a near-certainty of a rate cut next week with a 70% probability of another in December. This confidence stems from the fact that inflation has shown a consistent downward trend throughout the year, with price pressures rising at a slower pace compared to the previous year. As the chart illustrates, seven out of nine months in 2024 saw a deceleration in core PCE price growth compared to the previous year.

- The Fed’s ability to navigate a soft landing hinges on its avoiding complacency. By carefully easing monetary policy and monitoring the normalizing labor market, the central bank can mitigate the risk of a reversal or hard landing. The next three months will be a critical test, as lower inflation readings are typically observed during this period. A substantial acceleration in October or November could lead the Fed to hold off on cutting rates in December. That said, a cut at next week’s meeting does seem reasonable.

Market Share or Margins: OPEC is facing challenges in developing a strategy to address the growing competition from US oil production.

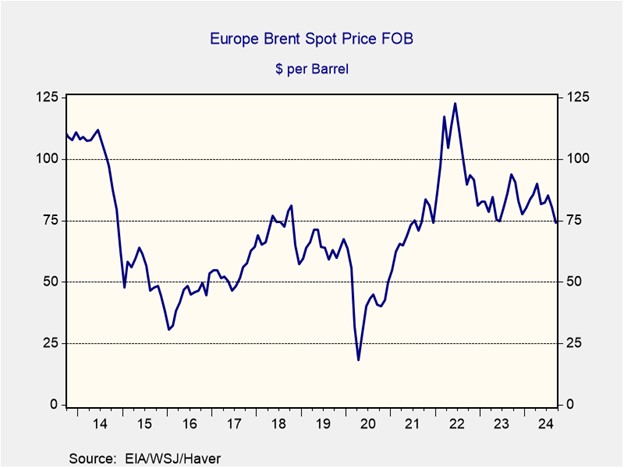

- US oil production reached a record 13.4 million barrels per day in August, helping to keep prices from surging despite escalating tensions in the Middle East. The increase was driven by Texas and New Mexico, which produced 5.8 million and 2.1 million barrels per day, respectively. Recently, strong US production has boosted its share of global oil production to nearly 22% in 2023, up from 19% in 2020. In contrast, top oil producer Saudi Arabia has maintained a steady output share of around 11%.

- The US’s emergence as a major oil producer has curtailed OPEC’s ability to influence global oil prices through production cuts. Despite efforts to curb supply, the oil market remains saturated due to weakening global demand, particularly from China. As a result, Saudi Arabia, OPEC’s most influential member, has experienced declining revenue from both lower oil prices and reduced production. This has compelled OPEC to explore strategies to bolster profitability, as many of its member nations rely heavily on oil revenues to fund their governments.

- OPEC is poised to address the global oil oversupply issue at its December meeting. While production cuts to bolster prices remain a possibility, the cartel may alternatively opt to flood the market to weaken competitors and regain market share. OPEC’s decision will likely depend on its assessment of global economic growth in the coming months. A positive outlook on global growth could prompt production cuts, supporting oil prices. Conversely, a pessimistic forecast for the global economy may lead to increased production, putting downward pressure on prices.

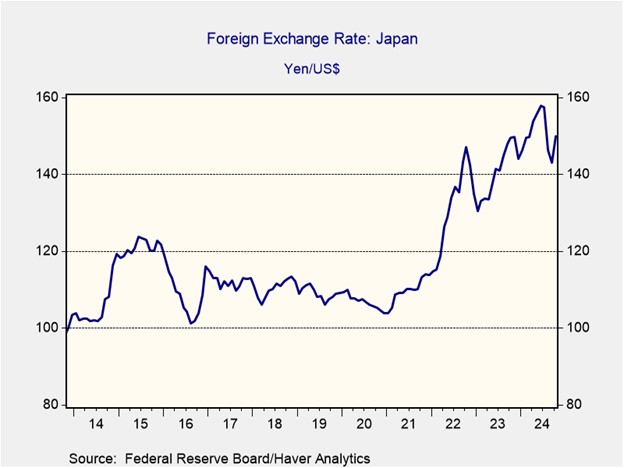

Japanese Yen Resurgence: Speculation over monetary policy has led the yen (JPY) to strengthen and Japanese equities to fall.

- On Thursday, Bank of Japan Governor Kazuo Ueda announced that the central bank would no longer state that it can “afford time” on future rate hikes, acknowledging that fluctuations in foreign exchange rates are having an effect on domestic price pressures. His comments marked a hawkish shift from the previous day’s more general BOJ statement, which had suggested that any rate increases would depend on economic and inflation trends aligning with the bank’s forecasts. Following Ueda’s remarks on Thursday, the Japanese yen surged 1% against the dollar at its highest.

- Since September, the country’s currency has depreciated significantly against the dollar, falling nearly 7%. This sharp devaluation was likely driven by a sudden shift in global interest rate expectations, primarily due to changes in market sentiment regarding central bank policies in the US and Japan. Following the September FOMC meeting, investors have begun to price in fewer rate cuts over the next few years. Additionally, the July market turmoil caused by the unwinding of the yen carry trade has led investors to believe that the Bank of Japan will adopt a cautious approach to rate cuts.

- Ueda’s comment suggests a potential hawkish shift in the BOJ, which should help support the JPY. We suspect that as long as uncertainty persists regarding the extent of the Federal Reserve’s planned rate cuts during its easing cycle, the BOJ will be forced to be more assertive with policy. Consequently, Japanese policymakers may seek to protect the yen by adopting a monetary policy stance that diverges from the Fed’s, potentially including a more hawkish rate hike at the December BOJ meeting.

In Other News: Canadian ports are bracing for strikes starting Monday, which are expected to cause supply chain disruptions across the country. Additionally, Iran has threatened to retaliate against Israeli attacks through proxy groups, resulting in a rise in oil prices. Furthermore, China sanctioned the largest US drone maker to signal its potential response to further trade restrictions imposed by the US.