Daily Comment (November 5, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment on this Election Day opens with a few words on opinion polls. After all, those are all we’ll have to look at until actual voting results start to come in later this evening. We next review several other international and US developments with the potential to affect the financial markets today, including a potential reprieve for Germany’s fragile coalition government and an end to the machinists’ strike at Boeing.

US Politics: As the US holds its elections today, the latest FiveThirtyEight average of national polls shows Harris with 48.0% support and Trump with 46.8%, well within all the surveys’ margins of error. In the swing states, the support for each candidate is also evenly matched and within the margins of error. Since we’re all likely to hear a lot about polls today, we thought it might be useful to provide a quick reminder of how these polls work and what the margin of error really means:

- For whatever measure we’re interested in — say, the share of voters who support former President Trump — there is a certain, specific number within the population as a whole. Let’s say it’s 49.2%. The problem is that to find this actual number, you’d have to ask each and every person in the population. That would be expensive and probably impractical.

- As an alternative, polling firms select a random sample of individuals in the population and use that to develop an estimate of the actual population number. Under the laws of mathematics, and assuming the sample is designed correctly, it’s possible to estimate the number of individuals you need in the random sample to generate a reasonably accurate estimate of the actual number in the population. Polling is expensive, so pollsters don’t want to over-do it. This is why you often see samples sizes of just 1,000 to 3,000.

- Let’s say you conduct your survey, and 50.5% of the individuals in your random sample say they support Trump. This is higher than the actual population number of 49.2%, but you don’t know that. However, based on the size of the random sample and the characteristics of the population, it’s possible to calculate how certain you should be that the actual population number is within a certain distance of your calculated sample estimate. This is the margin of error.

- The margin of error basically says that if you used the same sampling methodology 100 times, you would expect some share of the 100 sample estimates to fall within a number x and a number y, at a specific level of certainty. A commonly used level of certainty is 95%. Based on mathematical laws, for example, you may estimate that in your hypothetical 100 samples, 95% of your calculated support numbers for Trump would fall between 49.0% and 52.0%.

- Indeed, rather than focusing on the specific point estimates of the various polls, it may be good to focus more on the range implied by the margin of error. Think of the polls as saying, “We think there is a 95% chance that the true population support level for Candidate Z is between x% and y%.” Maybe that’s another way of saying we should all be careful about relying too much on the polls!

Germany: Just days after Finance Minister Lindner of the liberal Free Democratic Party proposed spending reforms that threatened to end the coalition government, as we reported in our Comment yesterday, Deputy Chancellor Habeck of the Greens offered a budget compromise aimed at keeping the coalition together. However, it isn’t clear if Habeck’s proposal will keep the three-party coalition together. As a result, Germany is likely to face continued political and economic uncertainty in the coming months.

Russia-United States: In an in-depth article yesterday, the Wall Street Journal described an apparent effort by Russia’s intelligence services to start fires on passenger or cargo aircraft flying to the US. In an apparent test run of the plan, magnesium-based devices in packages shipped via DHL ignited at sorting facilities in the UK and Germany. We first saw reporting on the incidents several months ago, but only now has the story been picked up by the major media.

- US and European national security officials warn that the sabotage program marks an unusually aggressive and risky new approach for the Russian intelligence services. They warn that the services could even be acting outside of the control of the Kremlin.

- The risk for investors is that a successful attack could cause a catastrophic airliner crash that kills US citizens. Even though former President Trump is often seen as supportive of authoritarian leaders such as Russian President Putin, we also note that his foreign policy type is “Jacksonian.” If he is re-elected today, his instinct for isolationism could abruptly shift toward punching back hard if US honor is besmirched or if US citizens are killed by a foreign power, even if that power is Russia.

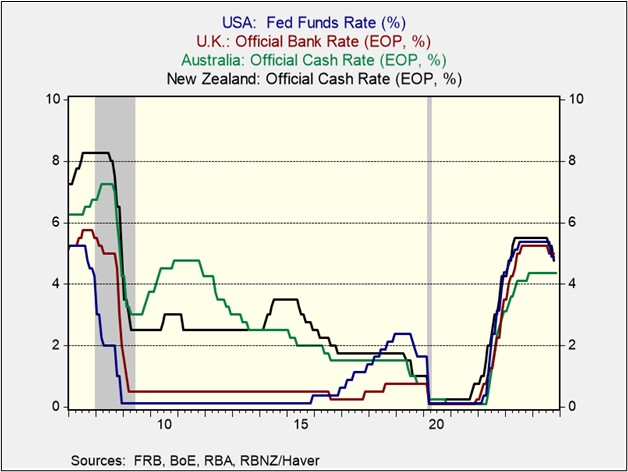

Australia: The Reserve Bank of Australia today held its benchmark short-term interest rate steady at 4.35%, meeting expectations and marking a full year at that level. In its policy statement, the RBA noted that while Australian economic growth has slowed markedly, core price inflation remains stubbornly high. The result is that the RBA is now a clear outlier among major central banks, most of which have been cutting rates.

China: The Caixin purchasing managers’ index for services rose to a seasonally adjusted 52.0 in October, up from 50.3 in September. Like most major PMIs, the private-sector Caixin gauge is designed so that readings over 50 indicate expanding activity. The Caixin services index has now been above that level for 22 straight months, illustrating how the current headwinds in China’s economic growth is in the manufacturing sector, which is saddled with excess capacity.

United States-China: Under pressure from Washington, top US semiconductor equipment makers Applied Materials and Lam Research have told their suppliers to stop using certain components from China or they will risk losing their status as vendors. The firms have also told their suppliers that they can’t have Chinese investors or shareholders.

- The warnings are the latest example of how the US and China are putting up barriers to the flow of technology between the two countries.

- As we have argued many times before, those barriers may enhance national security and resilience, but they could also raise costs and contribute to higher price inflation and interest rates going forward.

US Monetary Policy: As a reminder, the Fed holds its latest monetary policy meeting this week, with its decision due on Thursday at 2:00 PM ET. The policymakers are widely expected to cut the benchmark fed funds interest rate by 25 basis points to a range of 4.50% to 4.75%, and we agree with that assessment. However, because of the underlying strength in economic growth, relatively tight labor markets, and continued price pressures, we still think the pace and endpoint of future cuts could leave investors disappointed.

US Labor Market: Boeing’s 33,000 union machinists have finally ratified a new labor contract that will give them a 38% pay hike spread over four years and end their nearly two-month strike against the company. However, we note that the pay hike is more muted than workers gained in some other recent high-profile strikes. In part, that likely reflects Boeing’s idiosyncratic operational and financial challenges. However, it could also partly reflect the nation’s somewhat slower economic growth and cooler labor market.

US Residential Real Estate Market: According to data firm CoStar, the third-quarter apartment vacancy rate held steady at 7.9%, marking the first time in three years that the share of empty units didn’t increase. The figures suggest the recent slowdown in apartment construction and still rising demand will help reduce excess supply and lead to improved rental rates in the coming year.