Daily Comment (November 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Today, the market is closely watching to see if the Republicans can gain enough seats to take control of the House of Representatives. In sports news, the Baltimore Ravens made a remarkable comeback to defeat the Cincinnati Bengals. Today’s Comment will cover the latest FOMC meeting, Trump’s plans to refocus industrial policy, and the adjustments that the EU intends to make for a Trump presidency. As always, our report will also include a roundup of both international and domestic data releases.

Policy Path Uncertainty: The FOMC decided to lower its policy rate as expected but was very vague about the path of future cuts.

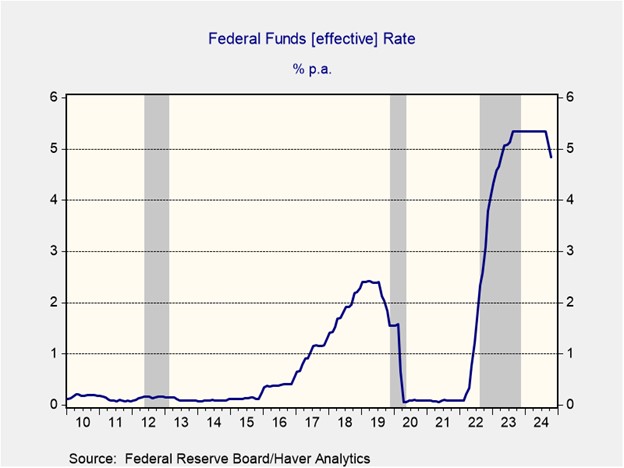

- The Federal Reserve lowered its benchmark interest rate by 25 basis points on Thursday, setting the target range at 4.50%-4.75%. This decision was influenced by recent economic indicators, including October’s inflation and employment data, which suggested a potential slowdown in economic activity. While Fed officials acknowledged the possibility of near-term inflationary pressures, they expressed optimism about a potential decline in January. However, they cautioned that uncertainty surrounding certain economic policy changes has complicated efforts to project cuts going into next year.

- The central bank’s reluctance to provide a clear interest rate path suggests a cautious stance, likely shaped by the recent election’s policy implications. In particular, concerns persist that the president-elect’s proposed tax cuts might intensify inflationary pressures. While Fed Chair Jerome Powell avoided directly commenting on fiscal policy proposals, he did describe the current deficit as being unsustainable. He further emphasized the central bank’s commitment to data-driven decision-making, stating that it “does not guess, does not speculate, and does not assume” about future policy shifts.

- Next month’s FOMC meeting will offer markets key insights into the Fed officials’ views on the inflationary impact of potential Trump administration policies. A more hawkish shift could set the Fed on a collision course with the incoming administration. Although there is speculation that Trump might seek to replace Fed officials with loyalists, such a move could backfire by sparking a sell-off in long-term bonds, which could drive up borrowing costs for the consumers he aims to support. A compromise is more probable, with Trump potentially making spending concessions in exchange for lower policy rates.

What’s Next for Build Back Better? Trump’s ascension into the White House will likely refocus but not fundamentally change the direction of policy.

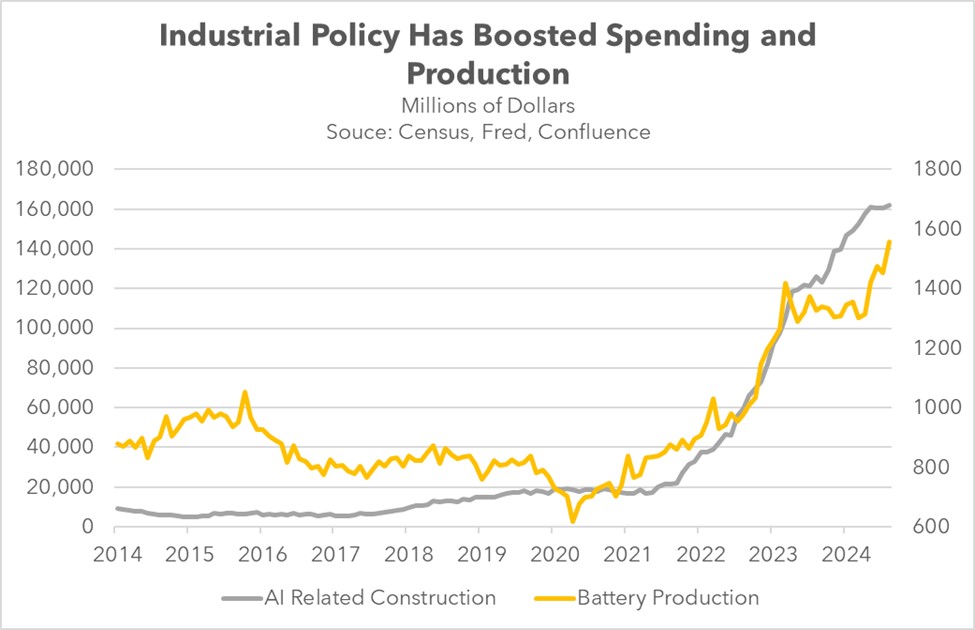

- The president-elect is expected to shift US priorities from using stimulus to incentivize foreign investment in the US to relying on tariffs as the primary tool. Last month, Trump criticized the Biden administration’s spending on stimulus and tax incentives to attract foreign businesses, calling it too costly and suggesting tariffs as a more effective alternative. He has also pledged to cut much of the unspent funding for climate initiatives in the Inflation Reduction Act, aiming to reduce the deficit and refocus the country by expanding fossil fuel production.

- Despite his lack of interest in the two spending bills passed by the Biden administration, Trump is unlikely to reverse most of these changes. The domestic industrialization strategy has driven a sharp increase in spending, fueling a surge in the construction of chip facilities, data centers, and battery production sites. Additionally, the bill was designed to create jobs in key Republican strongholds, making it even more complex to dismantle these initiatives, which may explain why House Speaker Mike Johnson walked back plans to repeal the CHIPS act.

- We expect the next administration to let market forces shape the direction of clean energy initiatives, while largely leaving chip production efforts intact for now. The reluctance to aggressively reverse these policies stems from the Republican party’s need to prioritize its anticipated tax proposals, which will likely face significant scrutiny due to their budgetary impact. Following this, Republicans will also focus on advancing a tariff bill which should also meet some pushback. While some adjustments to the CHIPS and Inflation Reduction bills may occur, we do not expect these to be top priorities.

EU Faces Reality: European unity is poised to be severely tested as the US pursues a strategic realignment that could upend the longstanding relationship.

- European leaders are strategizing on how to approach President-elect Donald Trump while preserving unity within their coalitions. During his campaign, Trump pledged to scale back US support for NATO members that fall short of defense spending targets, pushed for a swift resolution to the Ukraine conflict, and threatened tariffs on all European goods. Although these threats are not new — Trump raised similar issues in his first term — the urgency to address these vulnerabilities has intensified, as they pose a further risk to the bloc’s growth prospects.

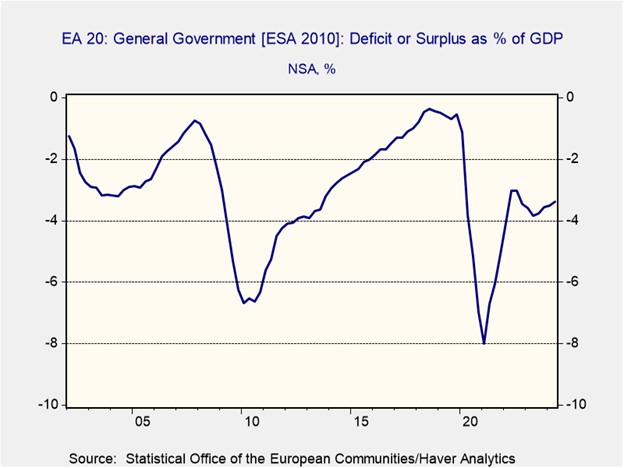

- A core challenge for the EU is reducing its dependence on the US for security and trade. Former ECB President Mario Draghi has proposed establishing a unified approach, which he estimates would require a public fund of 800 billion EUR ($861 billion) in additional annual investments. Meanwhile, French President Emmanuel Macron is advocating for the bloc to assert its sovereignty by boosting investment in its domestic defense industry, with a special focus on advancing technologies in artificial intelligence, quantum computing, space, biotechnology, and renewable energy.

- The EU’s ability to counterbalance a more assertive US will depend on its capacity for unity. By overcoming internal divisions and fostering deeper cooperation — potentially through a fiscal union — the EU could improve its access to capital markets through collective borrowing. This will not be an easy process, especially with individual countries struggling to meet deficit targets following the pandemic, but it is likely something the bloc will explore in the coming years. One potential approach could be the issuance of another joint EU bond to fund special projects.

In Other News: Israel is preparing to deepen its war efforts in Lebanon and Gaza in another sign that the conflict is unlikely to end until next year. The Trump team is considering ways to scale back some of the tax promises made during the campaign to facilitate the passage of legislation. Meanwhile, China approved a $1.4 trillion spending program on Thursday, which aims to help bail out local governments. However, there are concerns that this amount of spending may still be insufficient to effectively revive the economy.