Daily Comment (November 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently reacting to the latest inflation data. In sports news, the University of Oregon has maintained its number one ranking in college football. Today’s Comment will cover our insights on monetary policy, discuss the recent breakthrough in nuclear fusion, and provide an update on the Bank of Japan. As usual, the report will include a summary of both international and domestic data releases.

Fed Cuts in Doubt: Uncertainty about inflation and the labor market has led the market to reassess its bets regarding the future path of rate cuts.

- Federal Reserve officials Neel Kashkari and Thomas Barkin presented contrasting views on the path of interest rates. Kashkari, the Minneapolis Fed President, advocated for a rate cut in December provided that inflation remains within expectations over the next two months. In contrast, Richmond Fed President Thomas Barkin adopted a more cautious stance. While acknowledging current restrictive conditions, he indicated the Fed’s readiness to adjust rates to address inflation or labor market risks, potentially signaling a preference for a December pause.

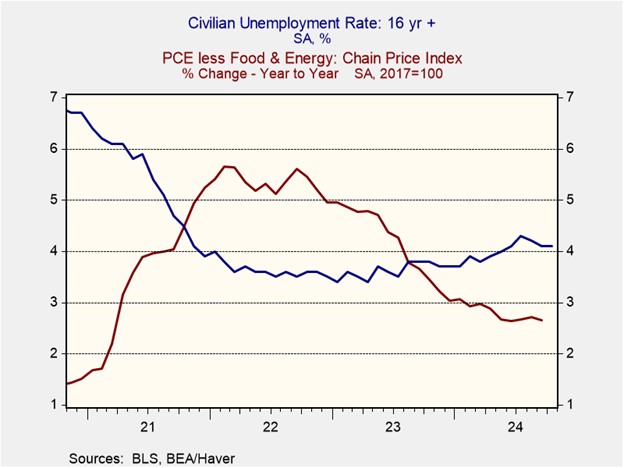

- While the central bank has implemented 75 basis points worth of rate cuts since September, growing concerns persist about the delicate balance between its price stability and maximum employment mandates. The latest unemployment data reveals a persistent rate above 4.0% over the past five months, while the Fed’s preferred inflation gauge, the core Personal Consumption Expenditure (PCE) price index, remains relatively stable at around 2.7%. The labor market’s resilience and persistent inflation have reduced rate cut expectations from 70% to 60% this week.

- Although the market is heavily favoring a rate cut in December, the decision is far from settled. A major determinant of the Federal Reserve’s decision to further ease monetary policy will be the November jobs report. A report indicating an uptick in the unemployment rate or another payroll figure below 100k could solidify the case for another interest rate cut. However, given the likelihood of hurricane-displaced workers reentering the labor force, we believe that the probability of a rate cut in the next month is still a coin flip.

Nuclear Fusion: A breakthrough in fusion technology is set to attract interest as investors seek innovations to make nuclear energy more efficient.

- A New Zealand startup has demonstrated a promising step towards fusion energy by generating a plasma cloud at 300,000 degrees Celsius for 20 seconds in its first experimental reactor. While this temperature and duration fall short of the requirements for practical fusion power, the experiment highlights the technology’s potential for future research and development. Over the last two years, public and private funding into nuclear fusion has waned due to a lack of progress, with investment growth falling from $2.8 billion in 2022 to roughly $900 million as of this year.

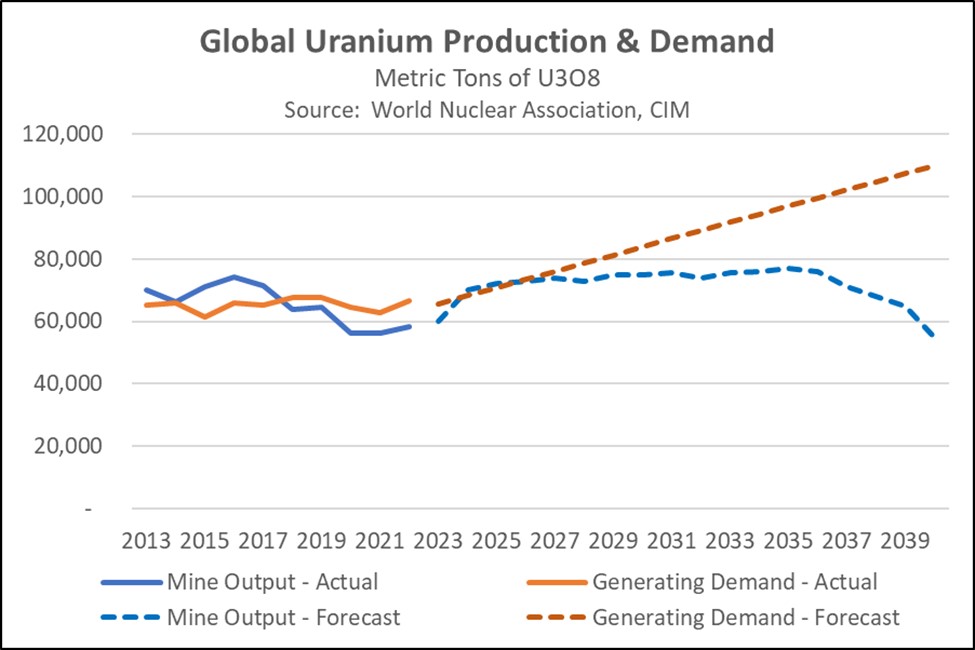

- Successful fusion energy development could revolutionize the global energy landscape by providing a virtually unlimited, inexpensive, and clean energy source. This is especially critical as global energy consumption is projected to skyrocket due to the rapid growth of AI and cryptocurrency mining. Morgan Stanley estimates that AI-related power consumption could increase fivefold in the next three years, prompting major tech companies to invest in their own nuclear reactors. This surge in demand for nuclear power has led to a significant mismatch in the supply and demand for uranium.

- While practical fusion energy remains years away, its potential to revolutionize the energy sector highlights the urgent need for ongoing research and development, particularly as global energy demands rise, and climate concerns intensify. We anticipate significant public and private investment across the industry as countries aim to achieve greater energy independence. Meanwhile, growing demand for uranium from the nuclear energy industry and the tech industry’s expanding data centers could further support elevated uranium prices.

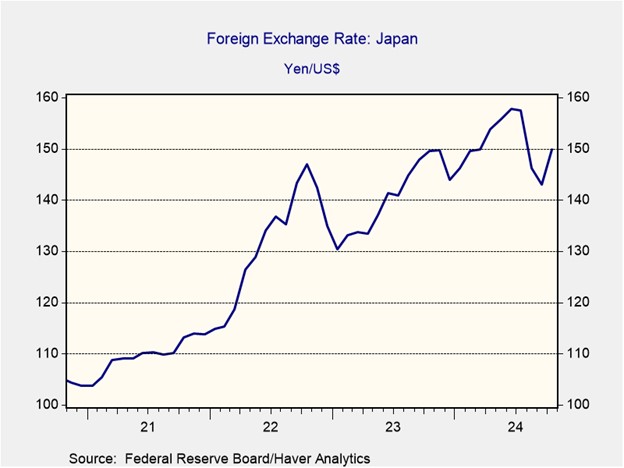

Yen Back in the Spotlight: The weakening of the Japanese currency is likely to increase pressure on the Bank of Japan (BOJ) to tighten policy and potentially intervene in the foreign exchange market.

- The Japanese yen (JPY) weakened to 155 per dollar on Tuesday, affected by market reactions to the “Trump trade.” The decline stems from concerns that potential US policy shifts under the new administration could lead the Fed to cut rates less than anticipated, thereby maintaining a wide policy rate differential between the US and Japan. Additionally, there are fears that Japan may suffer in a potential tariff war, as the incoming administration has pledged to impose tariffs on imports, which could hamper Japan’s economic growth.

- Recent currency volatility has heightened market fears of impending monetary policy tightening by the central bank. The October meeting minutes from the BOJ revealed internal debates about the appropriate timing for such a move, with some policymakers expressing concerns about potential market volatility following the US election. While the bank ultimately decided to hold rates unchanged, the sentiment suggests that the central bank would need to take more action to prevent the currency from weakening, adding to inflationary pressures. Nevertheless, most policymakers favored a cautious approach to rate hikes.

- BOJ policymakers are expected to tighten policy at their December meeting, though the path forward will largely hinge on future Fed actions. Japanese officials are keen to avoid a repeat of July’s market turmoil, when the rapid unwinding of the yen carry trade led to widespread panic. As a result, the BOJ may be hesitant to hike rates if the Federal Reserve does not continue its easing cycle. If this scenario unfolds, we anticipate the BOJ may lean toward currency market interventions to prevent exchange rate fluctuations from adding to price pressures.

In Other News: President-elect Donald Trump is expected to sign an executive order to establish a board overseeing military generals. In southern China, a deadly attack resulted in 35 fatalities, exacerbating public anxiety amid significant economic concerns. The German government has admitted defeat in its quest to stop the acquisition of Commerzbank by UniCredit.