Daily Comment (November 15, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently assessing the latest retail sales data. In sports news, the USMNT soccer team defeated Jamaica in the first leg of the quarterfinals of Concacaf Nations League. Today’s Comment will discuss why the Federal Reserve may scale back interest rate cut expectations in 2025, why investors may be ready to take money off the sidelines, and why Marine Le Pen’s presidential bid may potentially be blocked. As usual, the report concludes with a roundup of international and domestic data releases.

Powell Speaks: The Federal Reserve chair gave the first indication that the central bank may be altering the path of interest rates following stronger-than-expected growth.

- On Thursday, Fed Chair Jerome Powell stated that the economy’s strength means that the central bank is not in a rush to cut interest rates. His comments followed a CPI report indicating stalled inflation in October and a tight labor market, with jobless claims at their lowest level since May. Although he didn’t specifically reference the upcoming December meeting, his remarks led the market to lower its expectations for an imminent rate cut. The latest CME FedWatch Tool fell from 82.5% to just above 60.0% on Thursday.

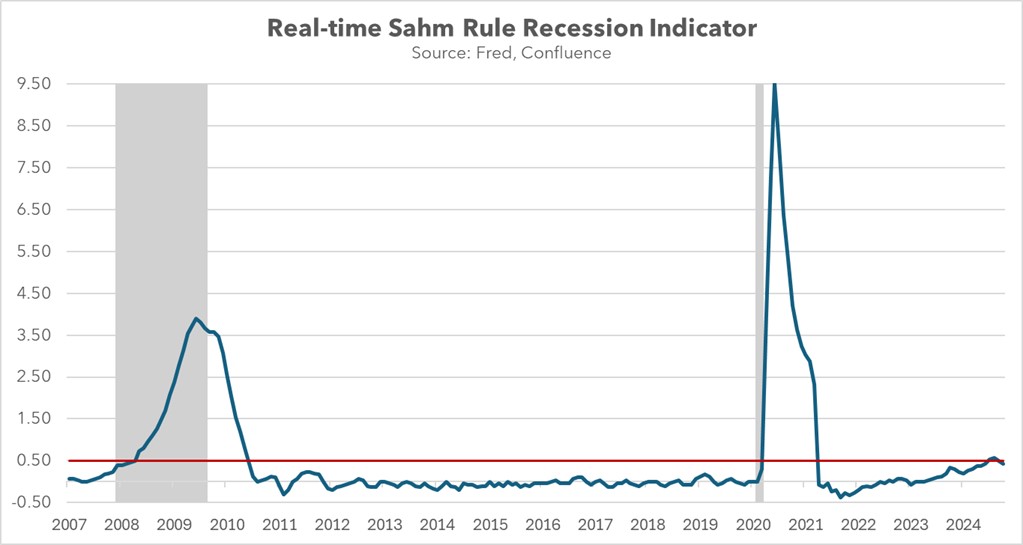

- His comment comes as the labor market shows signs of improvement since the Sahm Rule was triggered over the summer. In July, the three-month moving average of the unemployment rate rose 0.5 percentage points above its 12-month low for the first time since the pandemic. While such a sharp increase is typically associated with recessions, this time may have been a false alarm. As of October, the moving average is only 0.43 percentage points above the minimum, an elevated but not recession-indicative level.

- The Fed chair’s remarks indicate that policymakers may lower their expectations for rate cuts next year. The latest Summary of Economic Projections had forecast a 100-basis-point rate reduction in 2025, driven by concerns over potential labor market softening. However, given recent economic data indicating a less immediate recession risk, policymakers may opt to slow the pace of rate cuts for the next year. While a December rate cut remains possible, the chance of an indefinite pause is starting to increase.

Money on the Sidelines: Elevated interest rates and pre-election jitters have driven investors toward short-term funds, a shift that could carry significant implications for financial markets in the coming year.

- In September, US money market funds topped $7 trillion for the first time, according to the Office of Financial Research. This surge highlights investors’ sustained interest in higher deposit interest rates, even as the Federal Reserve has implemented a 50-basis-point rate cut and signaled further reductions. The milestone underscores a growing trend of investors favoring short-term cash holdings while awaiting clearer market direction. Notably, Warren Buffett, the highly respected investor, has begun reducing his stake in Apple and increasing his cash reserves, reflecting this cautious sentiment at the time.

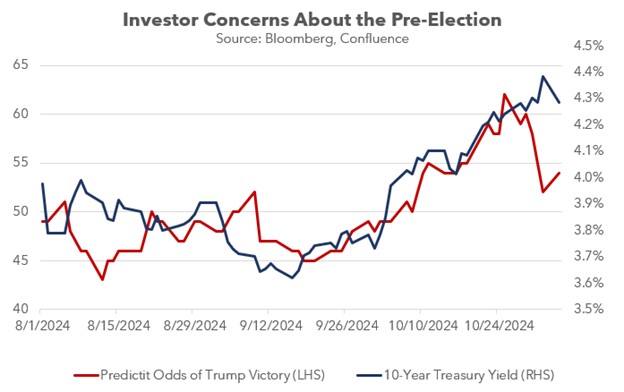

- The significant rise in risk aversion was driven by uncertainty surrounding what appeared to be a closely contested election. With polls remaining tight in the days leading up to the vote, investors adopted a cautious stance, bracing for outcomes on either side. This nervousness was reflected in the increasing yields on 10-year Treasurys despite the Federal Reserve’s 50 bps rate cut in September. The yield rise was seen as a “Trump trade,” fueled by concerns over a potentially widening deficit driven by the prospect of additional fiscal stimulus and tariffs.

- With the election concluded and Republican President-elect Donald Trump securing a decisive victory, investor risk aversion is likely to diminish significantly. The market’s sharp reaction to the outcome hints at the potential for a broader rally if promises of tax cuts and deregulation are realized. Consequently, we anticipate that a substantial portion of sidelined capital could flow back into the equity market in 2025, assuming the Federal Reserve maintains a steady course and avoids having to make an embarrassing U-turn in its monetary policy. This should be bullish for risk assets.

Le Pen in Trouble: The leader of France’s right-wing National Rally party could miss out on the next presidential election following accusations of funds misappropriation.

- French prosecutors have accused Marine Le Pen and members of her party of misappropriating European Union funds by diverting them to domestic activities rather than their intended EU-related purposes. They have recommended a 300,000 EUR ($316,890) fine for Le Pen, a 2 million EUR ($2.1 million) fine for the party, two years in prison or house arrest, and a five-year ban on holding public office. While a ruling is not expected for months, the prosecutor has called for a “provisional execution” of the sentence, which could prevent her from running for office even if the decision is sent to the appeals court.

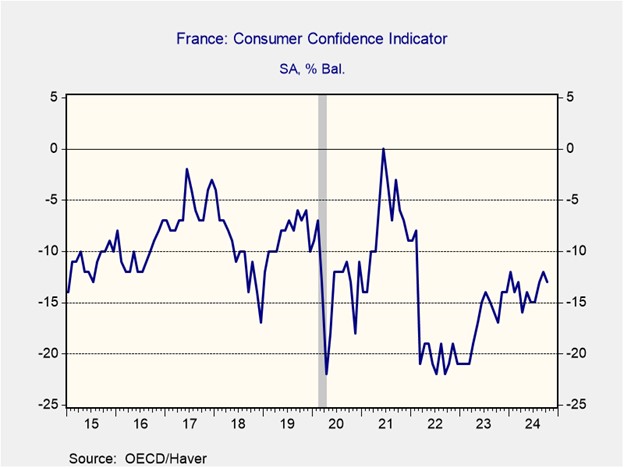

- Le Pen’s potential exclusion from the presidential race comes at a time when her popularity has surged, while her opponent’s has sharply declined. Her party not only secured the most votes in the European Parliament elections, but also led in the first round of the legislative elections, though it finished third in the second round. Meanwhile, French President Emmanuel Macron’s approval rating has fallen below 25% as he grapples with a loss of public trust following his controversial pension reform, which raised the retirement age from 62 to 64.

- While the immediate impact on French financial markets may be limited due to the presidential election taking place in 2027, the long-term implications of a popular leader’s legal troubles cannot be ignored. The perception of a politically motivated prosecution could erode public trust in the justice system, fueling a populist backlash that benefits the National Rally. This could, in turn, lead to increased market volatility, affecting French equities and bond yields. As the trial progresses, vigilant monitoring is crucial to assess its potential impact on the political landscape and financial markets.

In Other News: Argentina is considering withdrawing from the Paris climate accord, signaling that countries are increasingly resistant to burdensome environmental regulations. Meanwhile, China is finding it relatively inexpensive to borrow in the market as it seeks capital to help finance the fiscal stimulus necessary to revive its economy. Additionally, the ratings agency Moody’s has downgraded Mexico’s credit outlook due to the recent judicial reforms, indicating that these changes are sparking a backlash from investors.