Daily Comment (December 12, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is analyzing the latest PPI data to gauge the Fed’s next move. In sports news, former New England Patriots coach Bill Belichick has agreed to lead the University of North Carolina’s football team. Today’s Comment will explore why Fed policymakers remain concerned about inflation, provide an update on the government’s efforts to avoid a shutdown, and share insights on Canada’s monetary policy. As always, we’ll summarize key domestic and international data releases.

Inflation in Line: The CPI report did not disappoint, but there are still concerns about the future path of inflation.

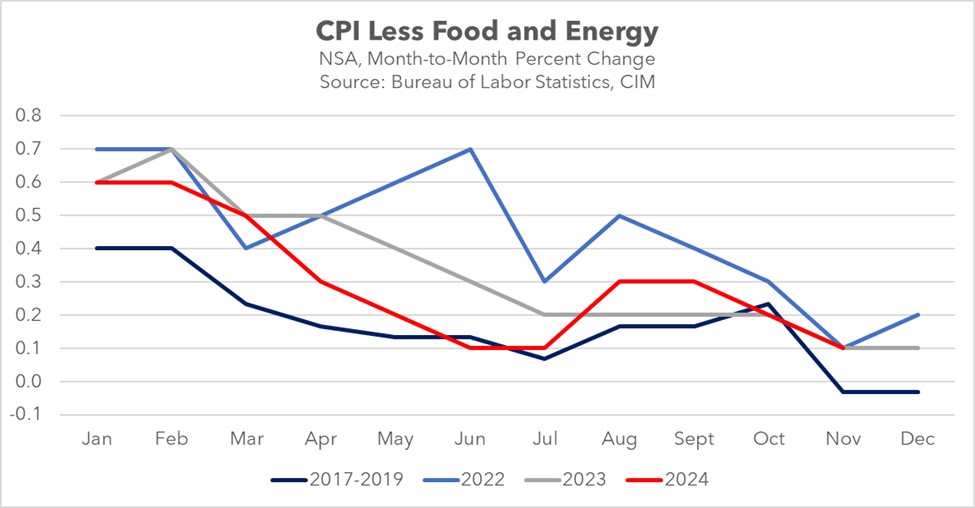

- According to the Bureau of Labor Statistics, the overall consumer price index accelerated slightly in October. The year-over-year change rose from 2.6% to 2.7%, while the core index, which excludes volatile food and energy, rose 3.3%, roughly in line with the previous month. The rise in inflation was driven by a few components, including transportation and food prices, which both showed signs of acceleration. That said, the report was likely good enough for policymakers to cut rates next week; however, there are still questions concerning the path of monetary policy for 2025.

- Fed officials will remain vigilant for signs of renewed inflationary pressures, especially at the beginning of the year. In the first quarter of 2024, core CPI surged well above its pre-pandemic trend, mainly driven by unexpected spikes in financial services and shelter costs. While price pressures eventually eased throughout the year, this early surge led the Fed to doubt its progress and delay rate cuts until September when a 50-basis-point reduction was implemented. If a similar scenario unfolds in 2025, the Fed could signal an indefinite pause on rate cuts for the year.

- Our primary concern is the potential resurgence of goods inflation driven by tariffs, which could reverse recent progress in moderating price pressures. The last time tariffs were implemented there was a significant increase in durable goods prices, particularly for home appliances. While this didn’t have a major impact on overall inflation then, it could diminish a key driver of disinflation this time. Although we don’t expect this to influence policy decisions at next week’s meeting, it could prompt Federal Reserve officials to adopt a more hawkish stance in 2025.

Spending Gap Bill: Lawmakers are working together to put together a stop gap spending bill to prevent the government from shutting down on December 20.

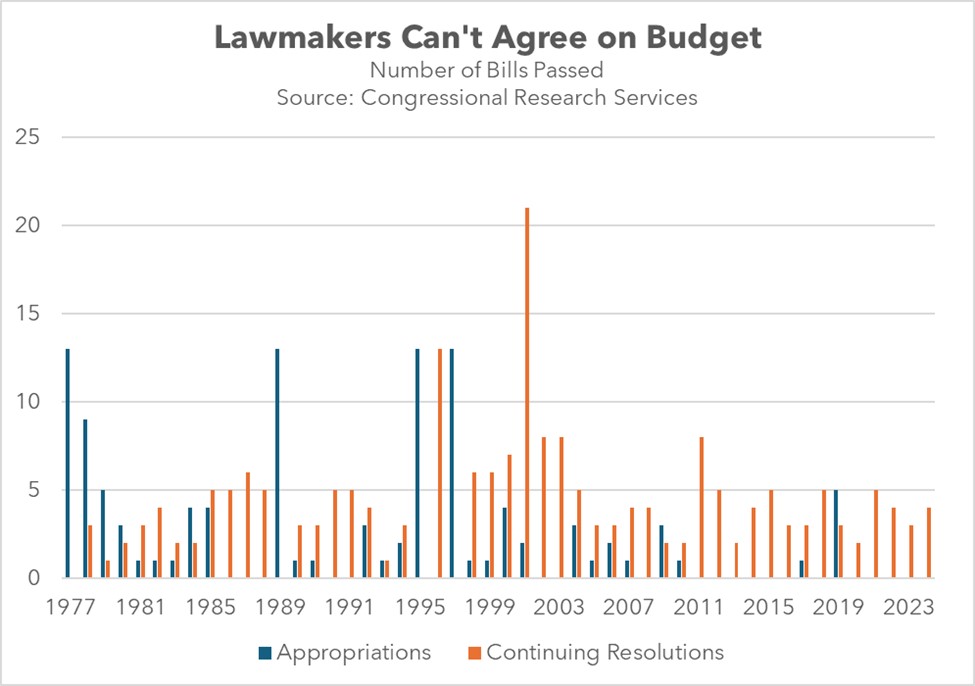

- The House of Representatives passed an $895 billion defense spending bill on Wednesday, the first of several appropriations bills needed to fund the government. While this bill garnered bipartisan support, upcoming appropriations are expected to be more contentious. Lawmakers face disagreements over the scale of disaster relief for Hurricanes Milton and Helene and whether to increase funding for agencies like the DOE and the EPA. Despite these challenges, there’s hope for a short-term funding agreement to keep the government open until the new year.

- In the post-financial crisis era, political infighting has forced lawmakers to repeatedly extend government funding with temporary measures known as continuing resolutions. Only once since 2009 has more than one appropriations bill been passed before the October 1 deadline. These stopgaps prevent government shutdowns but also prolong the appropriations process and contribute to the ballooning budget deficit. The government has already relied on five continuing resolutions this year, which has helped push the deficit to nearly $2.0 trillion this fiscal year. This puts it on track to be the largest deficit outside the pandemic era.

- The dispute over the budget will set up a showdown regarding how to raise the debt ceiling, which expires January 1. The ongoing political infighting over the budget is likely to raise investor concerns about the US government’s ability to address its fiscal challenges. The two major rating agencies have already downgraded the US credit rating, citing concerns about partisan gridlock, which could prevent a bipartisan agreement to reduce the deficit. As a result, we anticipate that continued political bickering over the debt will likely impact long-term interest rates in the future.

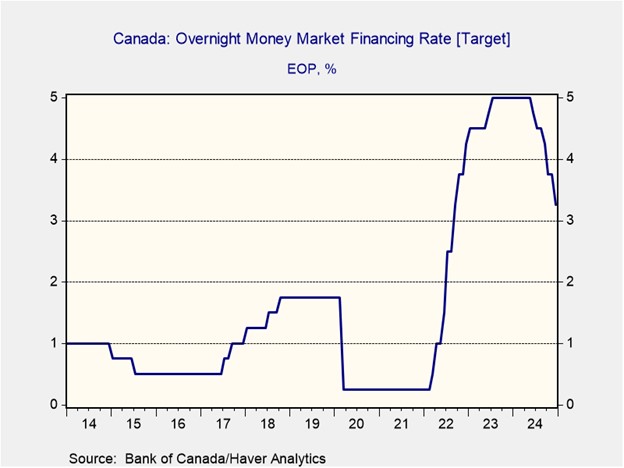

BOC and Tariff Threats: The Bank of Canada slashed rates by 50 basis points to stimulate its economy but warned of economic risks due to trade tensions with the US.

- The central bank lowered its policy rate to 3.25%, its lowest level since September 2022. Following the reduction, the central bank signaled a more gradual approach to future rate cuts. This shift in tone suggests that larger rate cuts may be less likely, and the central bank could adopt a more modest approach to its guidance as it seeks to stimulate the economy. During the press conference, Bank of Canada Governor Tiff Macklem warned that the economic outlook has deteriorated due to the threat of tariffs against Canada.

- The threat of tariffs poses a significant risk to the Canadian economy, which is already facing a slowdown. In the third quarter of 2024, GDP growth decelerated from an annualized pace of 2.2% to 1.0%. This slowdown was primarily driven by a decline in investment spending, which has been a drag on GDP for five of the last six quarters. The threat of a trade war could intensify business uncertainty, making it harder for companies to justify capital expenditures and job creation in Canada.

- A potential trade war with the US could significantly harm Canada’s economy, as roughly 20% of its GDP is tied to trade with its southern neighbor. To mitigate the negative impact of potential tariffs, the Bank of Canada is likely to ease monetary policy further to make it easier for households and firms to borrow. This could lead to a depreciation of the Canadian dollar relative to the US dollar, but it could also make Canadian exports more competitive globally.

In Other News: President-elect Trump has asked Chinese President Xi Jinping to join him at his inauguration as a possible olive branch. This move suggests a possible easing of tensions between the two sides. Microsoft shareholders voted down a measure that would allow the company to add bitcoin to its balance sheet, indicating that crypto is becoming more widely accepted. The European Central Bank voted to cut its benchmark policy rate by 25 bps to 3.00%.