Daily Comment (January 16, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is processing the latest development in the Israel-Hamas conflict. In sports news, three MLS teams are reportedly in discussions to sign Brazilian football star Neymar. Today’s Comment will share our thoughts on President Biden’s farewell address to the nation, analyze the latest inflation data, and discuss other market-moving stories. As always, our report will include a summary of international and domestic data releases.

Biden’s Parting Shots: The outgoing president took aim at the rising power of Silicon Valley in his final address to the nation. During his speech, he warned that the “tech industrial complex” has become increasingly powerful and has used misinformation and lies to enable the abuse of power. He also expressed concern about the rise of AI. His comments are a reminder of the growing wariness the public is experiencing with large tech companies.

- Both during Biden’s term and Trump’s first term, assertive approaches were adopted to curb Big Tech’s power. However, this time feels different, as tech firms appear to have widely embraced Trump’s return to the White House with open arms and seem to have turned their backs on the Democratic Party.

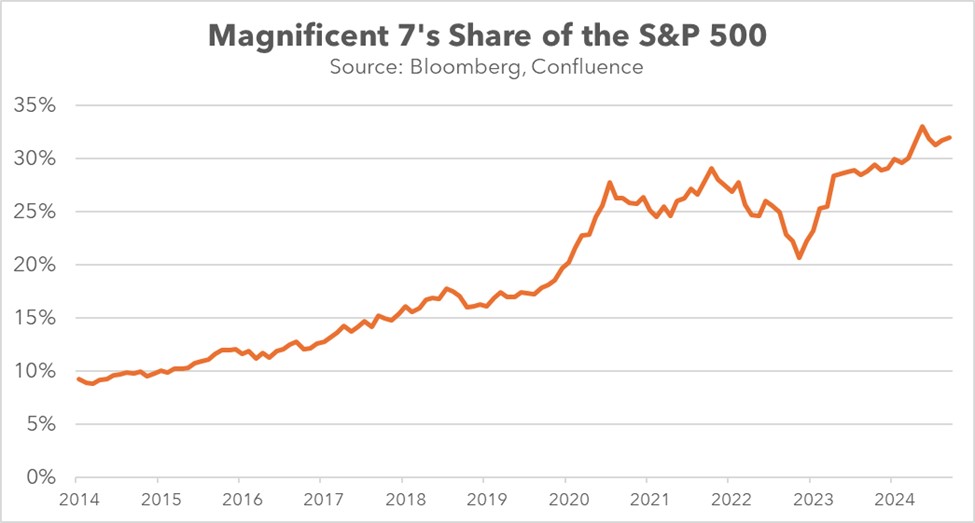

- Most of the Magnificent 7 companies donated to President-elect Trump’s inauguration, probably in an effort to curry favor with the incoming administration. These companies likely hope that staying in the president’s good graces will lead to leniency, as several are under investigation for antitrust violations and many rely on a disproportionate share of the revenue from countries that are likely to be targets of tariffs.

- However, it remains unclear how the tech industry’s newfound MAGA stance will resonate with the populist wing of Trump’s coalition. For instance, there have already been murmurs of discontent regarding the industry’s heavy reliance on H-1B visas, which some see as a means to sidestep domestic hiring. Additionally, concerns are growing over Elon Musk’s increasing influence, as many within the coalition view him as lacking genuine alignment with Trump’s vision for the country.

- President-elect Trump has, thus far, managed to navigate between the two sides, striving to keep both camps satisfied. While he has acknowledged that the program may negatively impact American workers, he has also concluded that it serves a purpose. We expect that this balancing act will continue throughout his term in office as he looks to ensure that Republicans maintain a fundraising advantage over Democrats going into future election cycles.

- Biden’s speech highlights how the tech industry is increasingly viewed as an adversary by the Democratic Party, making it a likely target for political attacks. Meanwhile, right-wing populists’ distrust of the industry adds another challenge. This suggests that the regulatory environment for Big Tech companies may not improve significantly as Trump may be reluctant to invest the political capital needed to shield them from backlash. However, an alliance with him could prevent potential breakups of the firms.

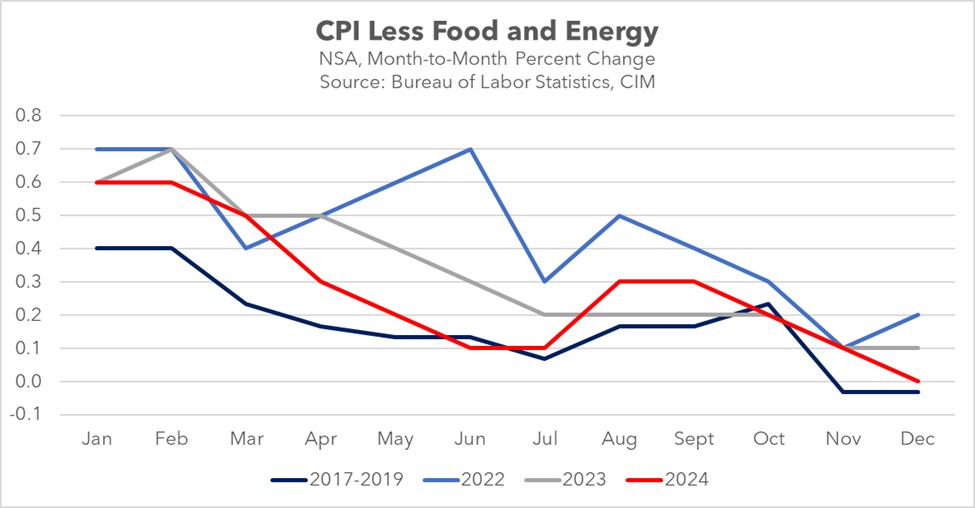

Rate Cut Hopes Get a Boost: The latest December inflation report has boosted investor confidence that the central bank will proceed with planned interest rate cuts this year. Investors now expect the bank to lower rates twice, up from last week’s prediction of just once, according to the CME FedWatch Tool. Following the report, the S&P 500 stock market index rose nearly 2%.

- Headline inflation increased 0.4% month-over-month on a seasonally adjusted basis, marginally exceeding market forecasts of 0.3%. Core inflation, excluding volatile food and energy prices, rose 0.2% month-over-month, falling short of the anticipated 0.3% increase.

- The optimism in the CPI was due to signs that underlying price pressures are finally beginning to stabilize. Shelter price inflation held steady at 0.3%, medical services eased from 0.4% to 0.2%, and recreation services eased from 0.3% to 0.1%.

- December’s inflation data provides further evidence that the Federal Reserve is making consistent progress in curbing price pressures. Notably, the CPI increased above the previous year’s pace in only two out of the 12 months of the year, strongly reinforcing the central bank’s progress towards its 2% inflation target.

- It’s also important to remember that inflation usually reaches its highest point in the first three months of the year. This is normal. However, the central bank will be watching closely to see if the month-to-month increase in prices slows down to its usual level. If it does, the bank might be more willing to lower interest rates significantly this year, if other factors remain the same.

Gaza Ceasefire: Israel and Hamas have agreed to pause the conflict after 15 months of fighting, despite ongoing tensions. The deal, announced on Wednesday, has received approval from both President-elect Trump and outgoing President Biden. While the agreement has been widely welcomed, concerns about its stability exist. Following the agreement, the Tel Aviv Stock Exchange rose to a record high.

- Hours after the agreement was announced, Israeli Prime Minister Benjamin Netanyahu accused Hamas of violating the deal. He criticized Hamas for opposing Israel’s veto over which Palestinian prisoners would be released in exchange for hostages following the 2023 attacks. Netanyahu warned that his cabinet would not approve the deal unless Hamas agreed to all of the terms outlined in the agreement.

- So far, the deal appears to be holding. The arrangement begins on Sunday with a 42-day ceasefire, which will lead to the Israeli military’s withdrawing from several regions in Gaza, as well as the delivery of aid to the Gaza Strip. The goal of the agreement is to secure the release of all hostages and effect a complete withdrawal of Israel from the region.

Canada Tit-for-Tat: Although Canada has stated its intention to comply with the US decision to shore up border security to mitigate rising trade tensions, it has also warned of potential retaliatory measures, such as tariffs, if its interests are significantly impacted.

- Ottawa announced potential retaliatory measures, including tariffs on steel and orange juice, if the US imposes tariffs on Canadian goods. While these measures are unlikely to impact the US economy significantly, they would directly target states like Michigan and Florida, with the former being a key swing state in national elections.

- The warning comes as the country braces for federal elections, set to take place before October 20, 2025. Lawmakers are working to strengthen their populist credentials, aiming to demonstrate to citizens that they will prioritize their needs.

- While we do not expect the US and Canada to engage in a trade war, tensions between the allies are elevated.